Key events in EMEA and Latam next week

We're expecting a flurry of 3Q GDP reports from the EMEA region next week and expectations are mixed. Figures from Poland will likely be better-than-expected and the Czech Republic should see a small acceleration. But the slowdown story in Hungary is set to persist, while Romania and Bulgaria could decelerate, too

Polish GDP: Above consensus?

For the third quarter, we expect Polish GDP to come in at 4.9% year-on-year- above consensus- supported by strong domestic demand. Investment should recover after a soft second-quarter, partially offsetting a moderation in private consumption.

The final CPI inflation reading should confirm a slowdown to 1.7% YoY in October. According to the flash reading, the slowdown was largely caused by food prices. But still, core inflation is likely to remain stable at 0.8% YoY.

Hungarian economy to continue gradual slowdown

We expect the Hungarian economy to continue its gradual slowdown after peaking in 4Q17, based on seasonal and calendar adjusted QoQ growth rates. Our LeadING HUBE indicators are pointing towards a moderate deceleration, mainly on the back of a challenging external environment. Against this backdrop, we forecast 4.3% YoY GDP growth in 3Q18.

Romania: The good and the bad

The National Bank of Romania should receive some good news from the CPI release. We expect inflation to decline by 1 percentage point to 4.0% YoY in October, largely on the back of statistical effects coming out of the base. This is likely to support the central bank's dovish stance.

But the 3Q18 GDP print will be less positive for the government, as it's likely to confirm that the official growth forecast is obsolete. We expect GDP growth to slow down to 3.0% YoY - mainly on base effects.

It will be interesting to see if there are any signs of cracks in the unanimity of the central bank given that Governor Mugur Isarescu's dovish tone was in stark contrast to Deputy Governor Liviu Voinea's hawkish message less than a month ago. An announcement from Fitch on Friday should be a non-event as the rating agency seems less concerned about the outlook relative to the other two major agencies, especially S&P.

Bulgaria: Slower growth and lower inflation

We expect Bulgarian GDP growth to slow down to 3.0% in 3Q18 from 3.6% in the previous quarter on both weaker external demand (as seen by the disappointing GDP reading in the eurozone) and softer domestic absorption.

While CPI is likely to accelerate quite significantly on a monthly basis, we expect it to decline by 0.2ppt to 3.4% year-on-year in October due to statistical base effects. An announcement from Fitch on Friday should not be news, though the S&P decision (due 30 November) could be more exciting. The agency has a positive outlook on Bulgaria but its rating is one notch below the other two major agencies.

Positive signs expected from Czech 3Q GDP

The flash 3Q GDP growth estimate for the Czech Republic should accelerate slightly from the somewhat weaker 2.4% rate in 2Q18, which was partially caused by the base effect and a negative contribution of inventories.

The Czech National Bank expects 2.7% SA YoY growth while MinFin is looking for 2.6% growth. Given the slightly disappointing September prints in the Czech real economy, we think a 2.6% figure is more likely. The Statistical office will not release details yet but household consumption and investment should remain the main growth driver. In contrast, inventories might surprise negatively due to a high base from last year.

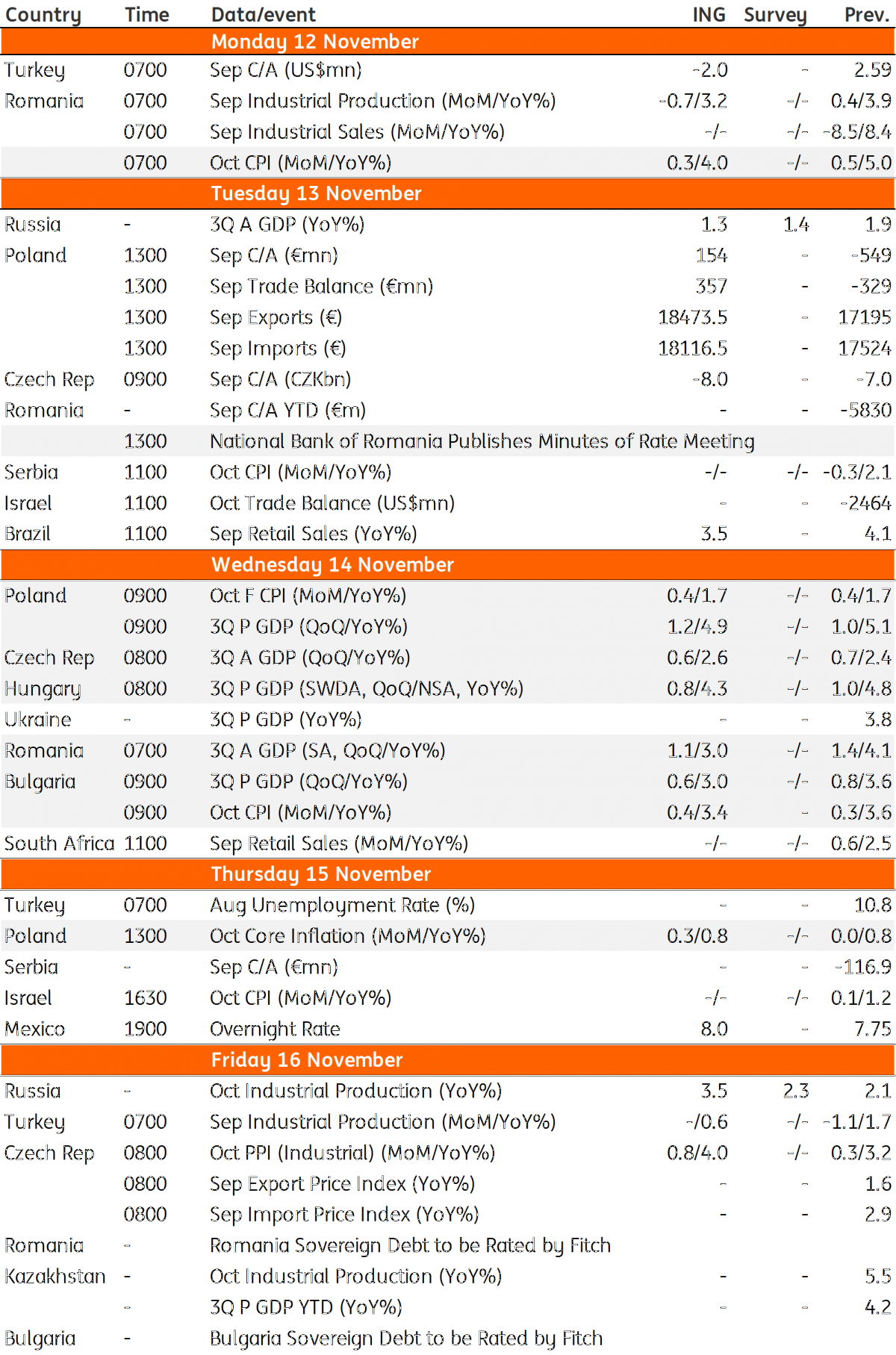

EMEA and Latam Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

9 November 2018

Our view on next week’s key events This bundle contains 3 Articles