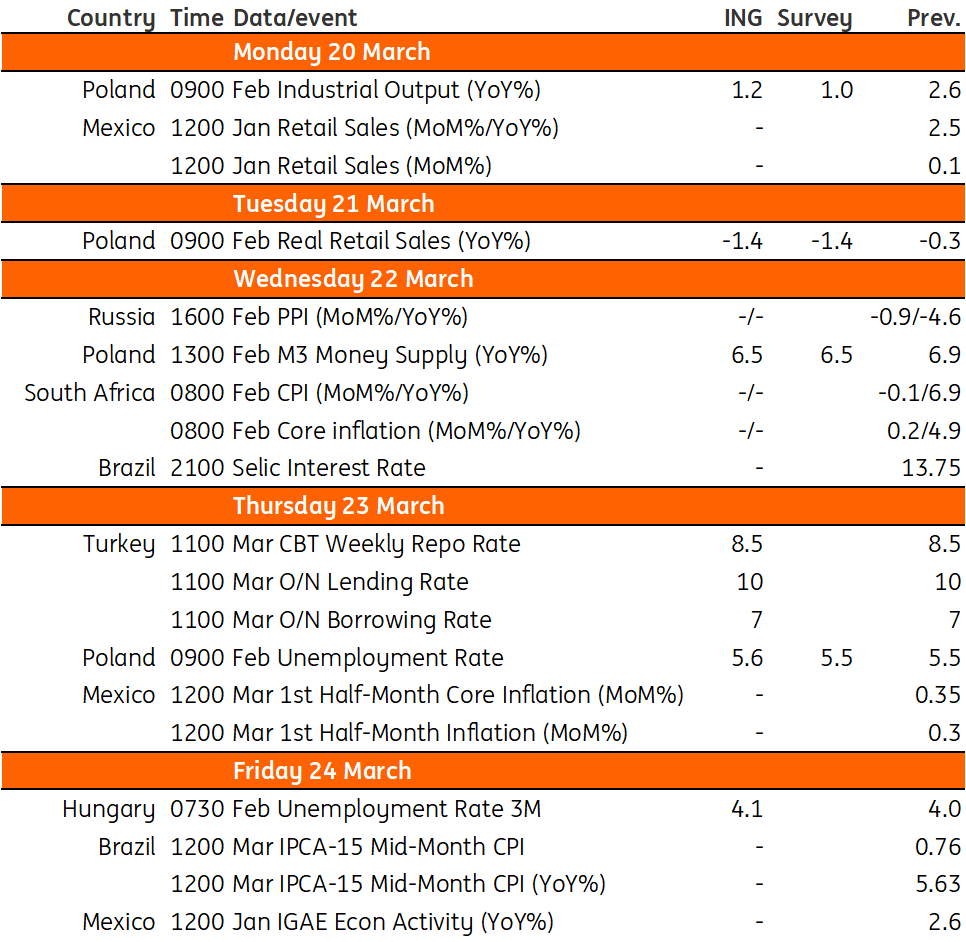

Key events in EMEA next week

A relatively quiet week ahead for the EMEA regions. Given the Central Bank of Turkey cut the policy rate last month, and signalled that cuts would not be continuous, we expect rates to remain unchanged for now. In Poland, consumer demand in early 2023 looks to remain subdued and we see continued weakness in retail sales

Poland

Industrial output (Feb): 1.0% YoY

A relatively strong January reading (2.3% year-on-year) was supported by calendar effects, but with a neutral impact of working days in February, industrial output growth is projected to have eased to 1.0% YoY. Even though the severity of the European energy crisis is smaller than feared, the outlook for the real economy, especially manufacturing in the EU, looks better than expected. PMI surveys point to slower declines in new orders and output, while cost pressures have eased. Demand and supply are more aligned, but Poland’s industrial growth is projected to be sluggish in the near term and the emergence of concerns about financial stability risks are skewed to the downside.

Retail sales (Feb): -1.4% YoY

Household consumption fell in the fourth quarter of 2022 and consumer demand remains subdued in early 2023 as a result of elevated inflation that has eroded the real purchasing power of consumers. We project continued weakness in retail sales of goods in early 2023, and yet another annual decline in consumption, especially given the high reference base from the first quarter of 2022.

Turkey: Central bank expected to remain on hold

Last month when the Central Bank of Turkey cut the policy rate to 8.5%, it signalled that interest rate cuts would not continue as a series. Given this backdrop, we expect the bank to remain on hold this month. But we can expect further macro-prudential measures to maintain favourable financial conditions with the objective of minimising the effects of the earthquakes in the period ahead.

Hungary: Unemployment expected to increase further

The relatively quiet period regarding data releases is set to continue in Hungary. The only hard data is the unemployment rate for February, where we see a further increase as companies are adjusting to the new reality earmarked by the technical recession.

Key events in EMEA next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

17 March 2023

Our view on next week’s key events This bundle contains 3 Articles