Key events in EMEA and Latam next week

Twist and turns in EMEA and Latam this week. Poland and Serbia's central banks look to keep their policy rates on hold while Czech data points to more reasons why we should expect a rate hike in September

More reasons for the Czech National Bank to hike in September

A surprise in both directions might be expected from July's statistics, related to holidays and the summer months. We expect both retail sales and industrial production to accelerate above this year's average driven by the calendar bias and a relatively low base rate. However, industrial production shutdowns are somewhat difficult to estimate, so the chances of a surprise in the upcoming release are relatively high.

Wage growth in the second quarter should also see a slight acceleration, predominantly driven by growth within the market segment, although public sector wages are likely to slow down, albeit only moderately, after a strong 12% YoY growth in 1Q18. Still, wage growth shouldn't disappoint central bank expectations and will add another argument for hiking in September.

Hungarian industrial data could be the best in 2018 yet

When it comes to Hungary, next week’s calendar is particularly busy. We expect good readings both in the retail and industry sectors. The latter could produce the best year-on-year figure in 2018, mainly down to base effects.

The government balance should remain around recent levels, showing the significant deficit as long as Brussels doesn't transfer the money related to EU projects. When it comes to the detailed GDP release, we expect a particularly strong figure showing in gross fixed capital formation.

National Bank of Poland to maintain their dovish stance

We expect the Monetary Policy Committee to continue its dovish rhetoric, as more evidence suggests wage pressures have stopped rising and CPI is likely to (temporarily) undershoot the central bank's target boundaries in 4Q18, significantly dropping below 1.5% YoY.

The National Bank of Poland's governor, Adam Glapiński, is expected to repeat that rates should remain flat until the end of 2020.

Serbia's key rate on hold at 3%

There's little reason for the National Bank of Serbia (NBS) to change its policy stance with only a minor uptick in July inflation to 2.4%, from 2.3% in June, and core inflation muted at 0.9%, versus the 0.8% in June. The downside pressures on EUR/RSD also seem to have diminished in recent weeks, which removes our main motivation for an eventual dovish stance of the central bank.

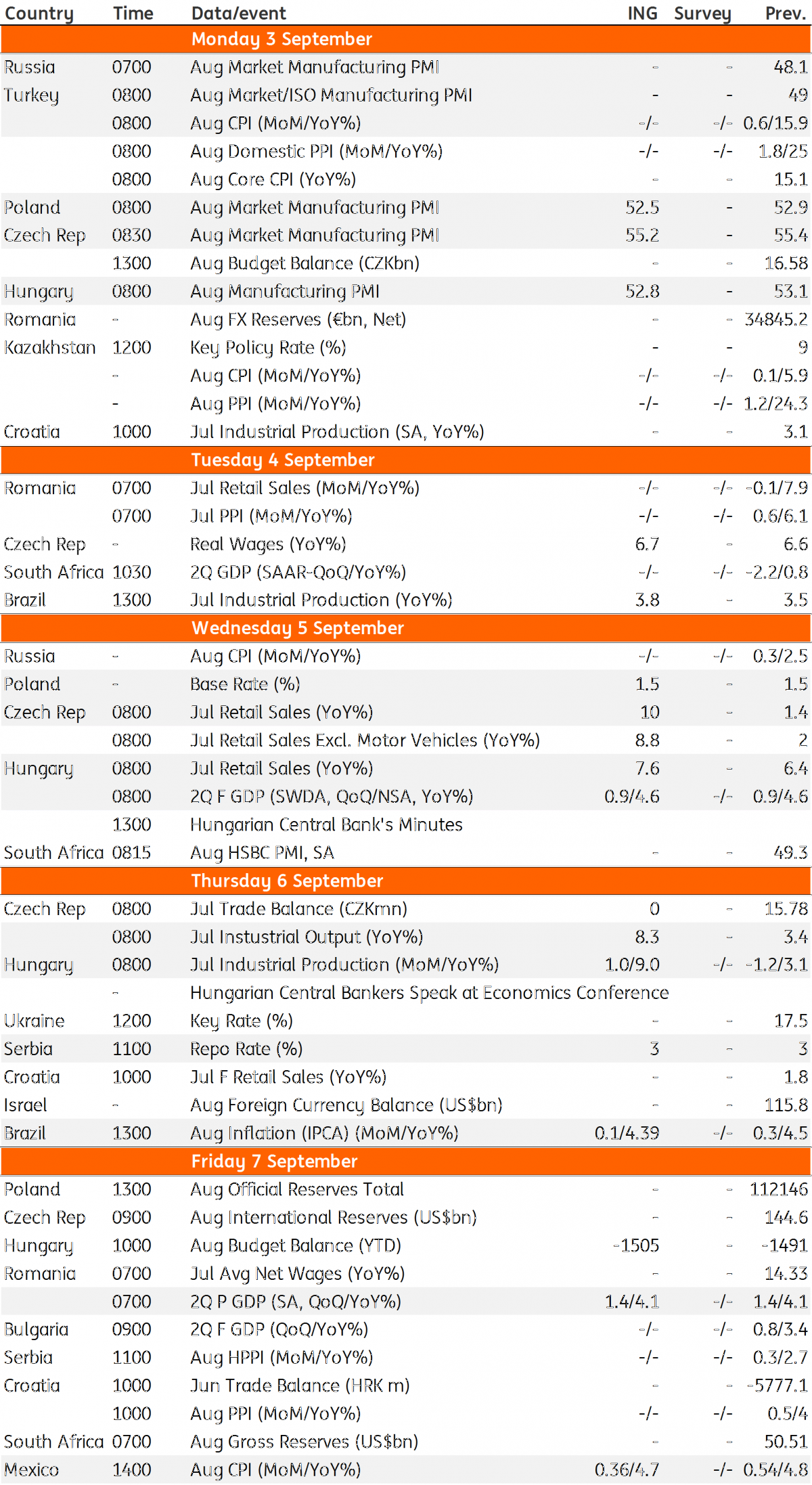

EMEA and Latam Economic Calendar

Download

Download article

31 August 2018

Our view on next week’s key events This bundle contains 3 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more