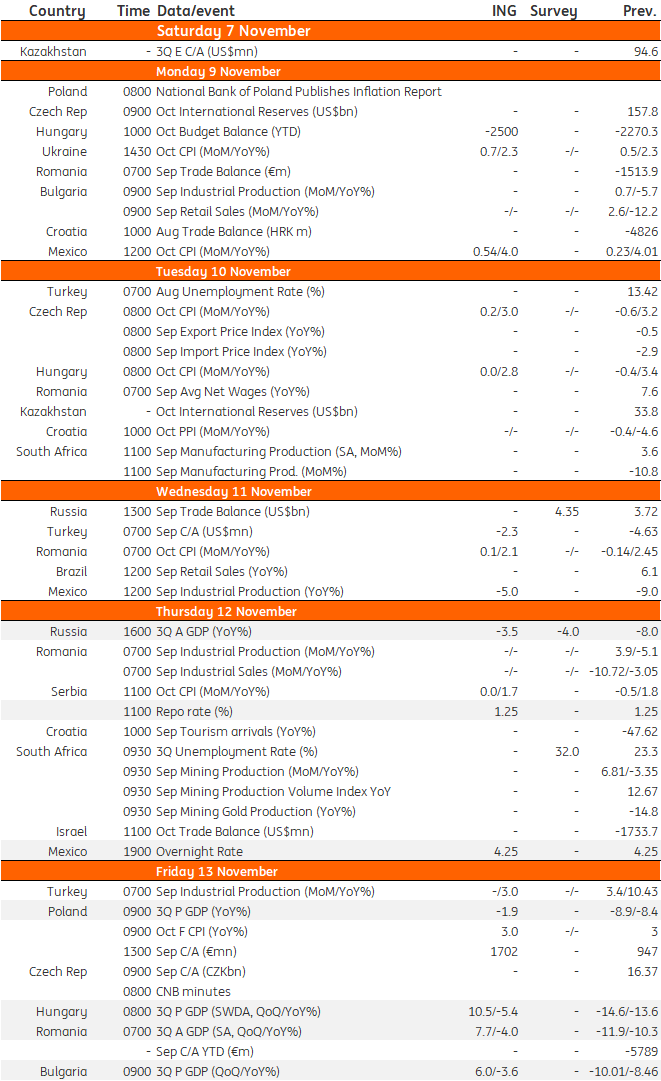

Key events in EMEA next week

Third quarter GDP data across the EMEA region next week is likely to reflect an improvement in economic activity. However, with the second wave of Covid-19 forcing fresh lockdowns, this is unlikely to last long

Czech Republic: CPI deceleration

We expect Czech CPI to decelerate further to 3.0% from 3.2% in September, though a few opposing forces will play a role. Preliminary data suggests that food prices could fall again in monthly terms (though they are volatile and difficult to estimate) while electricity prices should also fall in October given announcements from the biggest providers. On the other hand, a weaker Czech koruna in the last two months could be slightly pro-inflationary, while fuel prices stagnated in month-on-month terms. Still, full-year inflation is heading towards 3.2%, the highest full-year reading since 2012.

Hungary: Second wave to bring a new fiscal package and overshadow strong quarterly growth

We are still waiting for a new fiscal package from the Hungarian government in response to the second wave of the pandemic. The October budget data will give us a clue about how much room there is to manoeuvre. In our view, there is a chance for a 1% of GDP package this year. We see headline inflation dropping significantly on base effects and fuel and service prices as the Covid-19 impact spills over into the economy. The mechanical rebound will elevate quarterly GDP growth into double-digit territory in the third quarter, but this will provide only temporary comfort as we are heading into the winter with a rapidly worsening pandemic situation.

Poland: Third quarter GDP rebound won’t last long with cases back on the rise

Third quarter flash GDP data should confirm a solid recovery after the first wave of the pandemic, largely reflecting a rebound in consumer spending. However the number of Covid-19 cases in Poland is on the rise, forcing the government to reintroduce much of the security measures seen in the second quarter. This means another dip in GDP this quarter.

Current account figures should confirm a solid surplus, confirming our 3% of GDP surplus call for this year. Poland continues to benefit from solid external demand and relatively low oil prices. In the fourth quarter, the situation may even improve, as new security measures domestically are likely to limit imports, while external demand should remain relatively good.

EMEALatam Economic Calendar

Download

Download article

6 November 2020

Our view on this week’s events This bundle contains 3 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more