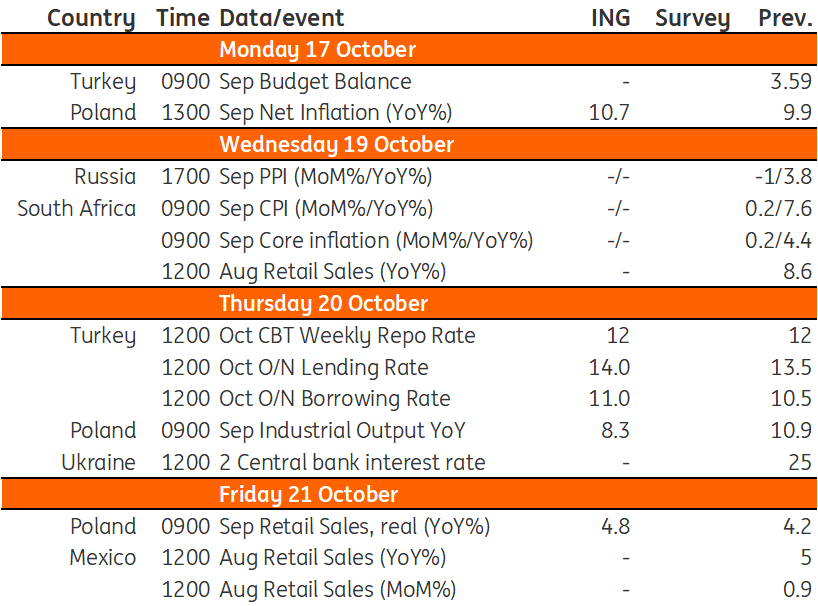

Key events in EMEA next week

We expect the Central Bank of Turkey to keep rates on hold next week, given the current global economic backdrop. However, we recognise there is a significant risk skewed toward more easing as the central bank focuses on preserving growth momentum in industrial production

Turkey: Central Bank of Turkey expected to remain on hold this month

The CBT’s recent rate cuts against a backdrop of high external finance requirements and a global risk-off mode may weigh on reserves as we have already seen a decline in the second half of September. Given this backdrop, the bank should remain on hold this month. However, there is a significant risk skewed towards more easing given i) President Erdogan’s call for further rate cuts to single digits by the end of the year ii) the CBT’s focus on supportive financial conditions so as to preserve the growth momentum in industrial production and the positive trend in employment given recent signals of decelerating economic activity.

Poland: Annual growth in industrial output moderated to single-digit levels

Industrial output (8.3% YoY):

Seasonally adjusted data indicate that output started expanding again in 3Q22, after declining in 2Q22. Hard data does not confirm the sharp deterioration in industrial conditions painted by the nose-diving manufacturing PMI. Still, annual growth moderated to single-digit levels in September. High prices and potential shortages of energy will weigh negatively on industrial performance in 4Q22.

Retail sales, real (4.8% YoY):

Although the inflow of refugees from Ukraine is positive for the consumption of goods, the impact of this factor seems to be waning as high inflation bites into real income and makes consumers more cautious about spending. In September, sales expanded by some 4.8% year-on-year i.e. at a similar pace as in August (4.2% YoY). The structure of sales is projected to remain similar, with poor sales of durable goods and solid sales of necessities (food, clothing). In 3Q22, sales were visibly weaker than in 2Q22 in annual terms, pointing to easing household consumption.

Key events in EMEA next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

14 October 2022

Our view on next week’s key events This bundle contains 3 Articles