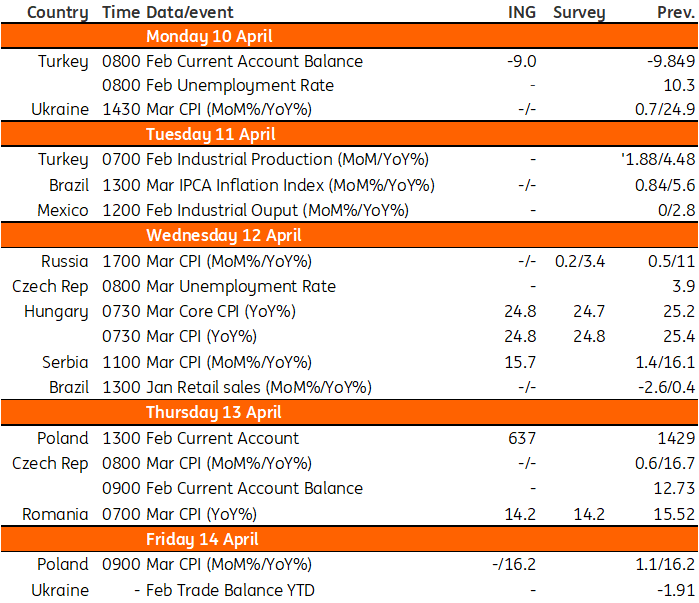

Key events in EMEA next week

Inflation data will be released next week for both Poland and Hungary. In Poland, we expect the flash estimate of March CPI to be confirmed at 16.2% year-on-year. For Hungary, we expect both core and headline inflation to continue thier retreat, given food, fuel and energy disinflation

Poland: Core inflation remains sticky

Current account balance (February): €637m

We forecast another month of current account surplus, albeit at a smaller scale than in January. The trade balance was in surplus again as exports in EUR jumped by 11.0% year-on-year, while imports virtually stalled (+1.9% YoY). Export industries are still catching up to their backlog of work (e.g. the automotive sector), while nominal import growth is being dampened by moderating prices of imported energy.

CPI inflation (March, final): 16.2%YoY

We expect the Central Statistical Office of Poland to confirm its flash estimate of March CPI inflation at 16.2% YoY. The collapse in annual fuel price dynamics was linked to the high reference base from March 2022, when gasoline prices soared as Russia invaded Ukraine. Food price growth remains elevated and our estimates indicate that core inflation, excluding food and energy prices, increased to 12.3% YoY last month. In the coming months, declining headline inflation is likely to be accompanied by 'sticky' core inflation.

Hungary: Expect improvements in both core and headline inflation

The only data-related excitement for Hungary is the March inflation print. We expect the headline reading to retreat further. The expected 0.5% month-on-month inflation will translate into a 24.8% year-on-year reading. The slowdown will be driven by fuel, energy and food prices. Regarding the latter, grocery stores last month attempted to raise customers’ attention with bigger and flashier sales of processed food products. As a result, headline and core inflation should continue their retreat, matching the headline rate at 24.8% YoY.

The reason food, fuel and energy disinflation won’t cause a bigger drop in the readings lies with services. For example, we see rising price pressure on services as a result of a 10% increase in taxi fares, and continued price adjustments in telephone and internet services (matching last year’s average inflation). From April onward, we expect a more marked reduction in inflation due to base effects.

Key events in EMEA next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

6 April 2023

Our view on next week’s key events This bundle contains 3 Articles