Key events in EMEA and Latam next week

Positive manufacturing PMIs will likely reflect the easing of lockdowns in EMEA next week, but this optimism may be overshadowed by a large increase in unemployment numbers

Czech Republic: Industry remains relatively weak

The June manufacturing PMI is likely to increase towards 45 points, as signalled by earlier-published counterparts from the eurozone and Germany. However, a stronger pick-up above the key 50-level is less likely as confidence from industrial companies fell slightly in June, according to data released by the Czech Statistical Office. As such, despite the reopening of large automakers after the Covid-19 shutdowns, industry remains on a weak footing with very limited signs of a V-shaped recovery.

Turkey: Oil recovery to boost inflation

We expect June inflation to be at 0.2%, pulling the annual figure slightly up to 11.6% from 11.4% in the previous month, due to the impact of the oil recovery on the transportation sector. However, in the second half of the year, we will likely witness some improvement in the outlook amid sluggish demand factors.

Hungary: High unemployment but a boost in wage growth expected

We expect the unemployment rate to reflect the impact of Covid-19, jumping above 6% and reaching a high not seen since early 2016. The bad news on the labour market might be mixed with good news for wages. The double-digit wage growth reflects a composition effect as well as the wage settlements in state-owned companies and large employers in the private sector. Based on the PMI figures in developed economies and knowing that some companies restarted fulfilling their outstanding orders, we see a rebound in Hungary's manufacturing PMI too, but still think the index will remain in contraction territory.

Poland: Positive PMI data may not indicate strong recovery

We expect the PMI manufacturing index to increase following rebound of sentiment in the eurozone, and particularly in Germany. Still, the recovery in the industrial sector should be less pronounced than the index suggests. High frequency data of electrical energy production shows a significant deterioration of demand which implies low activity within energy-intensive sectors. The automotive sector is also working at low capacity while production in the mining sector was halted due to the outbreak of Covid-19 in the Silesia region.

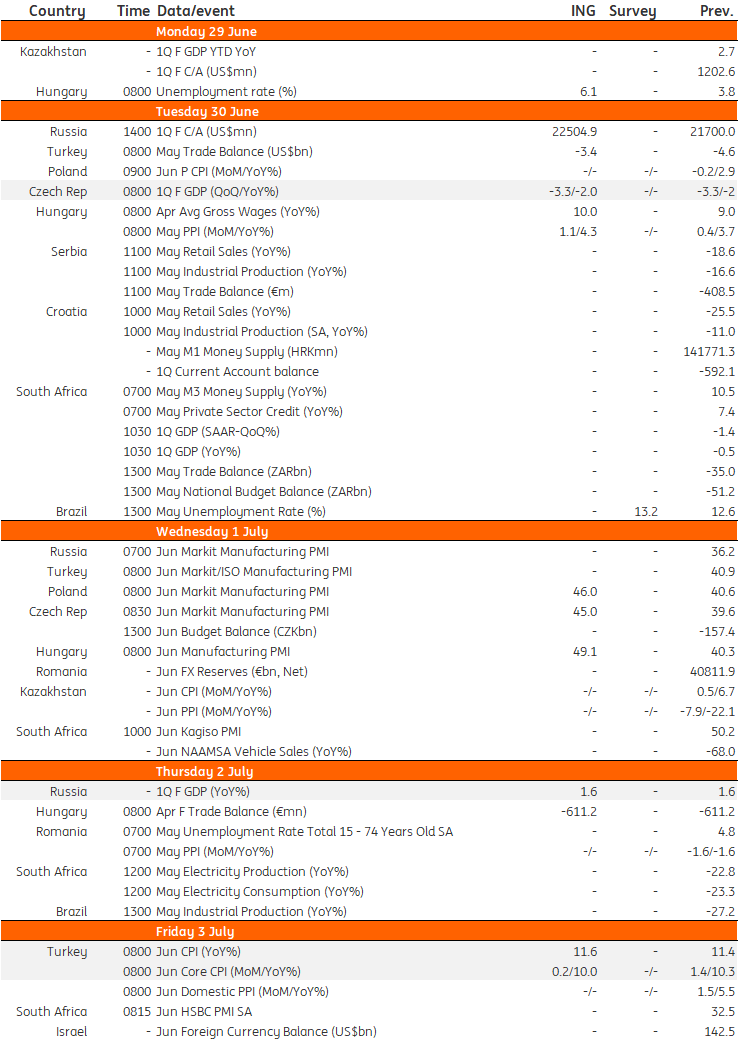

EMEA and Latam Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

26 June 2020

Our view on next week’s events This bundle contains 3 Articles