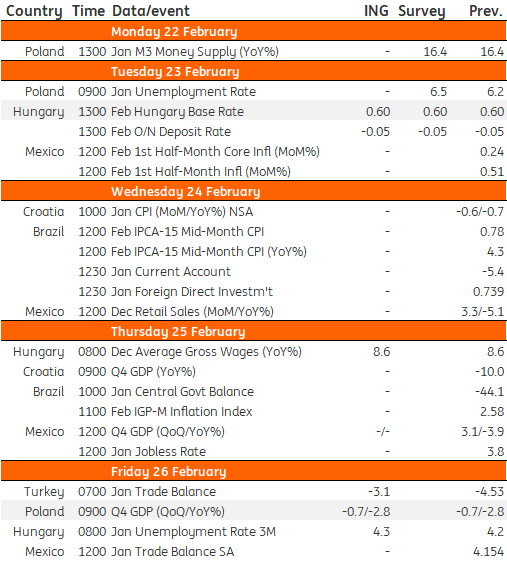

Key events in EMEA next week

A relatively quiet week lies ahead in the EMEA region, as the National Bank of Hungary is set to keep rates on hold again while Poland's GDP should align with the flash estimate

Hungary: Non-event meeting as NBH in wait-and-see mode

We see the February rate setting meeting of the NBH as a non-event. The latest incoming data will push the central bank to review its GDP and inflation outlook, but the new staff projection won't be revealed until March. As there is no immediate pressure on the bank, either from inflation or the forint, policymakers can afford to take a 'wait-and-see' approach again. So we expect the monetary policy setup to remain unchanged. The usual messages, which have telegraphed a relatively hawkish commitment since September, will also remain intact in our view. Besides the Monetary Council meeting, we’ll also find out the latest labour market data. We see wage growth remaining elevated, before falling sharply next month. The unemployment rate is to creep higher as the second wave puts employers in a difficult position and the number of registered job seekers increased by 3% month-on-month in January.

Poland: Flash GDP estimate to remain the same for 4Q

In the case of Poland, on Friday we will learn the structure of GDP in the fourth quarter. According to the flash estimate, Poland's GDP fell by 2.8% year-on-year and 0.7% quarter-on-quarter in the last quarter of 2020. We do not expect these figures to be changed. The structure should show ca. 3.0% YoY drop of consumption, 10% YoY fall in investment and a positive contribution from net exports (ca. +1.5ppt).

EMEALatam Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

19 February 2021

Our view on next week’s key events This bundle contains 3 Articles