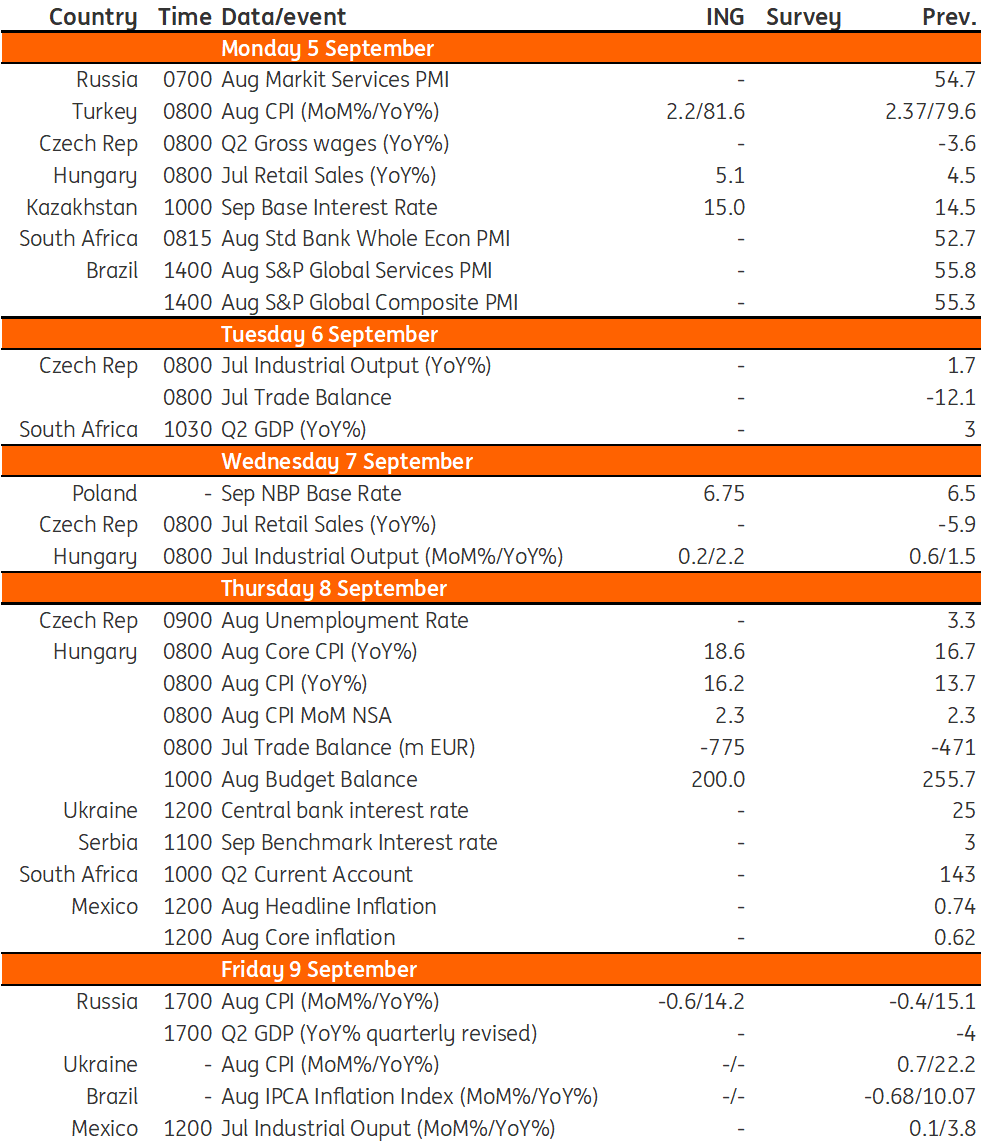

Key events in EMEA next week

A busy week ahead for Hungary with July's economic activity data and August's inflation reading. Retail sales should improve while inflation is expected to lift further. We're also expecting a 25bp rate hike from the National Bank of Poland

Poland: central bank decision on rates

In recent public statements, Polish policymakers pointed out the need to continue monetary tightening albeit at a smaller scale than before. Rate-setters mainly mentioned a 25bp rate hike and some even seemed reluctant to hike at all. An upward surprise from the August flash CPI means that a 25bp rate hike to 6.75% (our baseline scenario) looks like a done deal and the Council may even discuss a 50bp rate hike. Still, the end of the rate-hiking cycle is nearing and we currently see the terminal National Bank of Poland rate at 7.0-7.5%.

Russia: inflation subsiding after a big spike

Following a sharp spike to 17.8% year-on-year in April, Russia has been on a disinflationary path due to weaker demand, ruble appreciation and a good harvest. Next Friday’s CPI numbers for August are likely to show a 0.6% month-on-month decline in prices and a deceleration in the annual rate to 14.2% YoY. This challenges our year-end expectations of 13% and suggests that the actual print is likely to be at the lower end of the Bank of Russia’s 12-15% range. This means that the key rate, which has already been cut from 20.0% in February-March to 8.0% in July, has room to go lower. Yet given the stabilisation of households’ inflationary expectations and unclear supply-side prospects, we expect CPI to remain elevated next year and doubt that this downside to the key rate could exceed 100 basis points by year-end. The next Central Bank of Russia meeting is scheduled for 16 September.

Turkey: annual inflation expected to increase further

We expect annual inflation to have risen further in August to 81.6% (2.2% on monthly basis) from 79.6% a month ago, despite a decline in gasoline prices, as pricing pressures will likely remain broad-based with a largely supportive policy framework leading to currency weakness and external factors weighing on import prices.

Hungary: August core inflation reading expected to be 18.6%

We are facing a really busy calendar in Hungary next week. The first set of data will be July economic activity. Retail sales could improve a bit as pensioners got extra transfers from the government which is practically a retroactively increased pension due to higher-than-expected inflation. This could boost food consumption, while non-food retail got a boost from the new (less favourable) utility bill support scheme, which urged households to replace old household appliances with newer, more energy-efficient ones.

Based on PMI data, July industrial production could still be OK, though we see some downside risk here due to planned summer shutdowns. While industry is doing well despite the plethora of challenges, the trade balance is rather driven by the ever-rising energy bill of the country, and so we see further deterioration in the trade deficit in July.

The highlight of the week is going to be the August inflation reading. Due to a refined fuel price cap, which narrowed the range of beneficiaries, the Statistical Office will recalculate the fuel price higher in the consumer basket (some weighted average of capped and market prices). This might explain 0.9-1.0ppt from the 2.3% month-on-month inflation, which will lift the yearly reading up to 16.2%. As rising energy and agricultural commodity prices spill over into processed food and service providers adjusting their prices to the rising utility bills, we see core inflation at 18.6% year-on-year. However, there is one beneficiary of this sky-high inflation environment: the government budget, where we expect yet another surplus on rising revenues in August.

Kazakhstan: above expected inflation calls for another key rate hike

National Bank of Kazakhstan is likely to make another key rate hike on Monday from the current level of 14.50% to 15.00% or higher. Following the latest 50bp hike at the end of July, inflation continued to outperform the market and NBK expectations, reaching 16.1% YoY in August. Higher inflationary pressure appears to be broad-based in terms of structure and most likely calls for an adjustment in the key rate level.

Key events in EMEA next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

2 September 2022

Our view on next week’s key events This bundle contains 3 Articles