Key events in EMEA next week

Look out for a strong current account in Russia, an interest rate announcement in Turkey, and rising inflation figures in other emerging market economies

Russia: Expect to see a relatively strong current account, but capital outflows remain a risk

Russia's balance of payments for July, to be reported on 10 August, will likely show strength on the current account side thanks to strong fuel and non-fuel revenues amid restrained imports of services. The monthly current account surplus is expected to remain in a US$6-7 bn range, in line with 2Q21, and exceeding the FX purchases seen in July as well as the ones announced for August. Portfolio inflows into the local currency state public debt (OFZ) have been rebounding since mid-July and should also reinforce the ruble’s position. Meanwhile, private capital outflows remain the key risk factor for the ruble in the near term.

Elsewhere, the budget surplus may almost double from RUB0.6 tr in the first six months of the year to RUB1.1 tr in the first seven months, mainly on seasonal factors, but also reflecting strong revenue collection on both the fuel and non-fuel side, as economic activity is recovering. Speaking of which, the preliminary estimate of quarterly GDP on 12 August should show a material improvement from -0.7% year-on-year in 1Q21 to c.+10% YoY in 2Q22, primarily thanks to the low base effect, and suggesting the return of economic activity back to pre-Covid levels. With economic growth likely to moderate from now on, the Bank of Russia’s key focus is to remain on inflation, which is now showing signs of peaking, but the elevated inflationary expectations by households and the increased reliance of consumption on unsecured borrowing and withdrawal of deposits should keep the hawkish bias of monetary policy in place.

Turkey: Current repo rate to be maintained until inflation drops significantly

Driven by food inflation and administrative price adjustments, annual inflation - at 18.95% - maintained its uptrend in July, and almost aligned to the policy rate. While core inflation has lost momentum, inflation dynamics will likely remain challenging, with still buoyant demand conditions, elevated services inflation, and the impact of a normalisation in pandemic control measures. We expect the headline figure to remain above 18% until November before recording a pronounced decline in the last two months of the year due to base effects. Given this backdrop, we expect the Central Bank of Turkey to remain on hold at the August MPC and subsequent months, and focus on a measured cut, given its guidance that the current stance would be maintained until there is a significant fall in inflation.

Romania: Gas and electricity price hikes to push up inflation

Starting in July, a new round of price hikes for gas and electricity has come into effect which, together with higher fuel prices, should push July inflation close to 5.0%. Flirting with this level could be the new normal for the rest of the year.

Hungary: Strong monthly inflation expected to confirm the August rate hike

We expect some easing in Hungarian inflation pressures in July. However, our forecast of 4.7% YoY will still be well above the National Bank of Hungary’s latest projection and of course, way out of the 2-4% tolerance band. Moreover, as the deceleration is due to base effects, the strong monthly inflation will cement the 30bp rate hike expectation for the August meeting in Hungary. When it comes to the fiscal metrics, the monthly shortfall in July will be relatively small as revenues are rebounding on a strong economic performance while expenditures are falling further on the phasing out of some Covid-related temporary measures.

Poland: Strong rebound in GDP, CPI and current account figures following restrictions easing

Friday the 13th will be a busy day for data releases from Poland. First, the Central Statistical Office will publish its final estimate for July CPI - in our opinion this should come in at 5.0% YoY, in line with the flash estimate. This will also be when the GDP estimate for 2Q21 is released. In our view, the result should confirm the strength of the rebound in response to the gradual easing of Covid restrictions which started at the end of April. We estimate YoY GDP growth at 10.8% compared to a 0.9% drop a quarter before and the consensus forecast at 11%. The double-digit growth rate is the result of a low base last year and an acceleration in the QoQ growth to over 2% from 1.1% in 1Q21. The icing on the cake will be the balance of payments published by the National Bank of Poland. We estimate that the surplus of the current account increased to EUR771m in June from EUR60m in May. The market is slightly more pessimistic, expecting EUR514m.

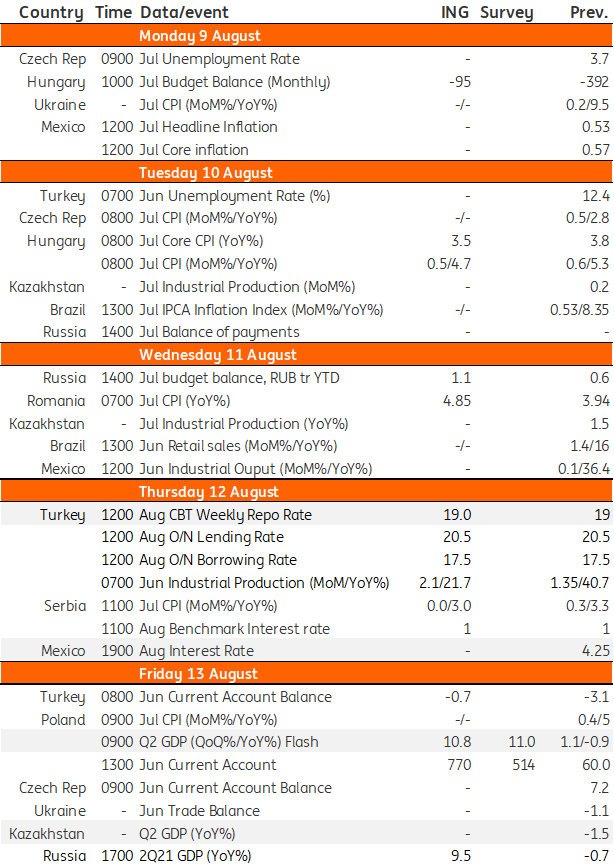

EMEA Economic Calendar

Download

Download article

6 August 2021

Our view on next week’s key events This bundle contains 3 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more