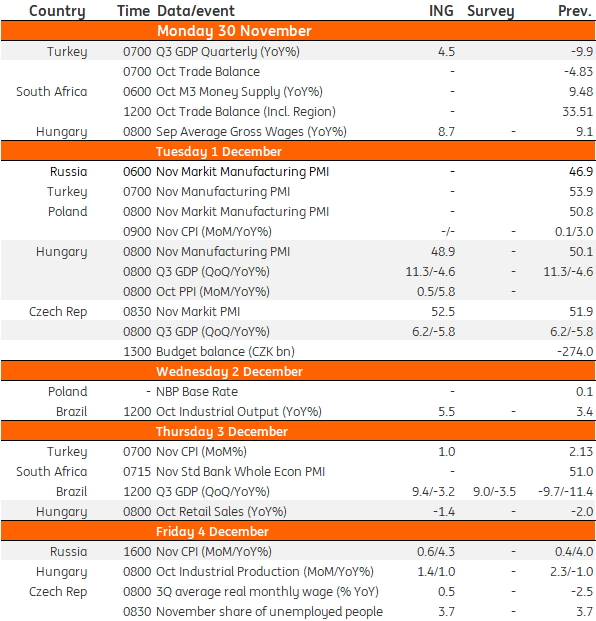

Key events in EMEA and Latam next week

Quite a busy week of data ahead for the EMEA and Latam regions. Watch out for GDP data, some CPI releases and industry data which will reveal what impact the second lockdown has had on economic activity

Hungary: Heavy week of data for retail, industry, and GDP

Next week’s calendar for Hungary will be quite heavy, headlined by the first hard data for the fourth quarter. October will still show some growth in the retail sector as the new containment measures only came into effect in November. We expect the good series of industrial data to continue based on soft indicators and the order books, so industrial production could show a positive year-on-year figure. With the revised third quarter GDP data, we will know the details behind the rebound. Our bet is on services and industry.

Russia: Uptick in CPI means the key rate will likely stay on hold for now

Russian CPI is likely to pick up from 4.0% year-on-year in October to at least 4.3% YoY in November due to higher global grain prices, recent rouble depreciation, and the lack of Black Friday promotions this year. This will mean a high likelihood of an unchanged key rate at 4.25% this December, but it does not mean a reversal in the Bank of Russia’s overall dovish stance, as confirmed this week by Governor Elvira Nabiullina. Based on the temporary nature of the current CPI uptick and likely weakness in the Russian growth story in 2021 we continue to expect a small reduction of 25-75 basis points in the key rate from the current level, depending on the global emerging market trends.

Czech Republic: Despite 3Q GDP accelerating, expect a 4Q decline from renewed lockdowns

We will get detailed 3Q GDP data next week in the Czech Republic. While the economy accelerated solidly by more than 6% quarter-on-quarter, according to the flash estimate, it will decline again in the last quarter. Next year’s outlook is mixed; more positive news related to vaccination vs. the assumption that Covid restrictions will continue to weigh on growth in the first half of the year. The November PMI should remain above 50 points but lag behind its counterpart from Germany, and 3Q wage growth should accelerate by around 3.5% YoY in nominal terms (0.5% real terms) after a weak 2Q (0.5% YoY nominal, -2.5% YoY real) affected by coronavirus economic restrictions.

Turkey: 4Q growth to lose momentum and November inflation to tick upwards

As the 3Q data shows a continued strong recovery, we expect GDP growth in this period to be 4.5% YoY, though the pace of activity will likely lose momentum given moves by the Banking Regulation and Supervision Authority and the Central Bank of Turkey.

November inflation will likely push the annual figure up to 12.6% from 11.9% a month ago given the continuing impact of food prices and pass-through from currency volatility.

EMEALatam Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

27 November 2020

Our view on next week’s key events This bundle contains 3 Articles