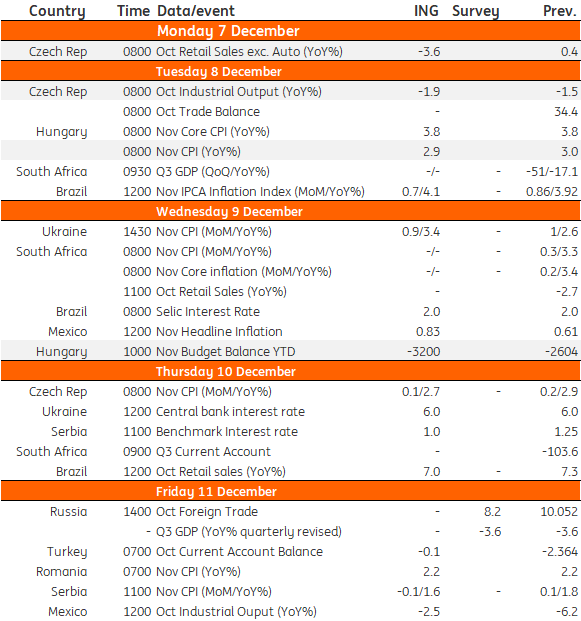

Key events in EMEA and Latam next week

Data releases across the EMEA region next week are expected to show that economies have stagnated in response to the second lockdown. Keep an eye on inflation in Hungary and the Czech Republic, as well as industry data and retail sales

Hungary: Inflation lower than expected and budget deficit to deteriorate

Although next week’s calendar for Hungary looks quite thin, we still have two interesting data releases. First of all, the November CPI which will come in at 0% on a monthly basis mainly due to fuel price developments, in our view. This also means that core inflation is expected to remain unchanged at 3.8% year-on-year. With these readings, the inflation trajectory remains lower than expected by the central bank, probably triggering a downward revision to the December Inflation Report. As the new containment measures were introduced in November, we expect a further significant deterioration in the budget deficit.

Czech Republic: Retail sales, industry data and inflation all to decline

October retail sales will be partially hit by the second Covid lockdown and a closure of retail shops starting on 22 October. As such, a single-digit decline is again expected in YoY terms after very mild growth in September. Also, some small YoY contraction should occur in Czech industry in October, though car production slightly increased in YoY terms for the first time since February, according to the preliminary figure. Inflation is likely to further decelerate amid a higher base (2.7% YoY), which is broadly expected, but will stay firmly in the Czech National Bank's upper tolerance band.

EMEALatam Economic Calendar

Download

Download article

4 December 2020

Our view on next week’s key events This bundle contains 3 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more