Key events in EMEA and Latam next week

Expect a fair bit of data in EMEA and Latam next week but our main focus will be the Czech central bank

Czech central bank to hike

Due to a significantly weaker Czech koruna and pro-inflationary risks stemming from strong wage dynamics, we expect the Czech National bank (CNB) to deliver a 25bp hike next week.

The CNB had expected EUR/CZK to be at 25.2 on average in 2Q18; however, in reality, it looks as if it will be 25.6 which means the koruna is more than 1.5% weaker versus the euro. Assuming the Bank's rule of thumb, that 1% Czech koruna appreciation is equal to a 25bp hike, then one-and-a-half to two interest rate hikes seem to be missing at the end of June.

Given its transparent forward guidance to tighten monetary conditions, the weak koruna allows the central bank to deliver a much-needed hike.

The ECB’s decision to provide forward guidance on stable deposit rates until summer 2019 is not a game changer for the CNB. The sensitivity of the koruna to rising interest rate differentials has significantly declined due to the one-way positioning after the end of the FX-floor regime, enabling the CNB to make its monetary decision much more independently of the ECB.

Attention on Polish VAT revenues

We expect the central government budget surplus to remain solid in May at approximately PLN 7 billion. The VAT revenues should get a fair bit of attention as the previous month presented only a moderate annual increase.

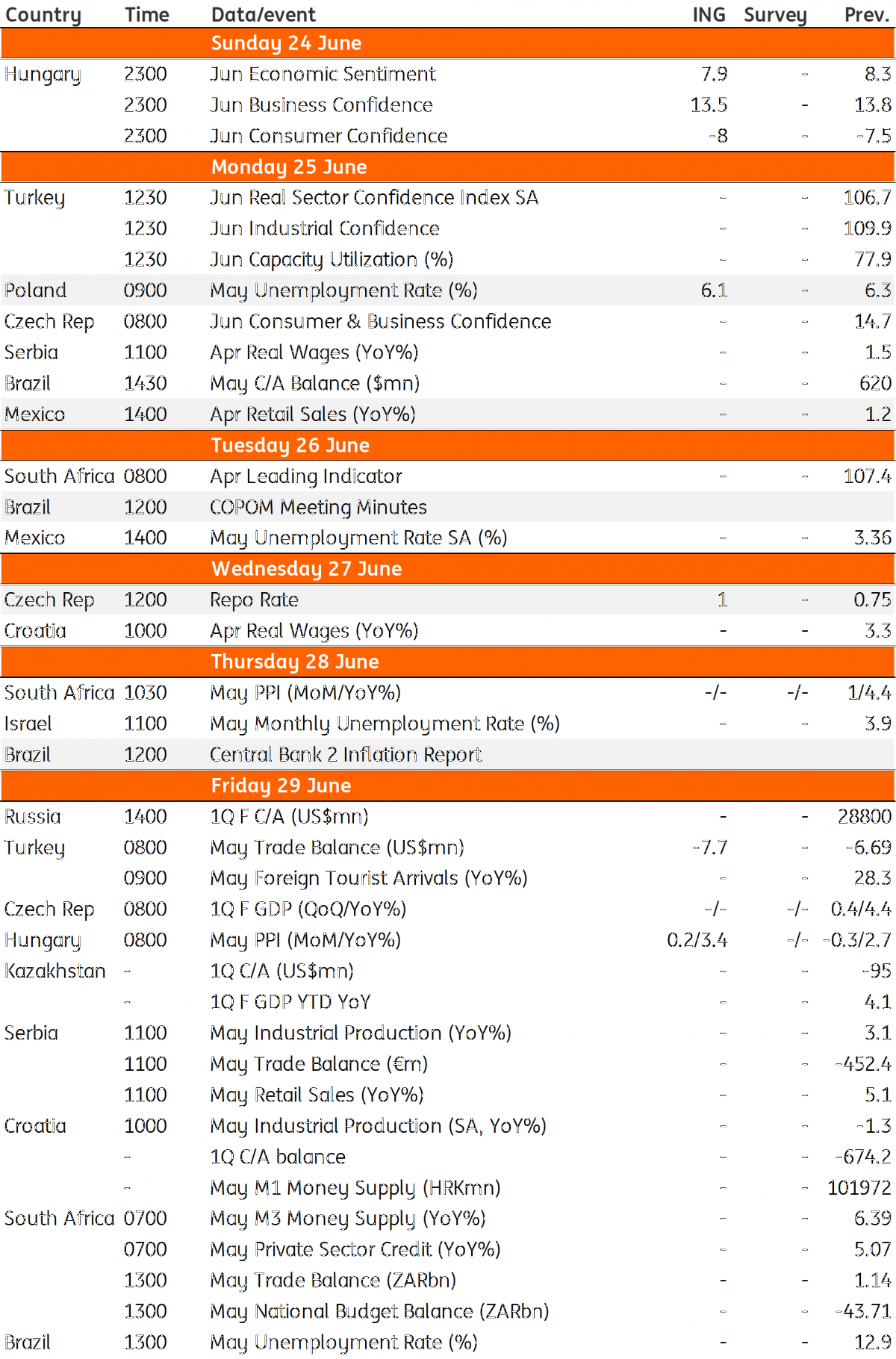

EMEA and Latam Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

21 June 2018

Our view on next week’s key events This bundle contains 3 Articles