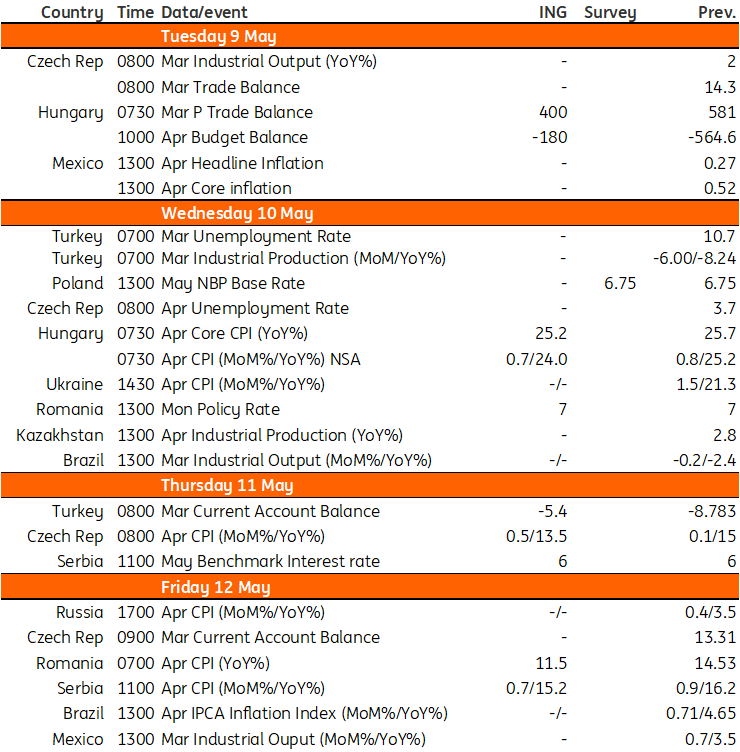

Key events in EMEA next week

Next week's EMEA calendar features the Romanian National Bank's policy rate decision, and we expect the key rate to remain unchanged at 7%. In Hungary, we see only minor easing for April inflation, with core inflation remaining elevated on a monthly basis

Hungary: April inflation prints to show only minor easing

We are hopeful that the upcoming week will bring some positive news for Hungary. First of all, we expect the trade balance to remain in surplus territory thanks to depleting import activity on dropping domestic demand and energy consumption. In parallel, we see further positive impacts on non-energy exports due to the car and electric vehicle battery manufacturing sectors.

With rather weak economic activity still, the budget balance will have a hard time showing a material improvement in April. However, as the March deficit was partly a result of one-off items, excluding those will improve the picture slightly.

The star of the week will be the April inflation print. We see the month-on-month headline inflation showing only minor easing. Slightly lower fuel and energy prices accompanied by some easing price pressure in food prices will be almost entirely wiped out by seasonal factors and additional price increases in services, mainly in telecommunication and leisure activities. The latter will be the main reason why core inflation remains elevated as well on a monthly basis. However, base effects will help to improve the big picture, thus we see both the headline and the core year-on-year readings showing convincing drops. However, the still 24-25% YoY inflationary environment gives little cause for celebration.

Romania: NBR set to keep rates unchanged

The National Bank of Romania (NBR) will announce its latest policy rate decision on 10 May. We expect the key rate to stay at 7.00% with no forward guidance. We think that a clear consolidation of the current disinflationary trend will be needed before the central bank makes its next decision; we're expecting a cut in the first quarter of next year. Real positive rates (i.e. inflation below the key rate) might be the trigger for action. Our inflation estimates indicate that this could be the case in February-March 2024 when inflation should dip below 7.00%.

Czech Republic: Scope for a rate increase remains limited

In the Czech Republic, we think headline inflation decreased further in April from 15% to 13.5% and core inflation also softened. The recent Czech National Bank meeting sent a clear hawkish message in the sense that three board members voted for a 25bp rate hike. In our view, the scope for a rate increase is limited until we see the overall economic wage growth exceeding 10% YoY.

Key events in EMEA next week

Download

Download article5 May 2023

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more