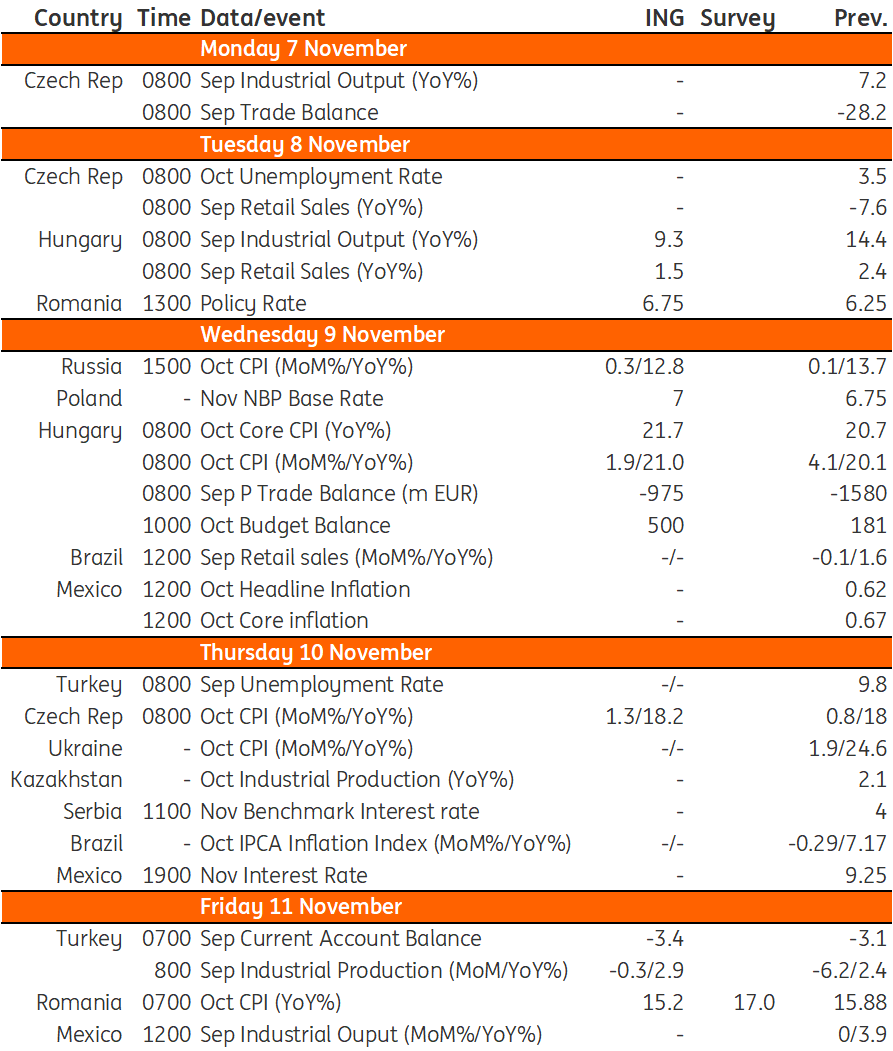

Key events in EMEA next week

Two central bank meetings will take place next week. For the National Bank of Poland, we see a 25bp hike to 7%, however it is a close call between that and there being no change in the policy rate. For the Romanian National Bank, we expect a reduction in the tightening pace, taking the key rate to 6.75% with a 50bp hike

Czech Republic: Inflation accelerates due to fuel prices, while energy remains uncertain

We expect inflation to accelerate again in October from 0.8% to 1.3% month-on-month, which translates into an acceleration in the annual rate from 18.0% to 18.2% year-on-year. The main reason for this is the significant increase in fuel prices in October (5.0% MoM) and food prices. On the other hand, we see a seasonal downward movement in clothing prices. The main issue as always in recent months is energy prices. These were largely behind September's surprise, but the main question in October may be the impact of the saving tariff as a government measure that should affect household prices throughout the fourth quarter. As in previous months, the statistical office’s approach is unclear and therefore inflation could surprise either way.

Poland: Baseline scenario is a 25bp hike to 7.00%

The November Monetary Policy Council (MPC) decision will be a close call between 25bp and no change in the National Bank of Poland (NBP) policy rate. On the one hand, headline inflation continues to trend upward and is increasingly broad-based, as indicated by rising core inflation. The peak is still ahead and bringing inflation back to the NBP target in the foreseeable future will require additional policy tightening. On the other hand, the Polish zloty firmed recently and the majority of the Council is increasingly eager to refrain from further rate hikes as it claims that monetary policy has almost reached its limits in containing demand factors. Our baseline scenario is a 25bp rate hike, but we do not rule out a scenario where rates remain unchanged. The Council will receive new macroeconomic projections and some policymakers indicated that the mid-term outlook for CPI inflation may trigger additional fine-tuning with respect to interest rates.

Romania: End of the tightening cycle is close

The Romanian National Bank (NBR) will announce its latest policy rate decision on Tuesday. We expect a reduction of the tightening pace to 50bp, taking the key rate to 6.75%. An open-end press release leaving the door open for another hike in January is to be expected. The NBR will also approve its latest inflation report and we should see another upwardly revised inflation forecast. The year-end estimate could flirt with the 17.0% area, though our own estimate currently sits closer to the 16.0% handle. Nevertheless, upside surprises in inflation prints versus estimates are still persistent, and forecasts should be taken – as usual lately – with a lot more than a pinch of salt. Perhaps more important than the rate hike itself will be any hint of an alteration in the tight liquidity management stance. We see little to no chance of this being changed for now. Read our full preview here.

Hungary: Slowdown, adjustment and rationalisation

Next week will be extremely busy in Hungary. We start the week with September economic activity data with an expectation of a general weakening in businesses. Retail sector growth will be limited by rising inflation thus decreasing real wage growth. Industrial production is a bit of a black box now with the wildly volatile manufacturing PMI, but we think we will see a slowdown here as well as adjustment and rationalisation continue as manufacturers face rising energy bills.

The October inflation readings might draw a lot of interest, too. Our calls are higher readings in headline and core inflation. The common drivers here will be rising processed food and services prices with some extra pressure coming from durables as well as the forint hitting its weakest level versus all the majors during October. We might see a bit better trade balance data as energy prices have been moving lower in general, supporting the reduction of the monthly deficit via the energy-related goods balance. Speaking of balances, we are about to see the October budget balance as well. Here we are expecting a significant surplus, thanks to the revenue side as a huge chunk of windfall tax payments were first due in October.

Key events in EMEA next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

4 November 2022

Our view on next week’s key events This bundle contains 3 Articles