Key events in EMEA and Latam next week

Expect moderate gains in EMEA inflation next week on the back of fuel price shocks. Meanwhile, retail sales, unemployment figures, and key Russian data will be in focus, as the effect of lockdown easing remains ambiguous

Hungary: Positive retail sales and inflation data may be overshadowed by fuel price shocks

We start the week with May retail sales. Based on big data, we expect some improvement on a monthly basis, translating into a 4% year-on-year drop. Fuel sales and the hospitality sector remain the main drag in sales activity. Soft indicators point toward an improvement in industry, albeit a moderate one, meaning ‘only’ a 10% month-on-month drop in output after a historical collapse a month ago. June inflation data might reflect the aftermath of the lockdown, translating into easing price pressure in services. On the other hand, this effect will be overridden by the fuel price shock, which should push headline CPI close to the central bank’s 3% target.

Czech Republic: Inflation, unemployment and retail sales outlook looking positive

Czech inflation might stay close to the May figure and slow down just negligibly as fuel prices have started to grow in month-on-month terms. Also, food prices might further accelerate based on preliminary figures, given the typical seasonality of price gains. The unemployment rate will be released earlier, on Tuesday instead of Thursday; based on MinLab information this should stagnate in June, but some government support measures which ended in June may bring new applicants to the labour offices during the summer months. We will also get information on how retail sales and industry recovered in May after historical slumps in April caused by restrictive measures and lockdowns.

Russia: Expect higher inflation and a wider budget deficit

Russia is likely to see CPI growth accelerate from 3.0% year-on-year in May to 3.3% YoY in June. This will largely be the result of the low base effect of June 2019. The Bank of Russia has indicated that an acceleration of CPI in the direction of the 4.0% target is to be expected, therefore the pick-up in inflation is unlikely to threaten the 50bp downside to the key rate in the second half of the year. Meanwhile, the pick-up in gasoline prices as well as other non-food items on protectionist measures and the post-lockdown recovery in activity will remain factors to watch.

Balance of payments data for 2Q20 is likely to show resilience in the current account, which is likely to show a surplus close to the US$10bn figure in 2Q19, as the drop in oil revenues is being offset by the drop in imports of goods and services, as well as by lower dividend outflows. Meanwhile, some acceleration in private capital outflows, modest portfolio inflows into the local bond market, and a likely reduction in the central banks’ FX sales are factors that are likely to limit ruble appreciation in 2H20.

We expect Russia’s federal budget deficit to continue widening in June, as the recovery in oil prices is ‘darkened’ by the OPEC+ mandated cut in the oil production, while spending growth has likely remained high. Ahead of the vote on constitutional amendments, increasing social guarantees to the population and widening the powers of the president (and allowing the current one to nominate himself in 2024 and 2030), President Putin has increased the overall fiscal stimulus package from 3.5% to 4.0% of GDP, targeting both social payments and support to business. The 7-day voting concluded with 78% ‘in favour’ with a 65% turnout. With around 40% of the population directly dependent on the budget, fiscal policy is likely to remain an important tool in supporting household income.

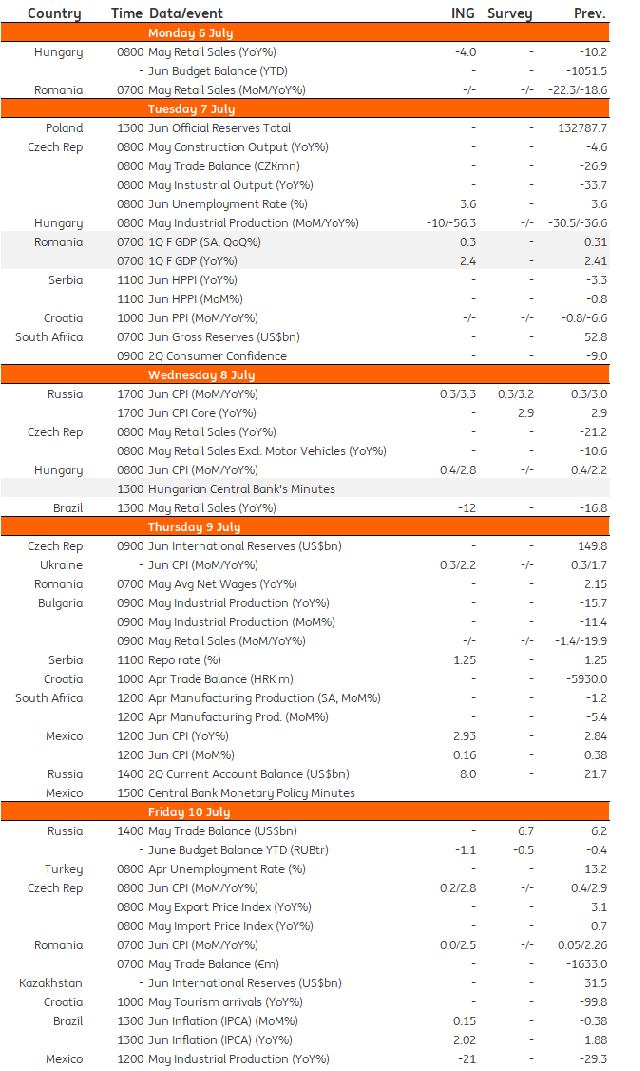

EMEA and Latam Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

3 July 2020

Our view on next week’s events This bundle contains 3 Articles