Key events in EMEA and LATAM next week

Election time in Hungary and a busy central bank week in EMEA, but who do we think will hike, cut or hold rates?

Hungary: it's election time!

In Hungary, the key event is the general election on Sunday. We see Fidesz-KDNP winning the election by a simple majority, but the end result could be much closer than anyone’s guesses, especially if the opposition finds success in its coordination withdrawing candidates. On the data front, the CPI release could bring some excitement. We expect inflation to pick up somewhat, however the latest CPI readings across Europe showed downside surprises and this might happen to Hungary too.

Romania: looking for clues in the national bank's minutes

In Romania, we expect CPI to slow down from 4.7% to 4.6% YoY in March. The National Bank of Romania (NBR), had asymmetrical information at its latest meeting, including preliminary data on March CPI, which shifted the balance towards a no change decision, against the market consensus. We will be looking for more clues in the NBR minutes, due 11 April, but also for a change in the recent unanimous voting pattern.

Serbia: inflation and FX outlook to cut rates

In Serbia, we hold a non-consensus view and look for a 25bp rate cut to 3% by the central bank as the inflation outlook is supportive and the FX market is relatively stable.

Poland: low inflation environment to reaffirm dovish rhetoric

We expect the Monetary Policy Council to reaffirm their dovish rhetoric, especially after a very soft CPI inflation reading in March (flash estimate at 1.3% YoY, with core inflation close to 0.5% YoY). The National Bank of Poland's Governor Glapiński is likely to confirm that interest rates hikes are unnecessary in the low inflation environment. Eventual rate cuts should be also excluded.

Czech Republic: rates temporarily on hold to avoid CZK appreciation

While the labour market will continue its favourable development with the unemployment rate falling further, March CPI is expected to remain below the Czech National Bank's (CNB) target. Despite the fact that fuel prices fell slightly in month-on-month terms (-0.8%) and that food prices most likely just stagnated, core inflation slightly increased, which should keep year-on-year dynamics at 1.8%, as in the previous month. Lower inflation compared to its peak in October 2017 is driven mainly by base effects and lower food prices, not a game changer from the monetary policy perspective.

However, as we already mentioned in our Czech National Bank preview, the CNB wants to sound dovish now, to avoid CZK appreciation driven by hike expectations, as tightening of monetary conditions via FX would leave limited room for interest rate tightening. Therefore we believe that inflation slightly below the target is convenient for the CNB and its communication strategy for the time being.

The CIS space: Russian inflation to uptick, National Bank of Ukraine to keep key rate on hold

In the CIS space, Russia’s highlights will be inflation data for March, where we expect only a marginal pick-up in headline/core rates, and flash estimate of the C/A surplus which we expect at decent US$27.3bn.

In Ukraine, the expected stabilisation of annual inflation near 13% will likely allow the Nartional Bank of Ukraine to keep its key rate on-hold at 17%.

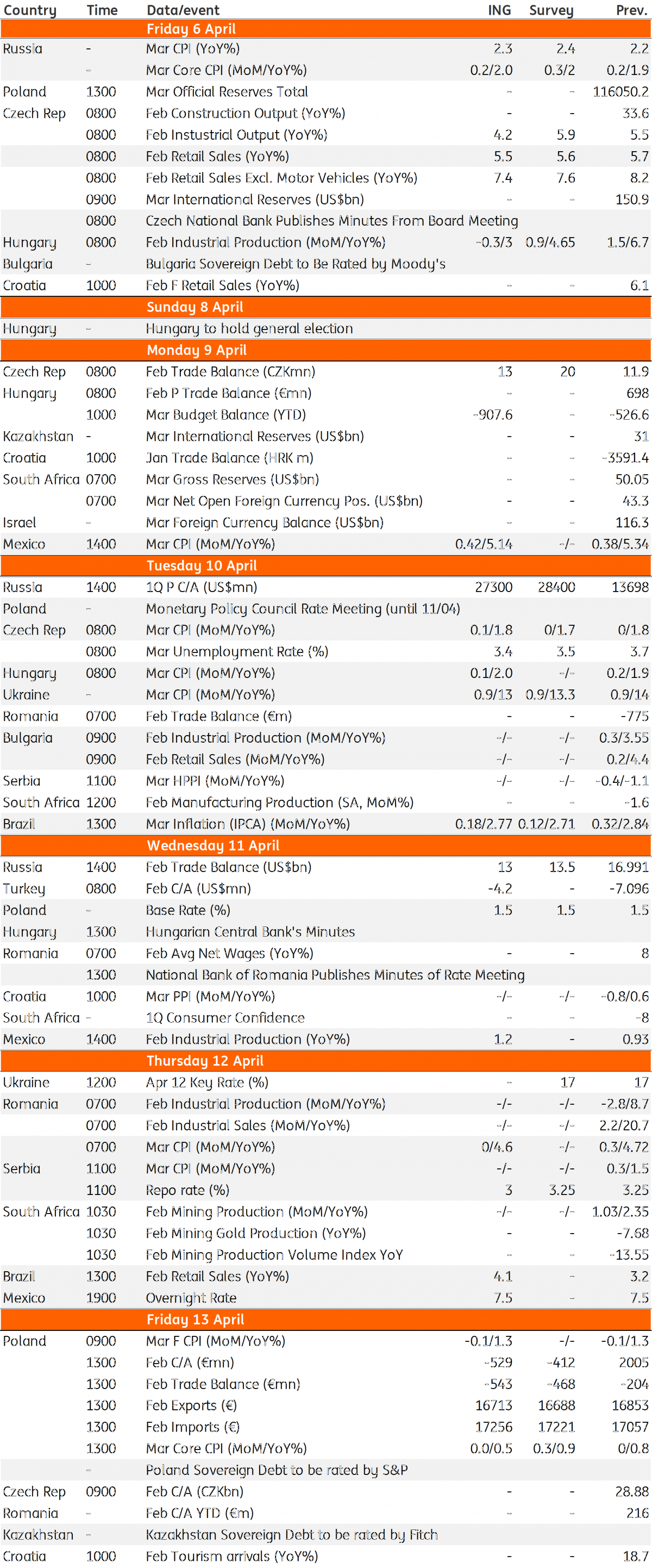

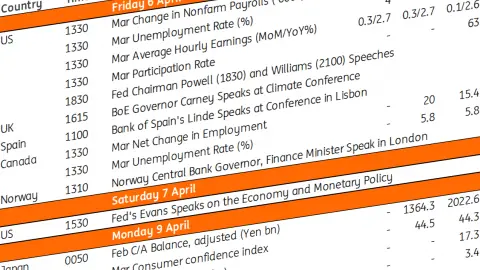

EMEA and Latam Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

5 April 2018

Our view on next week’s key events This bundle contains 3 Articles