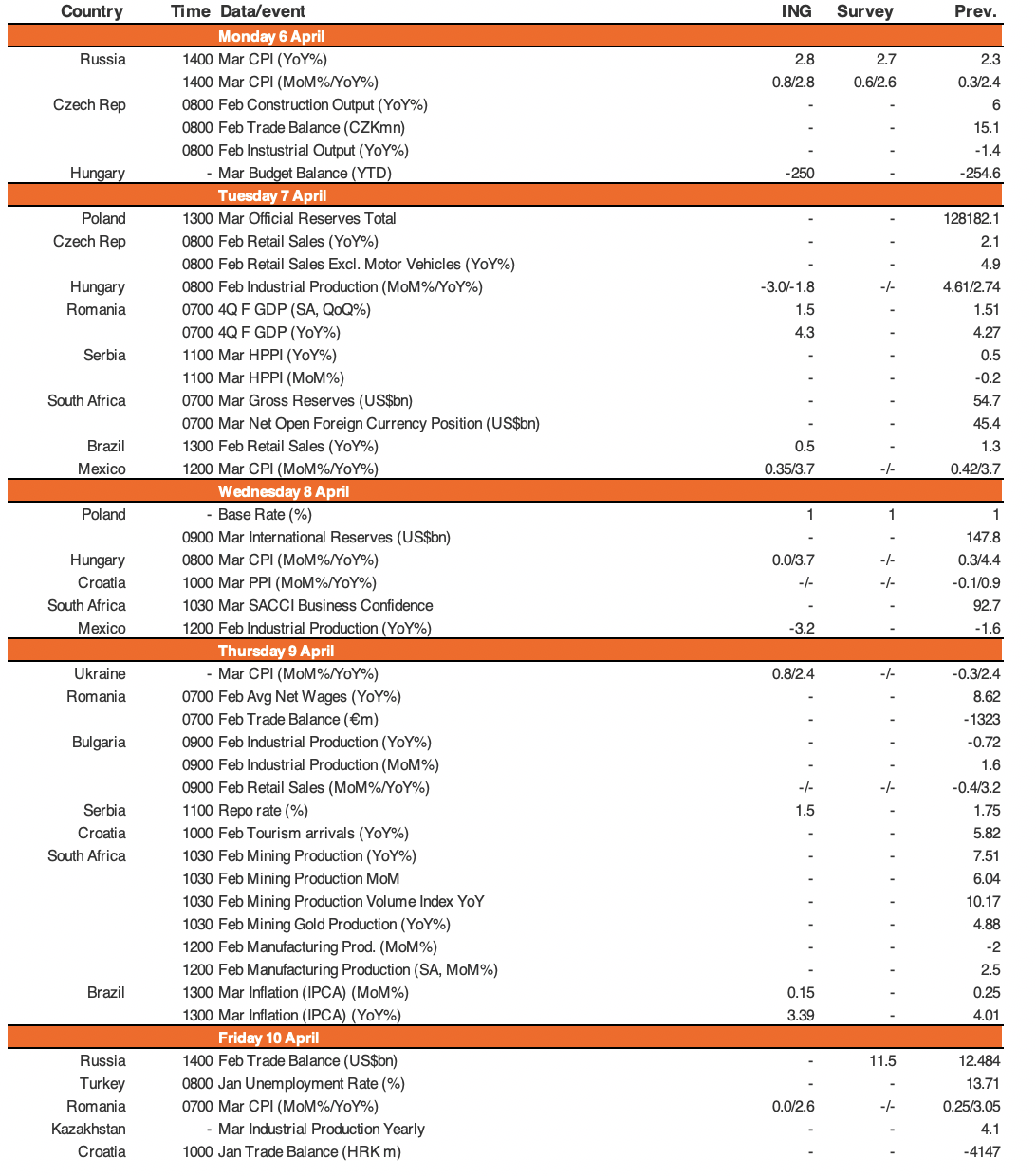

Key events in EMEA and Latam next week

More of the same story as data across the EMEA region reflects the economic cost of Covid-19. March CPI readings are a battle between the drop in fuel prices versus stockpiling as a result of quarantine measures

Hungary: As a starter next week, Hungary’s Ministry of Finance will release the March budget balance, where we expect a significantly better monthly deficit due to an EU transfer and the expected jump in VAT revenue related to the panic buy. For the main course, we will have February industrial production, which will be partially affected by Covid-19 (via the supply chain channel), so the 3% MoM drop is just the beginning.

Last but not least, the dessert: we see the March CPI reading heavily affected by the drop in fuel prices, but this might be somewhat counterbalanced by the weaker HUF and the demand-driven jump in food prices. If the latter will be weaker than expected and services will be heavily affected by lack of demand, we can see even a drop in prices on a monthly basis, compared to our base case of stagnation.

Czech Republic: Ministry of Labour decided to publish March share of unemployed people earlier and moved data release already to Friday April 3 from the next Wednesday. As such, we got the first tangible data revealing Covid-19 impact on the March labour market. Other releases being published next week are related to February, meaning the data are outdated already now.

Poland: We do not expect MPC to change rates or to introduce new unconventional instruments at the April meeting. NBP so far is actively intervening on the Polish sovereign bond market. Additionally, market liquidity will be heightened in May by PLN40bn (c. 2%GDP) via strong cut of required reserve ratio.

Further rate cuts are plausible at the next meetings (e.g. in May or June) if economic data show stronger deterioration of activity.

Russia is likely to see its CPI spiking from 2.3% YoY in February to 2.8 - 3.0% YoY in March, as the expectations of quarantine measures and ruble depreciation has pushed Russian to stock up on food, pharmaceuticals, personal hygiene items, and consumer electronics. More acceleration is to come in the coming weeks, amplified by some statistical effects, meaning that the CBR’s target of 4.0% will be exceeded in a matter of months instead of previous expectations of early 2021. Meanwhile, unless there’s another round of RUB depreciation (which is a risk but not the base case) the fast spike is likely to reverse in 2H20 on the drop in demand. As a result, we continue to expect the key rate to remain unchanged at 6.0% in the foreseeable future.

Download

Download article

3 April 2020

Our view on this week’s key events This bundle contains 3 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more