Key events in EMEA and Latam next week

Data from Poland next week should show a rebound in retail sales and wage growth, as well as signs of resilience in industry, signalling the economy is in no danger of an imminent slowdown

Poland: Domestically, things look pretty solid

We expect strong industrial production in April (9.5% year-on-year), with calendar effects adding two percentage points to the headline. On a seasonally adjusted basis (approximately 7.1% YoY), we are still seeing robust contributions from the export sector and those closely related to construction. Polish industry seems to be surprisingly resilient – we don't see imminent signs of a slowdown, even the most negative sentiment index (PMI) is returning towards the 50-point threshold, which signals expansion.

Labour market data should reveal a rebound in wages (6.5% YoY in April) after a surprisingly soft March. A negative drag is visible in the case of construction. However the number of companies planning wage increases - reported in the National Bank of Poland's (NBP's) survey, is consistent with a further acceleration in the coming months. The magnitude of increase is unlikely to be strong; we expect growth to stabilise in the 7-8% YoY range.

Retail sales should increase from 1.8% to 7.1% YoY (constant prices). Last month's deceleration - and thus the current rebound - are solely related to Easter effects. Nevertheless, overall sentiment remains good. Consumption will be supported in the coming months by the introduction of new social programmes including: 1) the lump-sum retirement payment in May and 2) child benefit expansion in July.

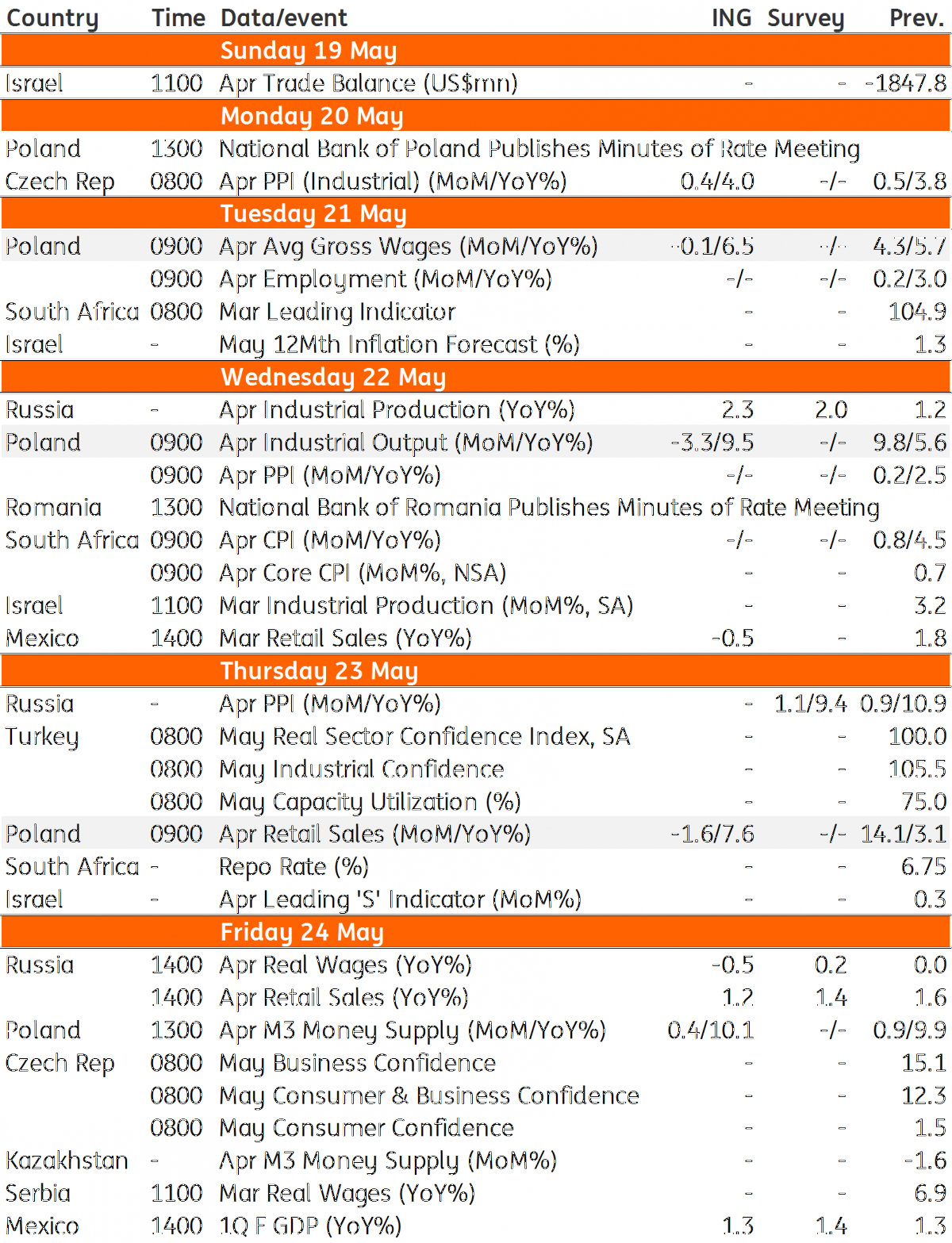

EMEA and Latam Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

17 May 2019

Our view on next week’s key events This bundle contains 3 Articles