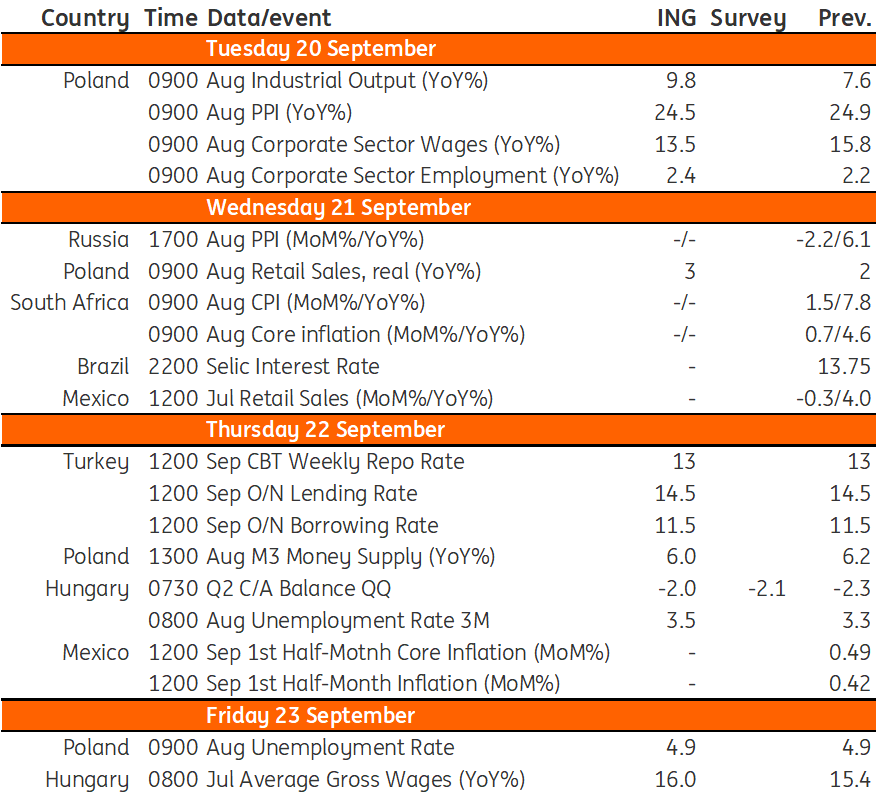

Key events in EMEA next week

Despite the Central Bank of Turkey implying in its forward guidance that further rate cuts are ahead, we believe it will keep the policy rate unchanged for now to assess the impact of recent moves. For Poland, we forecast that unemployment will remain at 4.9% whilst PPI inflation will decline to 24.5%

Turkey: Expecting the CBT to keep rates unchanged this month

While the Central Bank of Turkey (CBT) cut the policy rate last month in a surprise move, it did issue forward guidance implying further rate cuts were ahead, citing some loss in economic momentum. The CBT moves will likely be determined by FX developments, as the tourism season comes to end, as well as the growth outlook. We expect the CBT to keep the policy rate unchanged this month to see the impact of recent moves, though the risks are on the downside.

Poland: Key data for the week ahead

Industrial output: Annual growth of industrial production moderated to a single-digit pace in July (7.6%), but is projected to improve somewhat in August (9.8%) amid the less negative impact of the number of working days in year-on-year terms. The output should be supported by shorter summer production halts in the automotive industry and house appliances plants. Electricity production was also rather solid. Output was reduced in some energy-intensive industries due to the soaring price of natural gas.

PPI inflation: We forecast that PPI inflation declined to 24.5%YoY in August from 24.9%YoY in July as prices in the manufacture of coke and refined petroleum products eased. Annual growth of metal products manufacture also declined. Unless we see yet another upswing in energy and industrial commodities, the producers’ prices should continue to decline. We believe that the peak is most likely behind us.

Enterprise wages: In July, enterprise wages jumped up by 15.8%YoY boosted by one-off payments and compensations for high inflation in the mining, energy and foresting sectors. In August, growth is expected to be lower, albeit still at a double-digit level. Nevertheless, real wages in the enterprise sector are projected to turn negative again. The labour market remains tight, which is what drives wages upwards.

Enterprise employment: Average paid employment went up by 2.3%YoY in July, with the number of posts increasing by 11,000 people versus the previous month. In August we expect a seasonal decline, but smaller than last year, which should drive annual employment growth up to 2.4%YoY. Despite signs of slowing activity, particularly in industry and construction, demand for labour remains solid, especially in services.

Unemployment rate: The labour market is drained from skilled workers and even the inflow of refugees from Ukraine that have assimilated quite well and are active in the labour market is not putting upward pressure on the unemployment rate so far. Since January the number of unemployed people is on a downward path and the registered unemployment rate is projected to remain at 4.9% for the second month in a row in April.

Hungary: Further widening of the current account deficit

The National Bank of Hungary will release the second quarter current account balance and it is expected to be in the same ballpark that we saw during the first quarter. A roughly €2tr deficit is the result of the rising energy bill of the country, deteriorating the balance of goods in an extreme manner. An early estimation of the July balance suggests further widening of the current account deficit. When it comes to the labour market, we see wage growth accelerating further, as the price-wage spiral has started.

More and more companies have announced extra compensation for employees (either one-off or mid-year salary hikes) in the last couple of months, which will be visible in the wage statistics as well. On the other hand, the news has also been about companies planning redundancies in the future (various surveys put the share of these corporates between 25-50%), thus we won’t be surprised if the unemployment rate reflects that development, moving a bit higher compared to the previous month.

Key events in EMEA next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

16 September 2022

Our view on next week’s key events This bundle contains 3 Articles