Key events in EMEA and Latam next week

In EMEA and Latam next week, the shine may be taken off strong Polish production figures due to weaker wage growth. The recent decline in oil prices will also feature again via some expected low inflationary figures

Poland: Solid production, weak wages

The final CPI reading for December should confirm low 1.1% year-on-year growth. Core inflation likely fell by another 0.1 percentage point to 0.6% YoY. We also expect solid industrial production in December (7.3% YoY), above local economists' consensus (4.7%YoY). Labour market information should surprise negatively with weaker wages – we expect a drop to 6.7% YoY from 7.7%.

Hungary: Low oil prices to pull down headline CPI - again

The only - but still key, data release from Hungary is the December inflation reading. After a huge drop last time, we see the headline inflation rate falling to 2.7% YoY. The main reason behind the expected drop is the significant decrease in fuel prices. Still, we expect core inflation to increase to 2.8% YoY, mainly on the back of services.

Romania: CPI to end 2018 within National Banks' target band

Helped by oil prices and a stable currency, the National Bank of Romania (NBR) has managed to tame CPI inflation. We expect inflation to end-2018 at 3.2% YoY. This is quite an achievement, despite benefiting from positive supply-side developments, as the figure stood at 5.4% in mid-2018. We see core inflation little changed at around 2.5%.

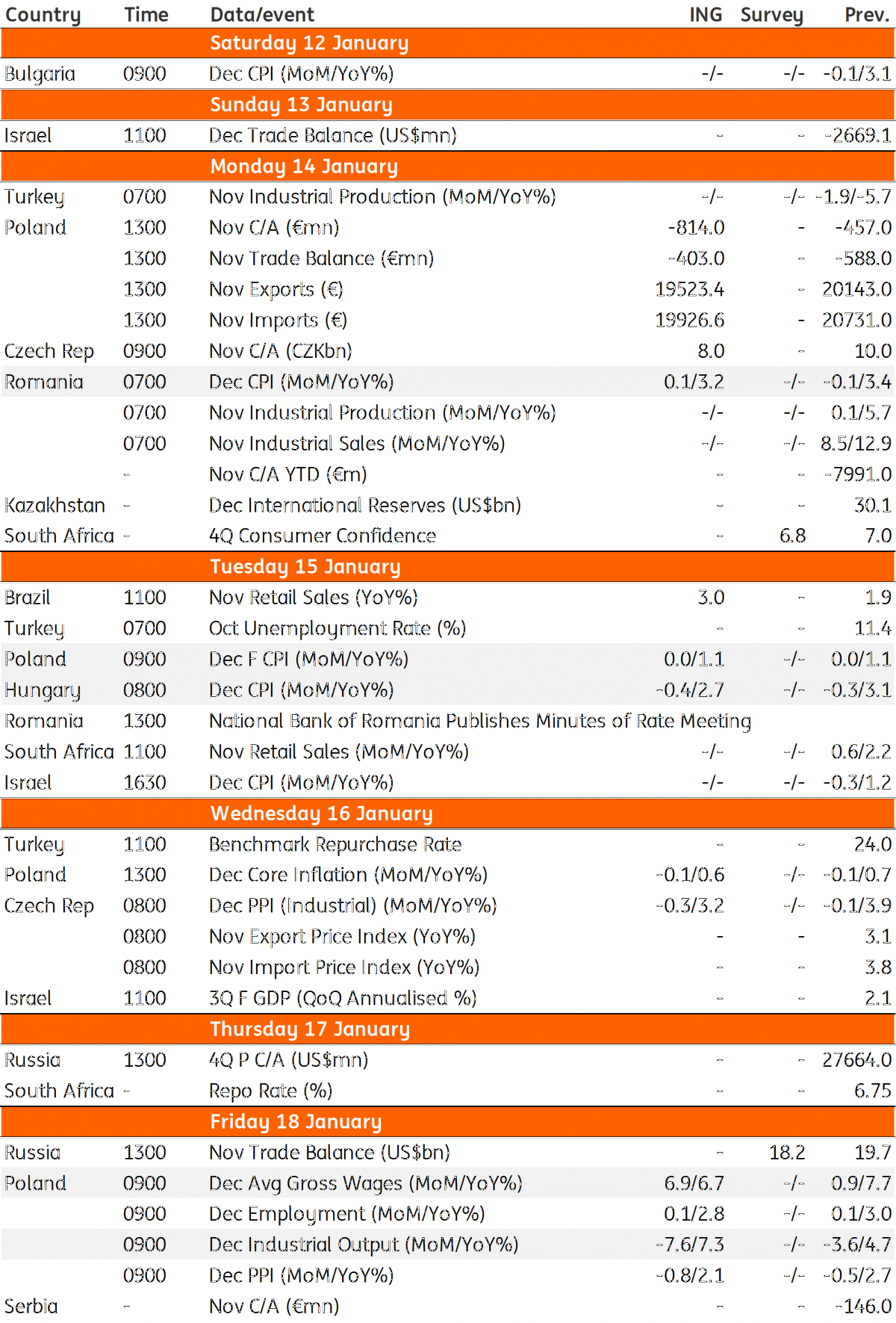

EMEA and Latam Economic Calendar

Download

Download article

11 January 2019

Our view on next week’s key events This bundle contains 3 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more