Key events in EMEA and LATAM next week

What is in store for Hungarian monetary policy? What will S&P and Moody's say about Romania?

Hungary: will the National Bank of Hungary change its monetary policy?

We don’t see the National Bank of Hungary altering its monetary policy, we think it will keep rates unchanged using its IRS tenders to provide the much-needed dovish impetus. In line with recent global movements, we expect the PMI and confidence indicators to slip, but to remain at a level that suggests further optimism.

Romania: a rating downgrade in sight?

We do not see any rating action by either S&P or Moody’s on Romania. Still, the reports are likely to highlight the negatives. With no fiscal consolidation in sight, Romanian credit looks exposed to rating downgrades in case of potential adverse economic shocks.

Poland: focus on the pace of investment recovery

The second reading of 4Q17 GDP will present a detailed breakdown of growth. The market's attention should be focused on the pace of the investment recovery, where we expect solid 11.4% year-on-year growth. The CSO statistical bulletin (published this Friday) will provide guidance as to whether the expansion was driven by the public or private sector.

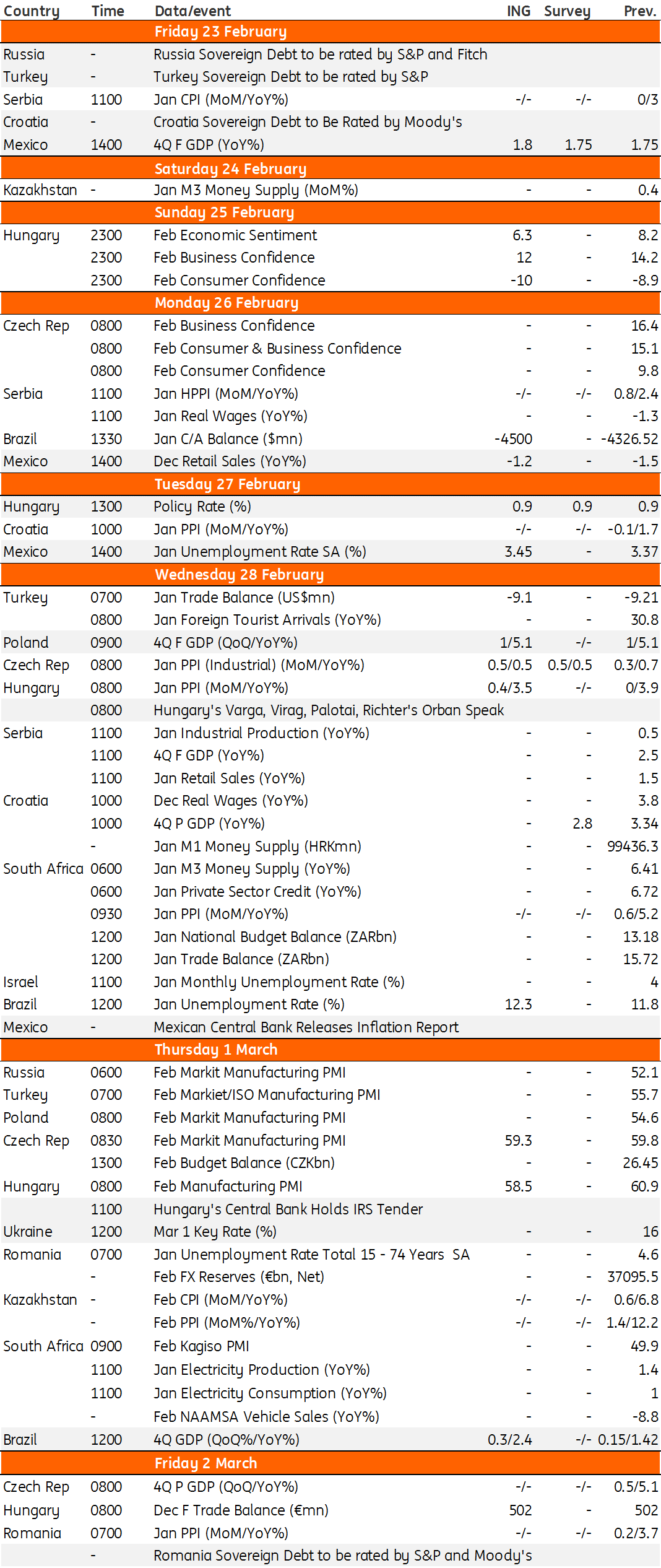

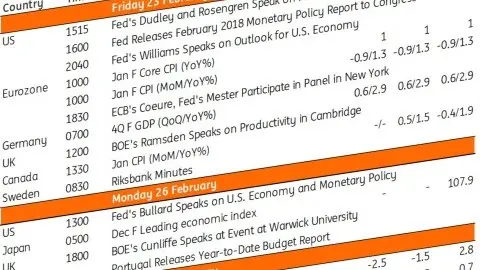

EMEA and LATAM Economic Calendar

Download

Download article

22 February 2018

Our view on next week’s key events This bundle contains 3 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more