Key events in EMEA and Latam next week

A handful of central bank meetings and some key data releases make for an exciting week ahead in EMEA and Latam

Russia: Central bank likely to favour a 'wait and see' approach

Russian CPI is likely to see a rapid deceleration to 2.4% year-on-year in January from 3.0% in December, however this is unlikely to be a strong argument in favour of a cut in the key rate, which we see staying at 6.25% next Friday. We think the following arguments favour a wait-and-see approach at the upcoming monetary policy meeting on 7 February:

- The current slowdown in the CPI stems from the high base effect created by the VAT rate hike, which took place at the beginning of last year. Following the drop to 2.0-2.5% YoY in in 1Q20F, CPI should return to 3.5-4.0% YoY by year-end 2020.

- The CPI composition suggests that food seems to be the sole disinflationary component, reacting to non-monetary factors - and the recent recovery in global agriculture product prices is now a risk factor.

- The consumer sentiment index in December was reported at 95 points, which is 6 points higher than a year ago, suggesting a lack of demand-driven constraints to CPI growth.

- The recent government reshuffle and new social policy measures, with an estimated budget expenditure of 0.5-1.0% of GDP per annum create the potential for an acceleration of consumption and overall GDP growth above the potential 1.0-1.5% rate, which may create additional inflationary risks.

- The coronavirus outbreak in China has negatively affected global markets, contributing to a 1% depreciation in the rouble year-to-date. ING analysts do not exclude further pressure on China's GDP, currency and oil and metals prices, as well as EM/commodity currencies – reinforcing our cautious take on the rouble, which was initially based on local fundamental factors.

Poland: Don't expect the NBP stance to change

We expect the National Bank of Poland to reiterate its forward guidance of stable rates in the coming quarters. The monetary policy committee is more afraid of activity worsening than it is of CPI inflation rising above the central bank's target.

The PMI manufacturing index is unlikely to rebound further given still modest readings in the eurozone. Still, the accuracy of this indicator was weak last year. Therefore, we don't expect any meaningful information about the industry from this release.

Czech: Not enough good news to tighten yet

We expect the Czech National Bank to remain on hold next week as foreign data has not improved sufficiently to persuade some more prudent board members to back a rate hike, which has been discussed during previous meetings. However, if global economic activity improves and inflation remains above expectations, one prudent hike remains on cards in the first half, most likely in May. The CNB staff forecast should continue to reflect the need to hike rates. Retail sales are likely to be positive mainly due to car sales, where strong YoY growth is expected due to a low base from December 2018, following the introduction of new emission standards. Industrial production is traditionally uncertain in December due to the possible impact of holiday shut-downs, but soft growth is expected after a surprising fall in November due to calendar effects (one working day more in YoY terms).

Hungary: The last piece of the puzzle

The last important pieces of the puzzle for fourth quarter GDP will be revealed next week. We expect retail sales to remain strong in December and industry to rebound, after posting two negative month-on-month production readings. Business confidence has been decreasing and we think the PMI reading will reflect that trend after showing improvement in the past three months. Overall, the readings will support our call for sound but softening GDP growth in the last quarter of 2019.

Turkey: Gradual deceleration in CPI

We expect annual inflation to drop slightly in January to 11.6% (0.8% month-on-month) from 11.8% a month ago thanks to benign unprocessed food inflation with a supportive base and VAT cut on furniture (from 18% to 8%), while annual energy group inflation will likely increase due to base effects.

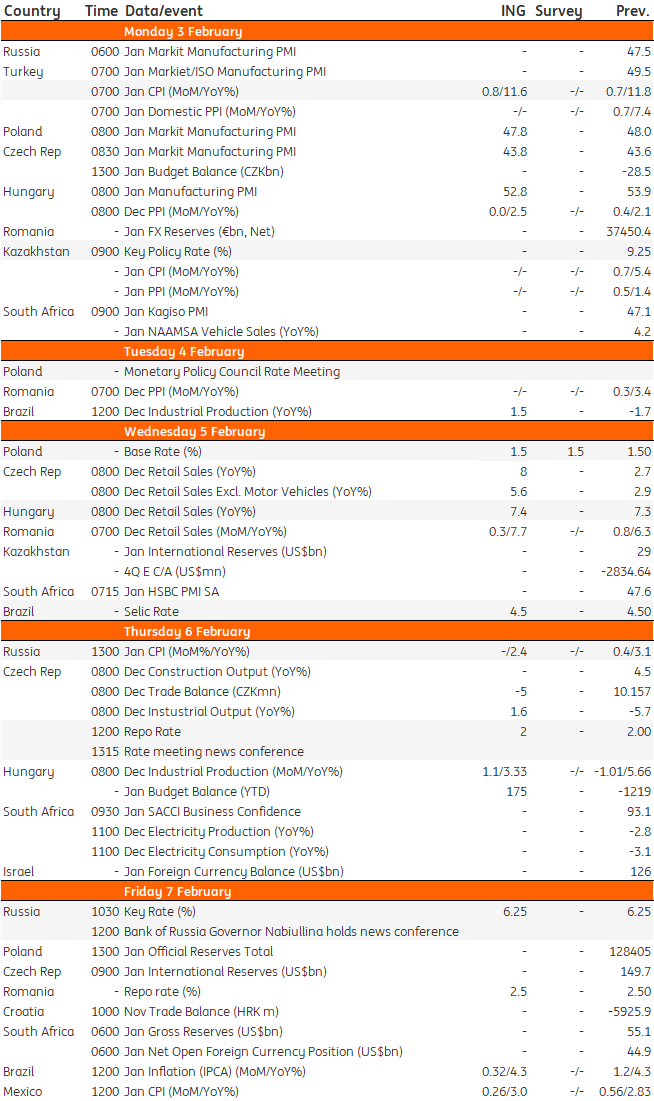

EMEA and Latam Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

31 January 2020

Our view on next week’s key events This bundle contains 3 Articles