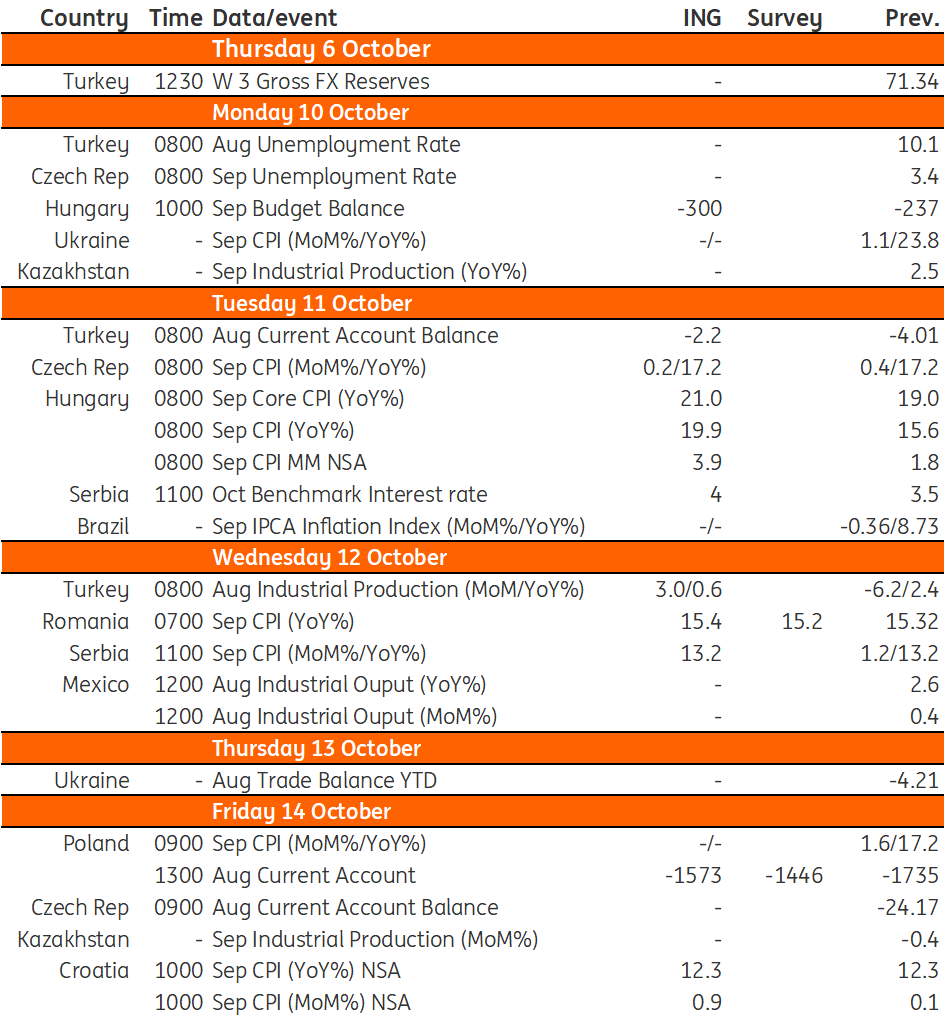

Key events in EMEA next week

Inflation data is in focus next week, with a substantial increase expected in Poland. In Hungary, the Ministry of Finance will release the preliminary budget balance for September

Poland: Current account widen to 5% of GDP and Sep CPI expected at 17.2%

Current account (Aug): EUR-1573mn

Weakening domestic demand and somewhat lower pressure from commodity prices eased pressure on Poland’s trade balance, but the scale of the external imbalance remains substantial. We forecast that in August exports in EUR went up by 14.7% YoY, while imports rose by 16.3% YoY. According to our forecasts, the cumulative 12-month current account will widen towards 5% of GDP by the end of the year.

CPI (Sep, final): 17.2%YoY

We expect the StatOffice to confirm its flash estimate of September consumer inflation at 17.2% YoY. The substantial upswing (from 16.1%YoY in August) was linked to rising prices of food and energy (mainly coal), but the scale of increase in core inflation is also shocking. According to our estimates, core inflation excluding food and energy prices jumped from 9.9% YoY in August to 10.7% YoY in September. Core prices increased by some 1.4% MoM, confirming that another wave of higher costs (mainly energy and transport) is being passed onto the prices of final products. Upward pressure on prices remains substantial and inflation is becoming stubbornly persistent. Deeply negative real interest rates and expansionary fiscal policy do not give much hope for significant disinflation anytime soon.

Czech Republic: Unchanged year-on-year pace of inflation

According to our estimates, inflation slowed again to 0.2% in September from 0.4% in August, which would be the slowest pace since November last year. In annual terms, this implies a stable rate at 17.2%. Compared to the previous month, we see higher prices for food (1.6%), clothing (1.8%) due to the start of the winter season and education (1.4%) due to the start of the school year. On the other hand, prices fell in transport (-1.5%) due to a drop in fuel prices (-4.1%) and tourism (-4.4%) due to the end of the summer season. For energy prices, we expect a similar pace of price increases as in the previous two months, although a few energy price hikes have again been announced for September by the main suppliers. However, the statistical office approach is still unclear and the last two months suggest that we can expect a gradual pass-through of these changes into the CPI rather than a spike in energy prices. Of course, as in the last two months, an upward spike in CPI energy prices cannot be ruled out, but otherwise, we see YoY inflation peaking in these months and we should see a decline by the end of the year, though still above the 16% YoY level.

Hungary: Inflation still moving higher whilst budget improves

Next week is all about the budget and inflation in Hungary. The Ministry of Finance is going to release the preliminary budget balance for September, where we expect a further deterioration with the pressure coming from the expenditure side, while the revenue side will see a boost from the windfall taxes only in the fourth quarter. In this regard, we expect a significant improvement in the months ahead. When it comes to the September inflation print, we see both the core inflation and the headline reading moving higher. The significant uptick in headline inflation is coming from the change in the utility bill support scheme. This could add roughly 3ppt to the year-on-year headline inflation as households were facing higher utility bills in September. The move in core inflation will come mainly from services and processed food as rising energy costs for corporates and the drought feed into consumer prices.

Key events in EMEA next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

7 October 2022

Our view on next week’s key events This bundle contains 3 Articles