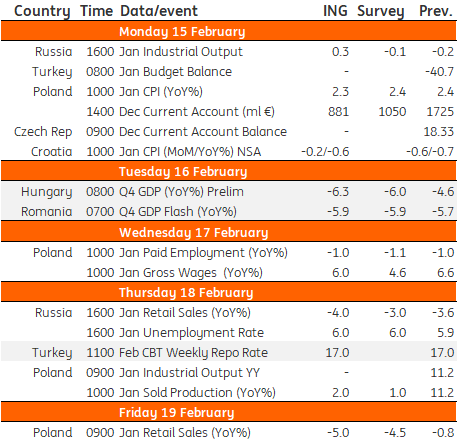

Key events in EMEA next week

A few important releases next week in EMEA. Hungary's 4Q GDP will likely decline, the Central Bank of Turkey is set to hold rates steady, Russian industry and consumer sentiment may reveal more on the recovery, and Poland's inflation should remain low, for now at least

Hungary: Decline in GDP expected amid continued drag on services

The highlight of the week in Hungary will be the preliminary 4Q20 GDP report. Although there were some silver linings during the fourth quarter, overall we expect a decrease in GDP on a quarterly basis. The biggest question mark still surrounds the performance of the service sector, which will remain the main drag on economic activity. We see industry having a positive effect, while construction and agriculture should be borderline negative and positive, respectively. The risks regarding the reading are clearly tilted to the upside, especially because of government spending, as it is hard to measure whether the spending spree in December impacted GDP or not. Prime Minister Viktor Orbán has mentioned preliminary estimates of GDP in 2020 around the -5.1 to -5.2% mark on average. That could mean a 0.0-0.1% quarter-on-quarter growth rate in 4Q20, in contrast with our -1.5% QoQ forecast which is based on public information.

Turkey: Rates to stay on hold

At the February MPC, the question is whether the recent upside surprise in inflation is significant enough for further monetary tightening. Despite still high risks to price stability and the CBT’s focus on credibility, the bank will likely hold the policy rate unchanged at 17% this month and prefer to wait-and-see as its concerns shift to the inflation outlook in the medium term.

Russia: Industry data to see some improvement but consumer activity remains subdued

Russian industrial production in January likely benefited from higher electricity and heating output due to cold weather and from easing in OPEC+ restrictions. At the same time, the calendar factor (January 2021 had two fewer working days than January 2020) reduced industrial support from the budget in January, and low consumer confidence speak against any material improvement in the manufacturing segment. Consumer activity has likely remained under pressure from the weak income trend in the private sector, though an improvement on the Covid-19 front leaves the door open for a positive surprise.

Poland: Inflation remains subdued

Next week we receive the most important hard data from the Polish economy in January. We think inflation remained subdued due to the high food base in 2020. The labour market should be strong. Despite the prolonged lockdowns, companies continue to affirm their demand for employees. Due to a high base, employment should still be lower than a year ago, but wages should show solid growth. Year-on-year production will slow down compared to December, mainly due to the adverse calendar pattern. An expected weaker sales figure is related to restrictions in January.

EMEA Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

12 February 2021

Our view on next week’s key events This bundle contains 3 Articles