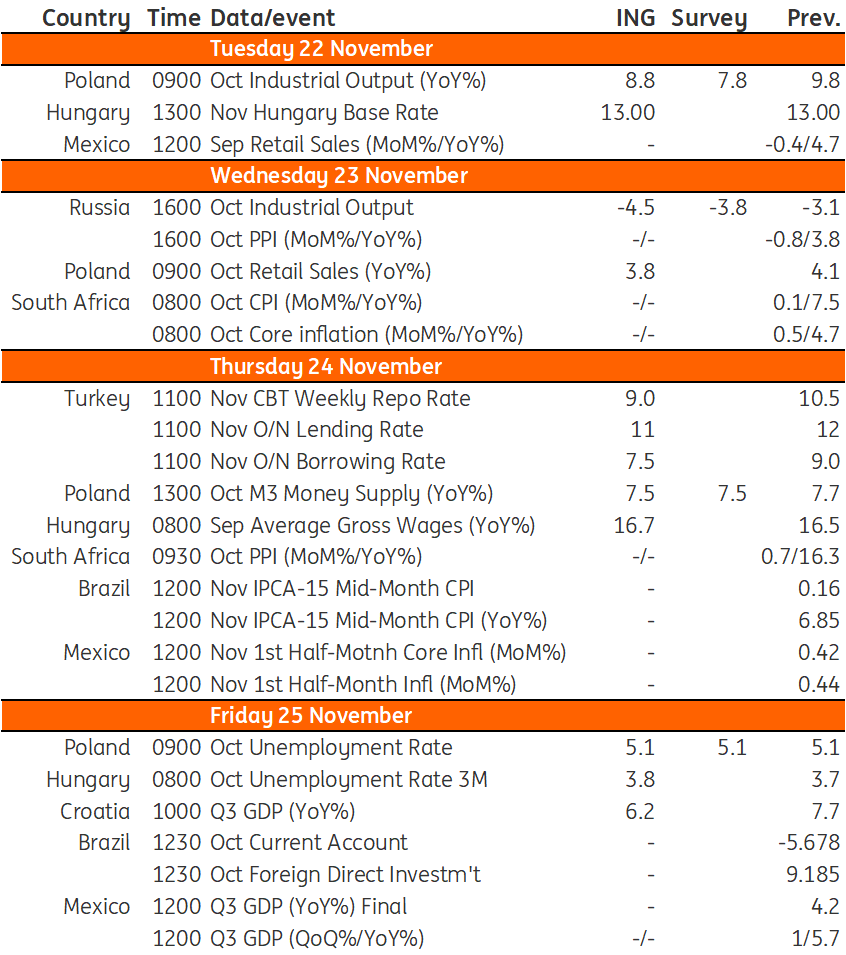

Key events in EMEA next week

We do not expect any movement from the National Bank of Hungary at next week's meeting, as the latest data were in line with expectations. The labour market is expected to be a mixed picture, with the unemployment rate moving up and wage growth remaining strong. We also expect the Central bank of Turkey to conclude its easing cycle

Poland: Wage growth is no longer keeping up with rising prices

Industrial output (October forecast: 8.8% year-on-year):

Industrial production is benefiting from an improvement in supply chain functioning, which supports exports-oriented industries, including automotive and electric products. When the backlog of work is unloaded and re-stocking is finished, domestic manufacturing is expected to slow over the medium term.

Retail sales (October forecast: 3.8% YoY):

Retail sales growth has slowed to low single-digit growth as wages are no longer keeping up with rising prices. We forecast growth of 3.8% YoY as high inflation is undermining consumers' purchasing power to such an extent that they are more cautious in their purchasing decisions. Household consumption growth is slowing.

Unemployment rate (October forecast: 5.1%):

A recent data revision lifted the registered unemployment rate toward a higher level, but the number of unemployed remains unchanged (lower denominator). Nevertheless, the trend remains positive and we forecast that in October the number of unemployed and the unemployment rate were broadly unchanged vs. in September. The Polish labour market remains resilient to softer economic conditions.

Turkey: Easing cycle to be concluded with a 9% policy rate

While inflationary pressures remained broad-based in October as all 12 main CPI categories contributed positively to the increase in inflation, the Central Bank of Turkey has signalled that it intends to conclude the easing cycle with another 150bp rate cut in November. This will bring the policy rate to 9.0%.

Hungary: Base rate set to remain unchanged

We do not expect any fireworks from the National Bank of Hungary at its November rate-setting meeting. The latest data regarding inflation and GDP were broadly in line with the central bank’s expectations and the next staff projection update is only due in December. Against this backdrop, we don't see any game-changing moves. When it comes to the risk environment, we haven’t seen a material improvement in domestic or external risk factors, which were flagged by the central bank as triggers to consider changes in its monetary stance.

By the time the National Bank of Hungary's (NBH's) rate-setting meeting takes place, we might see some positive headlines coming from the European Commission regarding the Rule-of-Law procedure. With a green(ish) light, Hungary will be able to secure the Recovery and Resilience Facility (RRF) plan signature just in time to not lose €4.6bn of the €5.8bn RRF grant which is at stake should Hungary miss the year-end deadline to have an accepted plan. But no matter how green this light is, we don’t expect the central bank to make a policy change so quickly and we see the NBH underscoring its hawkish “whatever it takes” approach again.

Though the EU fund story and the monetary policy decision will give plenty to talk about, we are going to see the latest labour market data as well. Here we expect wage growth to remain strong, reflecting the fact that companies made mid-year wage increases and one-off payments as inflation bit workers’ disposable income. Regarding the unemployment rate, we expect it to continue its gradual rise, as other employers are unable to remain in business without a reduction in their labour costs. In general, it will be quite a mixed picture of the state of the Hungarian labour market.

Key events in EMEA next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

18 November 2022

Our view on next week’s key events This bundle contains 3 Articles