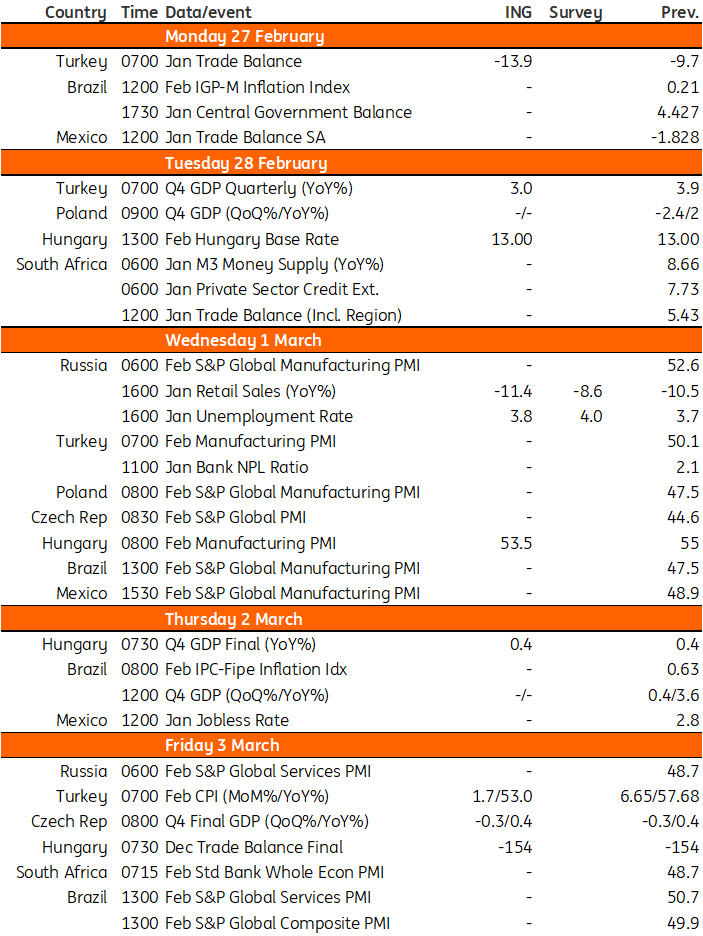

Key events in EMEA next week

For Hungary's rates-setting meeting next week, we expect no changes to be made. In the Czech Republic, we think the GDP report will confirm the previously-published flash estimate, and that the economy has continued to decline, entering into a mild recession

Turkey: Risks to outlook are on the upside

We expect February inflation to be 1.7% month-on-month, leading to a further decline in the annual figure down to 53% from 57.7% a month ago due to a supportive base and stability in the currency. However, given deeply negative real interest rates, further disinflation would be quite challenging, while risks to the outlook this year are on the upside with a potential policy mix of larger fiscal stimulus and looser monetary policy following the devastating earthquakes.

Regarding GDP growth, we expect further moderation to 3% for the final quarter of 2022, mainly due to weakness in the external demand, with growth for the full year 2022 will be around 5.3% due to a strong performance in the first half.

Czech Republic: two quarters of continuous decline in GDP

The Czech GDP report will likely confirm the previously-published flash estimate that the economy declined in the fourth quarter of last year, making it two consecutive quarters of decline, entering the Czech economy into a mild recession. The recession has mainly been driven by a continuous strong decline in consumer spending as households are facing the burden of high energy prices on their purchasing power.

Nevertheless, investment and exports likely recovered, despite lingering restrictive monetary policy in terms of high interest rates and strong currency. This seems to be a promising sign that the recession will be shallow, without a significant impact on the labour market, and the economy should return to soft growth in the second half of the year, driven by a gradual improvement in external demand.

Hungary: No changes from the policymakers yet

The main event in Hungary is the February rate-setting meeting. We have seen glimmers of hope that the economic picture in Hungary is about to improve. However, it is early days and therefore we expect the central bank to remain patient and see no change from the policymakers yet. While we are still waiting for January activity data, we are going to see another manufacturing PMI where we expect the reading to suggest optimism based on the still high level of orders. After that, we will look back again to try and understand the factors behind the late-2022 technical recession. As the Statistical Office reminded us in its press release after the flash GDP estimate, data quality has worsened so we might see some non-negligible revisions in the GDP data.

Key events in EMEA next week

Download

Download article

24 February 2023

Our view on next week’s key events This bundle contains 3 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more