Key events in EMEA and LATAM next week

A big week for EMEA central banks next week, but what else is going on in the region and Latin America?

The CIS space: Central Bank of Russia to cut rates

The Russia Central Bank meeting on Friday is no doubt the key event, but it is unlikely to bring any major surprises, with ING and the market expecting a 25bp rate cut as a balanced move on the way to normalise policy stance. Apart from this, the second estimate of the 4Q17 current account data for Russia and Kazakhstan will be released, which may see some non-game-changing adjustments.

Czech Republic: Expect a dovish first half of the year

The Czech National Bank (CNB) will stay on hold on Thursday next week, keeping its base rate at 75bp

As February inflation declined below the 2% target, some anti-inflationary risk to the latest forecast will be mentioned by the CNB Board. Inflation decline to 1.8% was driven mainly by high base effects and lower food prices, meaning no game changing from the monetary policy perspective. The CNB wants to sound dovish now, however, to avoid CZK appreciation driven by hikes expectations, as tightening of monetary conditions via FX would leave limited room for interest rate tightening.

But this is the preferred option for the CNB, to escape with rates from the zero-bound as much as possible. Therefore we expect a dovish CNB resulting in limited CZK appreciation in 1H18, enabling the CNB to hike twice in the second half of the year.

Turkey: 2017 growth to end on a high

Economic activity remains strong in 4Q with sustained growth in industrial production, albeit some deceleration. Domestic demand maintains its expansion despite some momentum loss in private consumption with the removal of tax incentives at end-3Q while investment appetite continues on its recovery path.

Accordingly, we forecast 6.9% GDP growth in 4Q17, translating into 7.2% for the whole 2017.

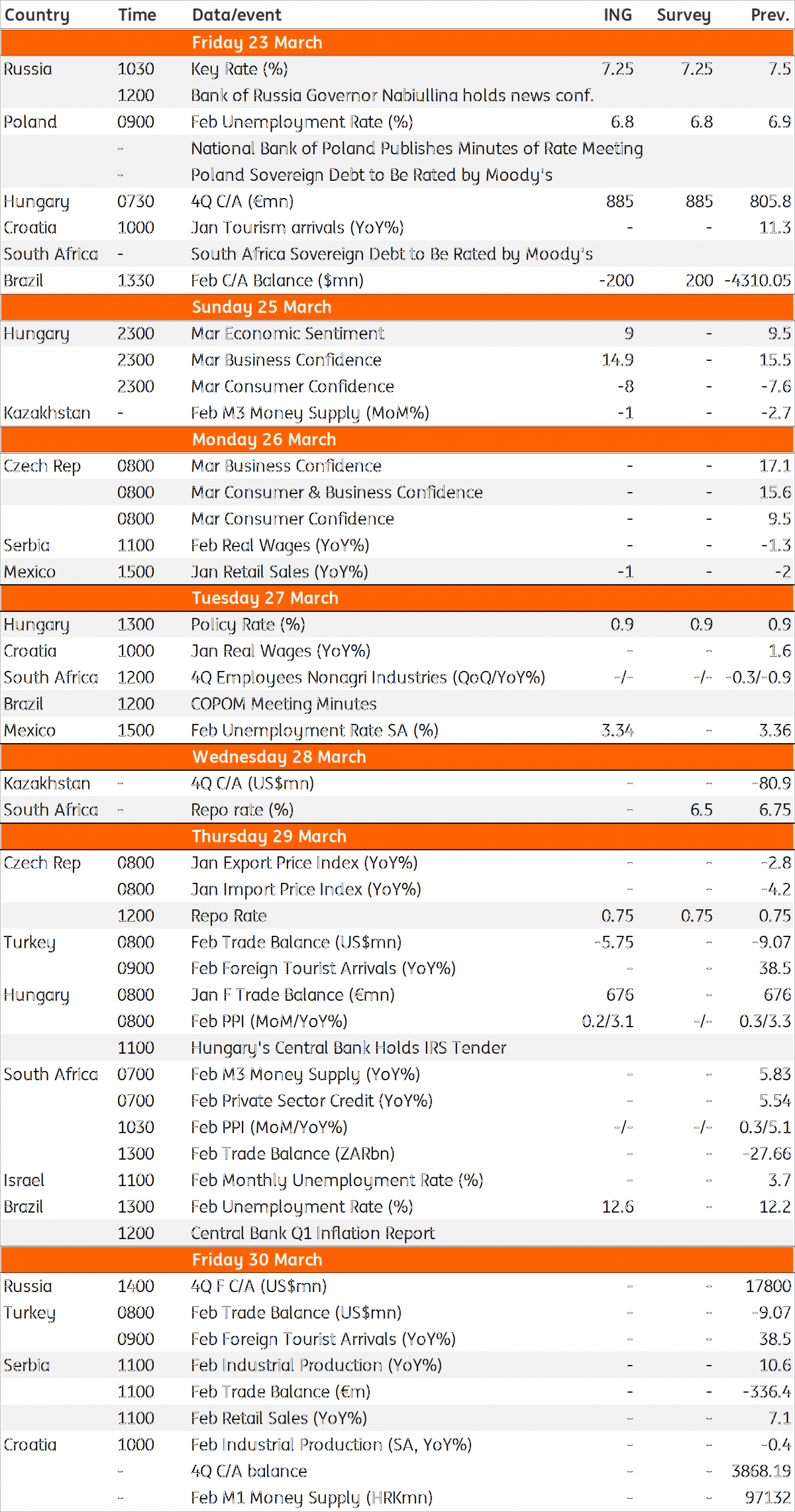

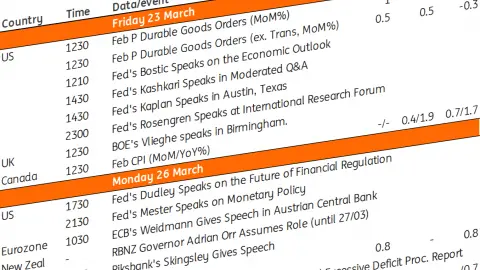

EMEA and Latam Calendar

Download

Download article

23 March 2018

Our view on next week’s key events This bundle contains 3 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more