Key events in EMEA and Latam next week

Czech consumers to remain confident, continued deceleration in Hungary and the Romanian central bank seems sceptical on budging its rates. Read more for an insight into why the week ahead for EMEA and Latam is a mixed bag

No change in the National Bank of Poland's policy

We expect a little deterioration of sentiment in manufacturing with the PMI index mirroring developments of this sector's confidence in Germany. CPI inflation should remain low compared with other CEE states, supporting no change in the National Bank of Poland's policy.

Czech retail sales may disappoint but consumer sentiment remains strong

While the PMI is likely to remain close to its May level, retail sales might slightly disappoint. While the number of working days in year-on-year terms were the same, the distribution of two public holidays differed. This year's holidays were on a Tuesday instead of last year's Monday. The Tuesday holiday will have motivated prolonged weekend breaks that could cause slightly weaker sales in year-on-year terms. Still, consumer confidence hit an historical high in May so consumer sentiment remains strong.

Continued deceleration in Hungary

In Hungary, we see the economic activity indicators showing further deceleration. On the one hand, a deceleration in both the industry and the retail sectors would fit the trend. On the other hand, last year’s high base will have a lot to do with the weak May readings. We expect the budgetary situation to worsen as there is still no sign that the government stopped the pre-financing of EU projects.

Turkish inflation on the rise

We expect June inflation to come in at 1% pulling the annual figure up from 12.1% to 13.5%. This is given the intensifying inflationary pressures from the recent Turkish lira depreciation with repercussions on the outlook for core goods, upward pressure from domestic PPI dynamics and unsupportive base effects.

Romanian central bank to keep the key rate unchanged

We expect the Romanian central bank (NBR) to keep the rate unchanged at 2.5% at the 4 July meeting, mentioning the need to assess the outlook better after more than 200bp in the tightening of lending rates in less than one year, despite CPI recently surprising to the upside. Nevertheless, with money market rates much higher than the key rate and with the Romanian leu under weakening pressure, we see a material chance (around 30%) of a 25bp hike.

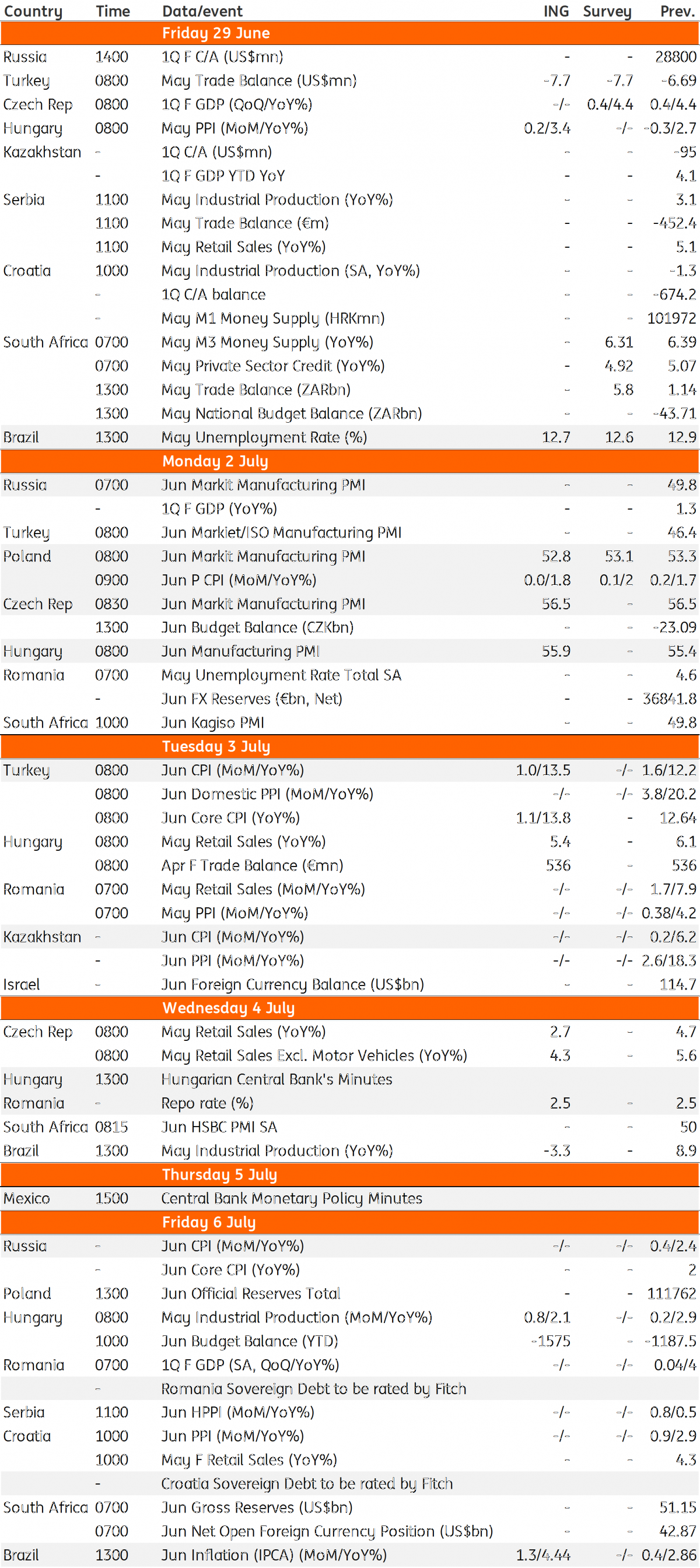

EMEA and Latam Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

28 June 2018

Our view on next week’s key events This bundle contains 3 Articles