Key events in EMEA and LATAM next week

Will the National Bank of Serbia cut rates? What is happening with inflation in the Czech Republic?

Hungary: activity indicators to accelerate

In Hungary, we expect the activity indicators to resonate with the quite impressive soft indicators, thus both retail sales turnover and industrial production might accelerate. Headline inflation will remain subdued, showing a slight drop on the back of base effects of fuel prices and targeted VAT cuts are expected to take more of an effect. As regards to the Fitch decision on 9 March, it might be too early to see any change despite the positive outlook, especially since we are close to the general election.

Czech Republic: inflation to decelerate

The Czech Statistical Office revised its CPI basket weights in 2018 using the new classification ECOICO. These changes were slightly proinflationary (almost 0.1ppt) mainly due to increasing weights of imputed rents, i.e. a higher contribution of rapidly growing residential properties in Czech inflation. However, due to base effects and stronger CZK, inflation should further decelerate meaning it might hit the 2% target, though estimates are now slightly less robust due to the CPI basket changes. This should be inflation's bottom value as we expect further acceleration from March.

Average wages for fourth quarter 2017 should be affected by a November increase in wages of state employees and will approach 8% year-on-year in nominal terms (5.5% in real terms). The same figures are expected by the CNB and Ministry of Finance.

Poland: MPC meeting to trim interest rate expectations

Wednesday's MPC meeting should trim interest rate expectations for 2019 – we expect the National Bank of Poland (NBP) to lower inflation projections for 2018, as forecasted in November, a core inflation pick up is not materializing. Secondly recent comments and minutes from the February meeting present a limited propensity for policy tightening even amongst hawkish members.

Serbia: will the National Bank of Serbia cut rates?

In Serbia, we expect the central bank to cut the key rate by 25bp to 3.25% given the new National Bank of Serbia (NBS) inflation outlook. The move was somewhat telegraphed by the governor Tabakovic at the presentation of the Inflation Report with the new inflation forecast, being quoted by Bloomberg saying that “inflationary pressures point to the need to cut the benchmark rate” as inflation is expected to stay near the lower end of the target band. Recent Dinar strength which prompted NBS FX interventions to curb it should ease NBS concerns of exchange rate depreciation with subsequent pass-through into inflation. We believe that any RSD weakness should be short lived as the monetary policy outlook is supportive for inflows into local currency sovereign debt.

Turkey: recovery in the inflation outlook

Easing base effects that have been in play since December will continue to contribute to the recovery in the inflation outlook. Accordingly, we expect the annual figure to decline further in February to 10.1% year-on-year (0.6% month-on-month) from 10.35% a month ago. Also, given the lack of major improvements in core inflation so far and the Central Bank of Turkey’s (CBT) signal to not alter the policy line until a sustainable single-digit inflation is achieved, we think that the CBT is likely to maintain their current stance in the near term as long as TRY remains stable. We expect the CBT to keep all rates unchanged again in March. Already at the limit of the liquidity policy with the effective cost of funding aligned with the late liquidity window, we do not see the bank changing the liquidity conditions this month either.

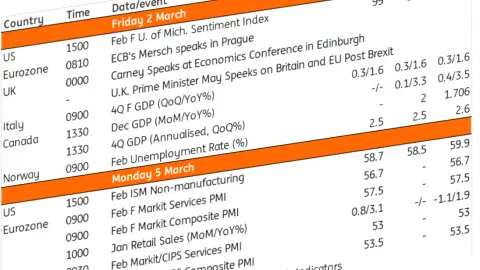

EMEA and LATAM Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

1 March 2018

Our view on next week’s key events This bundle contains 3 Articles