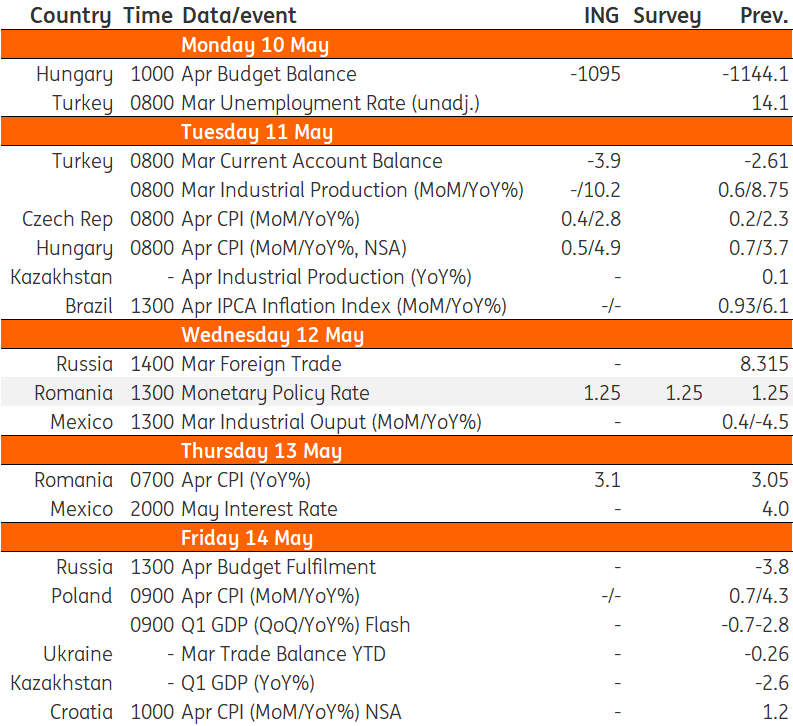

Key events in EMEA next week

Key releases to watch next week in the EMEA space are inflation data from Hungary and the Czech Republic which are likely to push higher, and Romania's central bank meeting which is expected to be rather uneventful

Hungary: Loose policy and partial reopening’s to push inflation higher

The key event in Hungary next week is the April inflation reading, and we expect the low base and partial reopening to impact inflation big time.

While we expect “only” 0.5% month-on-month headline CPI, the year-on-year reading could end up close to 4.9%. The Statistical Office’s out-of-the-blue announcement that it will reweigh core inflation from April (leaving out alcoholic beverages and tobacco from the core basket) will dampen the official core reading to probably below 3% YoY data.

Other than that, the April budget numbers will come out. We expect it to show some moderation impacting economic activity and thus the revenue side of the budget.

Czech Republic: Fuel price acceleration to push inflation higher

Fuel prices continued to grow in April, by more than 3% compared to March. Though weaker MoM dynamics compared to March, in annual terms, the low base effect will push fuel prices to grow by almost 20%, and the contribution of fuel prices to YoY headline inflation will increase from zero in March to 0.6 percentage points in April.

As such, we expect headline CPI to accelerate to 2.8% in April after 2.3% in March but mostly on the back of the base effect related to fuel prices.

Romania's monetary policy to remain unchanged

Romania's central bank will resume its regular policy meetings on 12 May.

We expect the next meeting to be a rather uneventful one, as the Bank should maintain the key rate at 1.25% and the reserve requirement levels unchanged. More closely watched will be any reference to inflation developments starting to raise eyebrows everywhere, and Romania is no exception.

While we do not believe that any future policy changes will be signalled at this meeting, we can assume that the wording will not be as complacent as before.

EMEA Economic Calendar

Download

Download article

7 May 2021

Our view on next week’s key events This bundle contains 3 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more