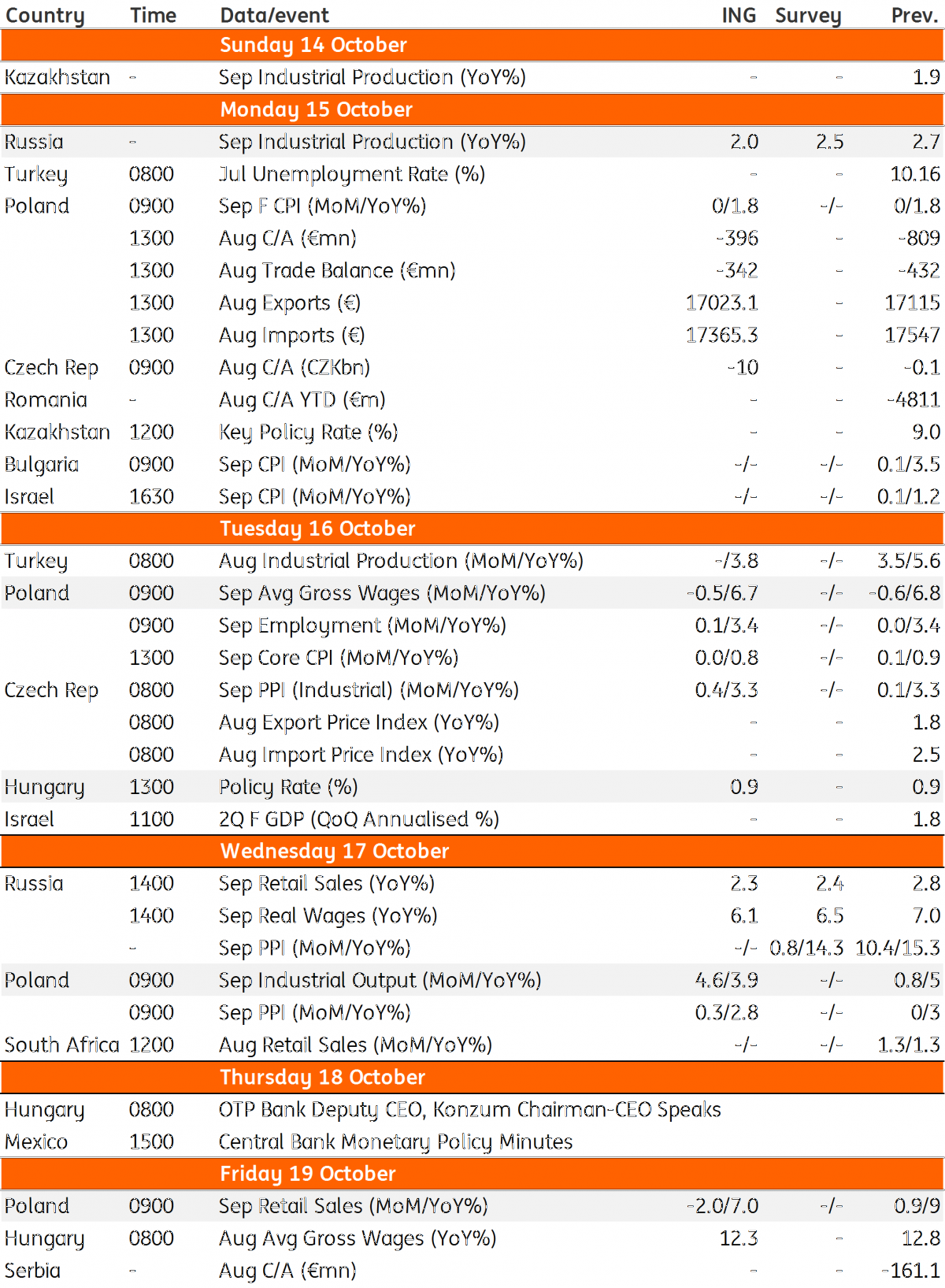

Key events in EMEA and Latam next week

A central bank meeting in Hungary, economic activity data from Russia and confidence indicators from Poland are this week's highlights in EMEA

Three reasons why Hungary's MPC meeting shouldn't surprise

In Hungary, the earlier-than-usual Monetary Policy Committee (MPC) meeting- due to a national holiday on 23 October- will likely be a non-event given (1) the National Bank of Hungary (NBH) made a lot of adjustments just three weeks ago; (2) one of them was that the NBH will do major adjustments only quarterly when it releases its new Inflation Report; and (3) the September inflation readings didn’t provide any major surprise as core inflation was at 2.4% year-on-year.

Russia: Industrial and consumer activity to soften

We expect Russian economic activity indicators for September to show signs of softening compared to the summer months. Industrial output should slow after the completion of large state-sponsored CAPEX projects and as result of calendar effects. The preliminary gauge of consumer sentiment also points to a likely deceleration in spending growth following the end of the electoral cycle, the recent budget policy decision and a new round of external uncertainties.

Poland's confidence indicators worsening should see sub-consensus data releases

We expect sub-consensus industrial production (3.9%YoY), wages (6.7%) and retail sales (7%) figures in September. Monthly activity data from 3Q18 still suggests GDP growth of close to 5% YoY, but given the worsening of nearly all confidence indicators, a slowdown in the 4Q is the most likely scenario.

EMEA and Latam Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

11 October 2018

Our view on next week’s key events This bundle contains 3 Articles