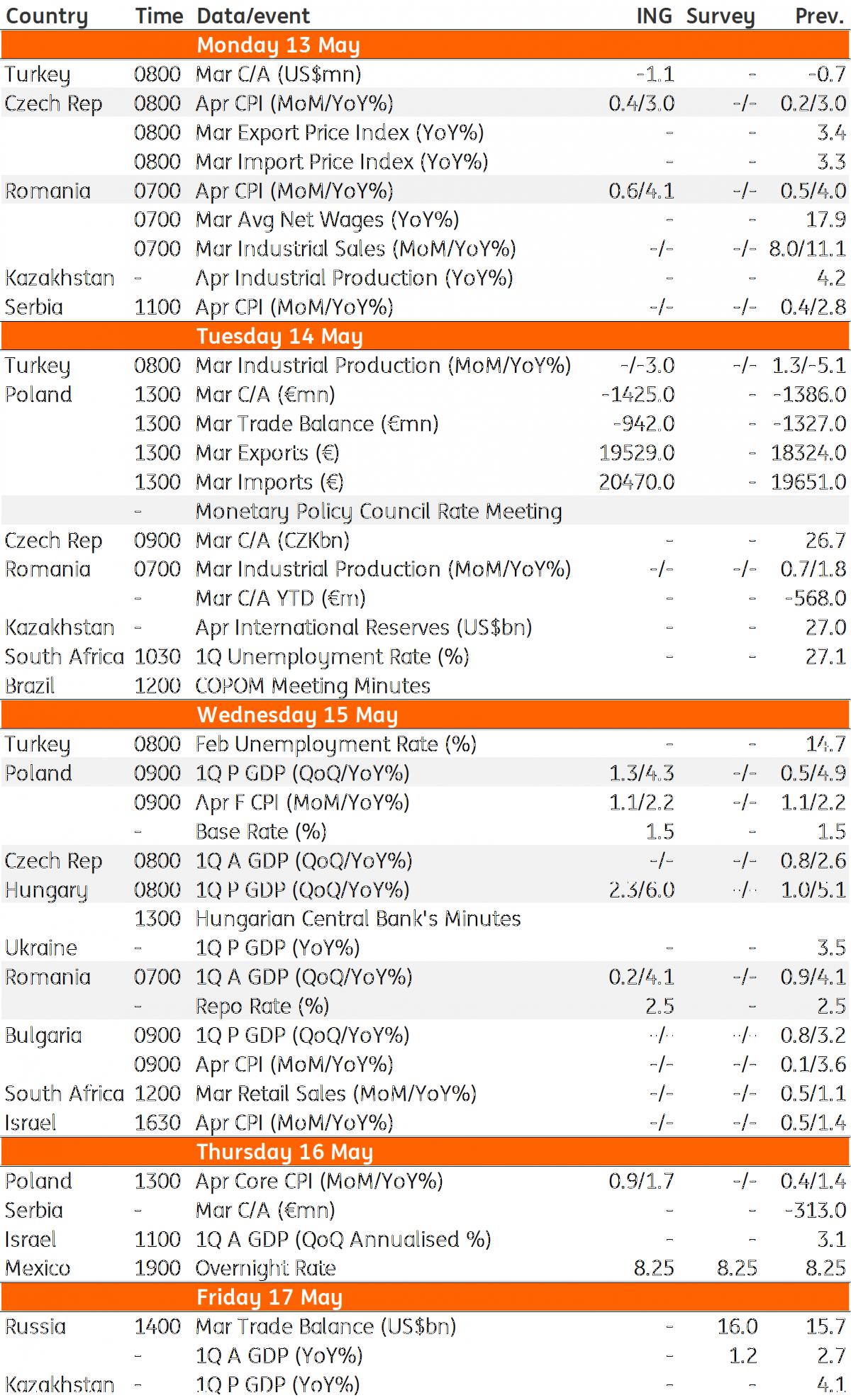

Key events in EMEA and Latam next week

Next week brings a flurry of 1Q19 GDP growth reports and the view is mixed. In the Czech Republic and Poland, we anticipate mild disappointment while in Hungary, we're gearing up for a record figure

Czech Republic: 1Q19 GDP could disappoint

In April, fuel prices accelerated 4.0% month-on-month and this should help push headline CPI up by 0.4% on the month, though a higher base effect should keep the yearly rate at 3.0%. In its latest forecasts, the Czech National Bank (CNB) predicted a 2.9% year-on-year figure in April, with a gradual slowdown from May onwards amid higher base effects in both fuel and core prices.

In our view, flash GDP for the first-quarter might be below both the CNB's (2.6%) and MinFin's (2.7%) forecast, due to weaker foreign demand.

Poland: Monetary Policy Council to ease inflation concerns

After a strong and surprising CPI increase in April from 1.7% to 2.2% YoY, we expect the Monetary Policy Council (MPC) to play down potential concerns about inflation. After the release, some centrist members (R.Sura, J.Kropiwnicki) reiterated their expectations that inflation should remain under control; the National Bank of Poland's governor should present a similar view.

The final CPI reading for April (due Wednesday) should provide more detail on the uptick in core inflation from 1.4% to 1.7% YoY. The rise may be related to methodological issues in the clothing category or the seasonal increase in package holidays (not seen in previous years). We expect increases in the coming months to be more gradual compared to the jumps seen in both March and April. The weaker industrial goods inflation in the eurozone should limit growth in Poland as well.

We expect GDP to moderate in the first-quarter from 4.9% YoY to 4.3% YoY, based on lower contributions from both investment and net exports. On the production side, we see weaker contributions from both the construction and transportation sectors.

Hungary: Record GDP growth

Economists and forecasters have been unanimously expecting a deceleration in Hungary's 1Q GDP. But high frequency data over the past three months suggests we could, in fact, see a new record for GDP growth, with the major surprise likely to come from the sizeable contribution from construction and a better-than-expected increase in industry’s value added. The National Bank of Hungary's (NBH) minutes should be a non-event (again) as the latest NBH press release didn't contain any meaningful change.

Romania: Key rate unchanged at 2.50% on fuzzy outlook, slower growth, higher inflation

We expect the April CPI to inch 0.2 percentage points higher month-on-month, bringing the annual rate to 4.1% - a new high for the year but possibly not the peak. Higher fuel prices are mainly to blame followed by a spike in fresh fruit prices and - to a lesser extent - in services. This occurred despite a mild appreciation in the Romanian leu in April. The latest hawkish NBR minutes likely came in anticipation of the inflation profile being different from what the central bank had in mind at the beginning of the year. We expect the National Bank of Romania to keep the key rate at 2.50% at its May meeting next week, maintain its hawkish tone and revise higher its inflation forecasts for this year. “Strict” liquidity management will most likely be cited again.

On the economic front, stronger consumption has likely been accommodated via higher imports hence the negative contribution to growth from net exports has probably offset - to a large extent - the consumption boost in the first-quarter of 2019. Public investment spending has been very low due to an unapproved budget bill. There are also high levels of uncertainty in the private sector due to late-2018 fiscal changes weighing in (as well as on) spending/investments decisions. All things considered, we expect a marginal acceleration in the economy by 0.2% in 1Q19 vs. 4Q18, which translates into 4.1% year-on-year growth.

EMEA and Latam Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

10 May 2019

Our view on next week’s key events This bundle contains 3 Articles