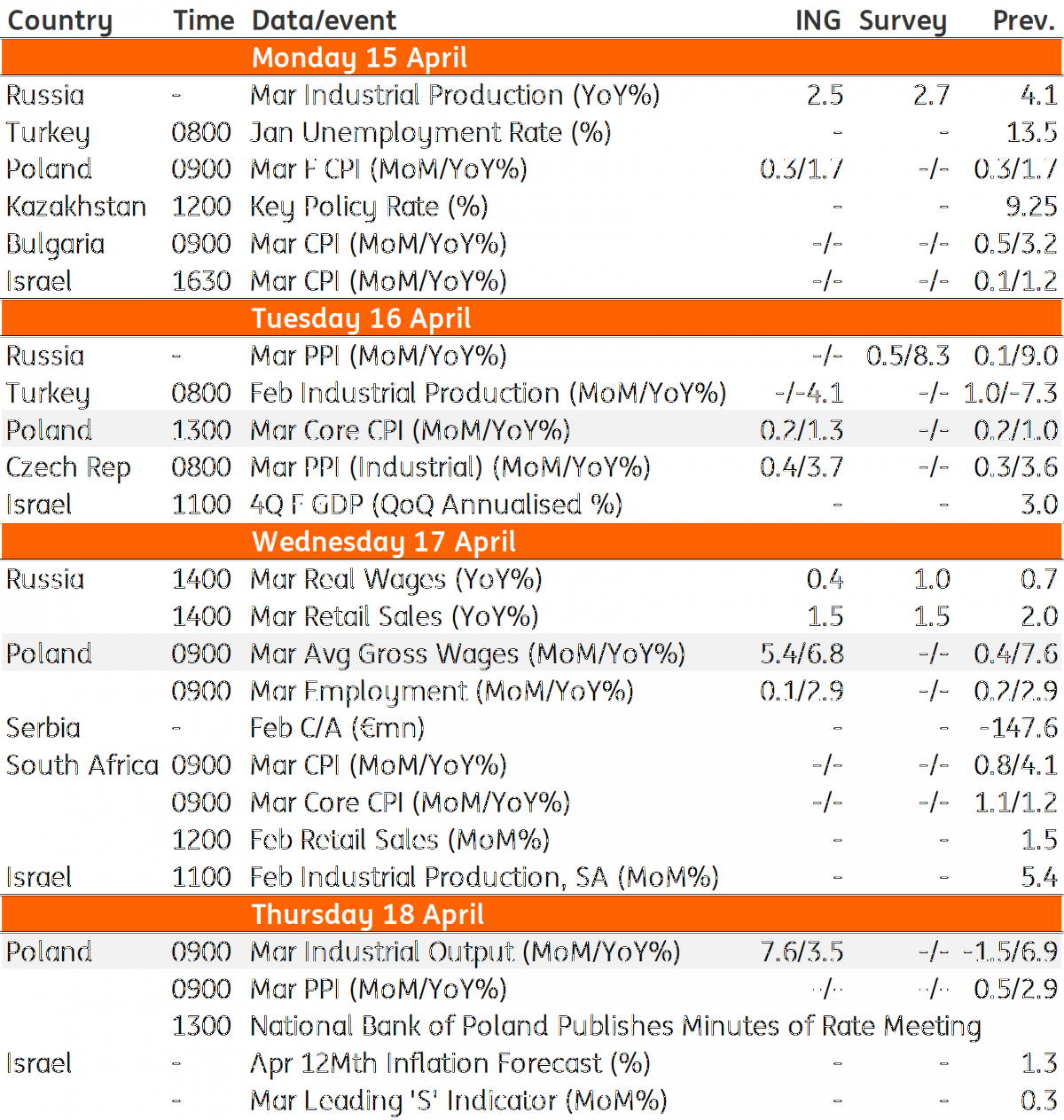

Key events in EMEA and Latam next week

Data from Poland next week should paint a mixed picture of the economy. While the labour market will likely remain solid, annual industrial output should decelerate

Poland: Positives for the labour market, but as for industrial production...

The final CPI reading should provide further information about the increase in core inflation in March – from 1.0% to 1.3% year-on-year. We expect the higher reading was driven by supply side factors, such as bigger charges in telecommunication, rather than demand-driven growth.

Figures on the labour market should be relatively upbeat. We expect a stable increase in employment (2.9% YoY) and a modest deceleration of wages - from 7.6% to 6.8% YoY. Lower wage growth was probably driven by negative statistical effects in the construction sector.

Finally, we expect industrial production to decelerate from 6.9% to 3.5% YoY. Calendar effects subtract approximately two percentage points. Also, export-oriented sectors are likely to record a weaker performance when compared with February. We also expect a lower contribution from the mining sector.

EMEA and Latam Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

12 April 2019

Our view on next week’s key events This bundle contains 3 Articles