Key events in EMEA and Latam next week

Key readings on second-quarter GDP take centre stage in EMEA and Latam next week. Poland and the Czech Republic should see good numbers thanks to strong domestic demand while Hungary could see a mild slow down

Two key events to watch in Hungary

In Hungary, there are only two events to watch out for next week, but they're important. On Tuesday, the Statistical Office releases the advance estimate of 2Q18 GDP. We expect a mild deceleration to 4% year-on-year, as both the industry and retail sectors have shown some sign of softening recently.

On Friday, the rating agency Standard & Poor's will review its sovereign debt ratings. In our view, the potential for an upgrade is 50/50. S&P gave a positive outlook exactly a year ago, and the important metrics are looking good. But recent market turmoil and deficit numbers (the EU-transfer story) could prevent the agency from acting. Neither outcome (confirm or upgrade) would come as a surprise, so we only expect a limited market reaction after the decision.

Double-digit investment growth could boost Polish GDP in 2Q

We expect 2Q18 GDP to grow by 5.3% year on year based on solid consumption and double-digit investment growth. The contribution from net exports should be positive after a -1.2% deficit in the first quarter, which was likely a statistical anomaly. Data on the labour market is expected to confirm a moderation of wage pressures in the enterprise sector - we forecast stable salary growth of 7.4% YoY.

Czech Republic reliant on domestic demand as growth driver

A flash estimate for 2Q Czech GDP should show growth accelerated slightly, in quarterly terms, after the 0.5% reading we saw in the first quarter. However, due to a high base rate and negative net exports, the annual rate should decelerate towards 2.5% - which would be the lowest YoY reading this year.

This shouldn't be taken as negative news as both household consumption and investments are likely to remain solid. As such, domestic demand will be the main driver of overall economic expansion this year, while net exports will detract from growth. This is due to weaker export activity as well as strong imports, predominantly driven by higher domestic demand and import-intense investments.

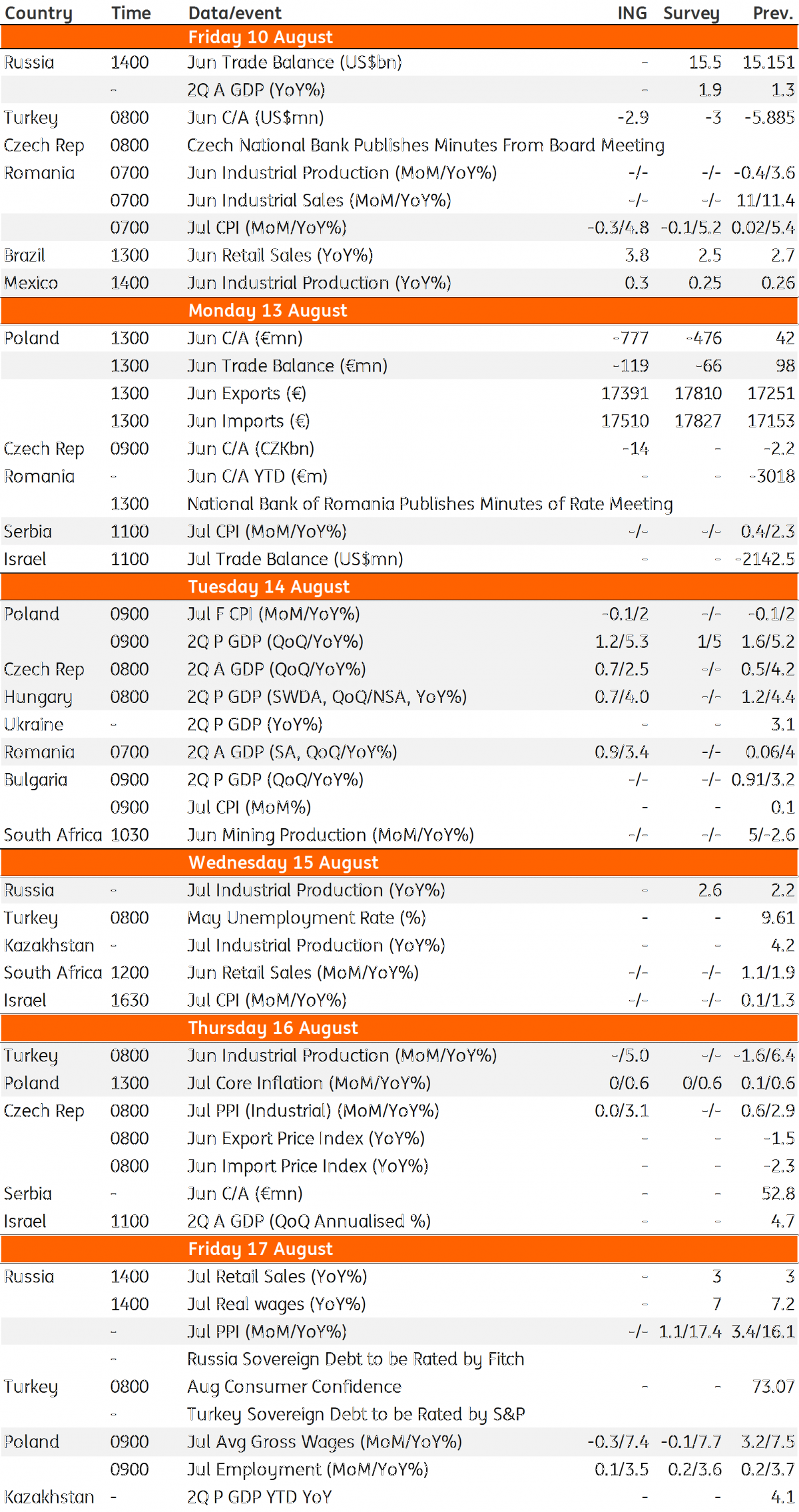

EMEA and Latam Economic Calendar

Download

Download article

10 August 2018

Our view on next week’s key events This bundle contains 3 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more