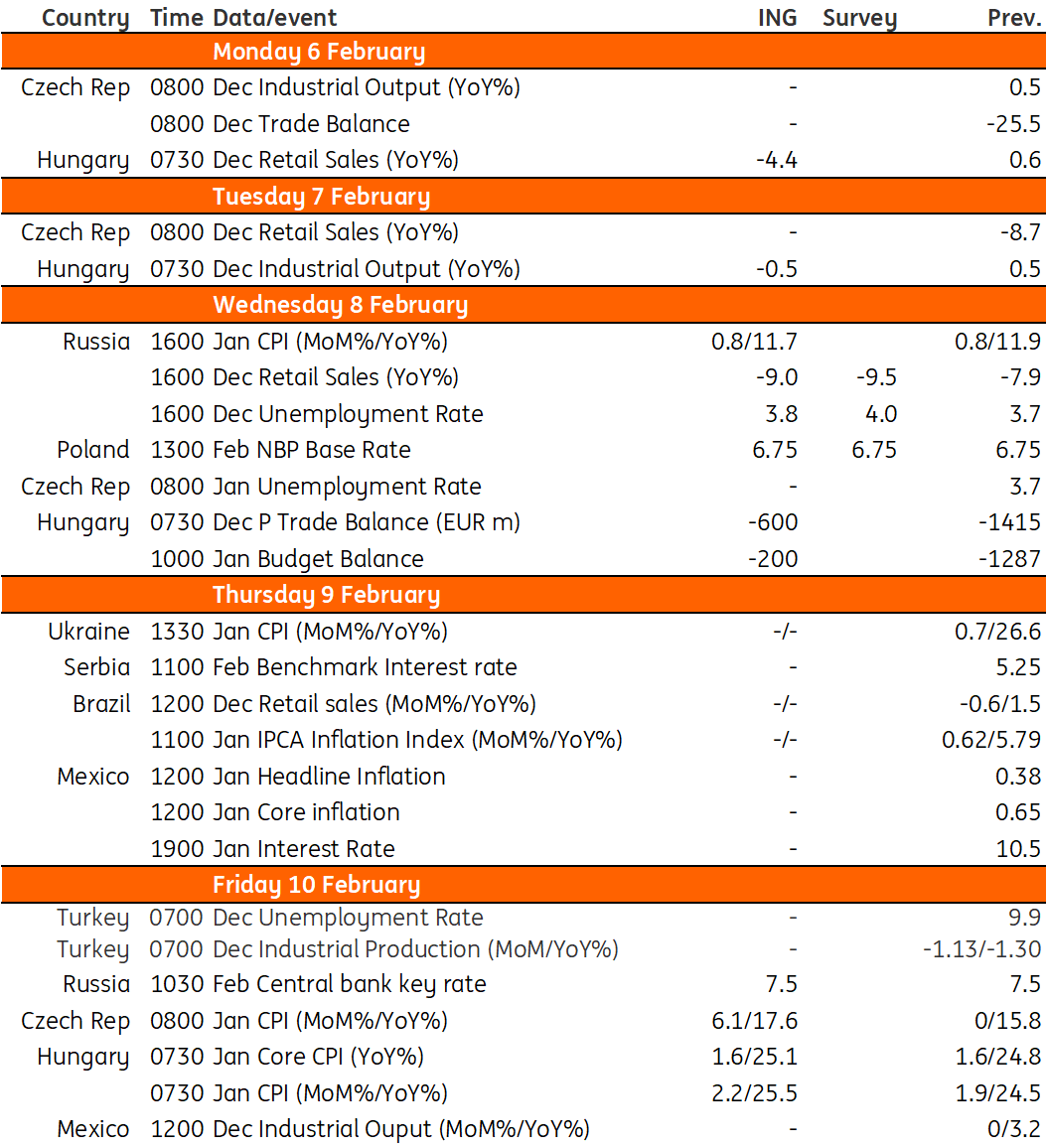

Key events in EMEA next week

An action-packed week ahead for Hungary. As the government has abolished the fuel price cap, we expect signs of a downturn in retail sales and industrial production figures, while headline and core CPI move above 25% year-on-year. In the Czech Republic, we see headline inflation accelerating further to 17.6% year-on-year, while core prices remain at 13%

Czech Republic: Spikes in CPI unlikely to influence CNB's decision

In Czech we expect the CPI increased by 6.1% MoM in January and hence the headline inflation likely accelerated further from 15.8% to 17.6% YoY. This increase was likely owing to the increase of regulated prices by around 40% YoY, while core inflation still remained strong at 13% YoY. This is in line with new CNB forecast. We see the risk, however, that some reprising upwards was made later in January hence it would be reflected rather in February CPI reading. Even a further spike in headline inflation is unlikely to persuade the CNB board to change their stance to keep rates unchanged at the next meeting in March.

Hungary: Data impacted by abolishment of fuel price cap

After a quite boring week, next week’s calendar will be really action-packed. On Monday and Tuesday, the Hungarian Statistical Office is going to release the December retail sales and industrial production figures. We expect to see major signs of a downturn. In retail sales, the government let go the fuel price cap, which lead the fuel sales falling from a cliff, while food and non-food retailers are suffering from a lowering demand due to the drop in households’ purchasing power. As industry had two working days less to produce in December 2022 than a year ago, we see the year-on-year performance to shrink, though seasonally and working day adjusted print will show a bit more favourable picture. Wednesday will be about balances. We see the January budget balance in deficit due a one-off expenditure item related to a public financed acquisition. Meanwhile, the December trade balance will bring some good news, as lower commodity prices will be finally filtering through the energy balance, as new energy contracts in the private and public sectors are following the global stock prices with a two-month lag. Last, but definitely not least, Friday brings the first inflation print of 2023. We see both headline and core CPI moving above 25% year-on-year, mainly driven by a strong start-of-the-year repricing in food and services and a second-leg impact of the scrap of the fuel price cap. In contrast, price changes in household energy and durable goods will limit the upside in the acceleration, in our view.

Key events in EMEA next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

3 February 2023

Our view on next week’s key events This bundle contains 3 Articles