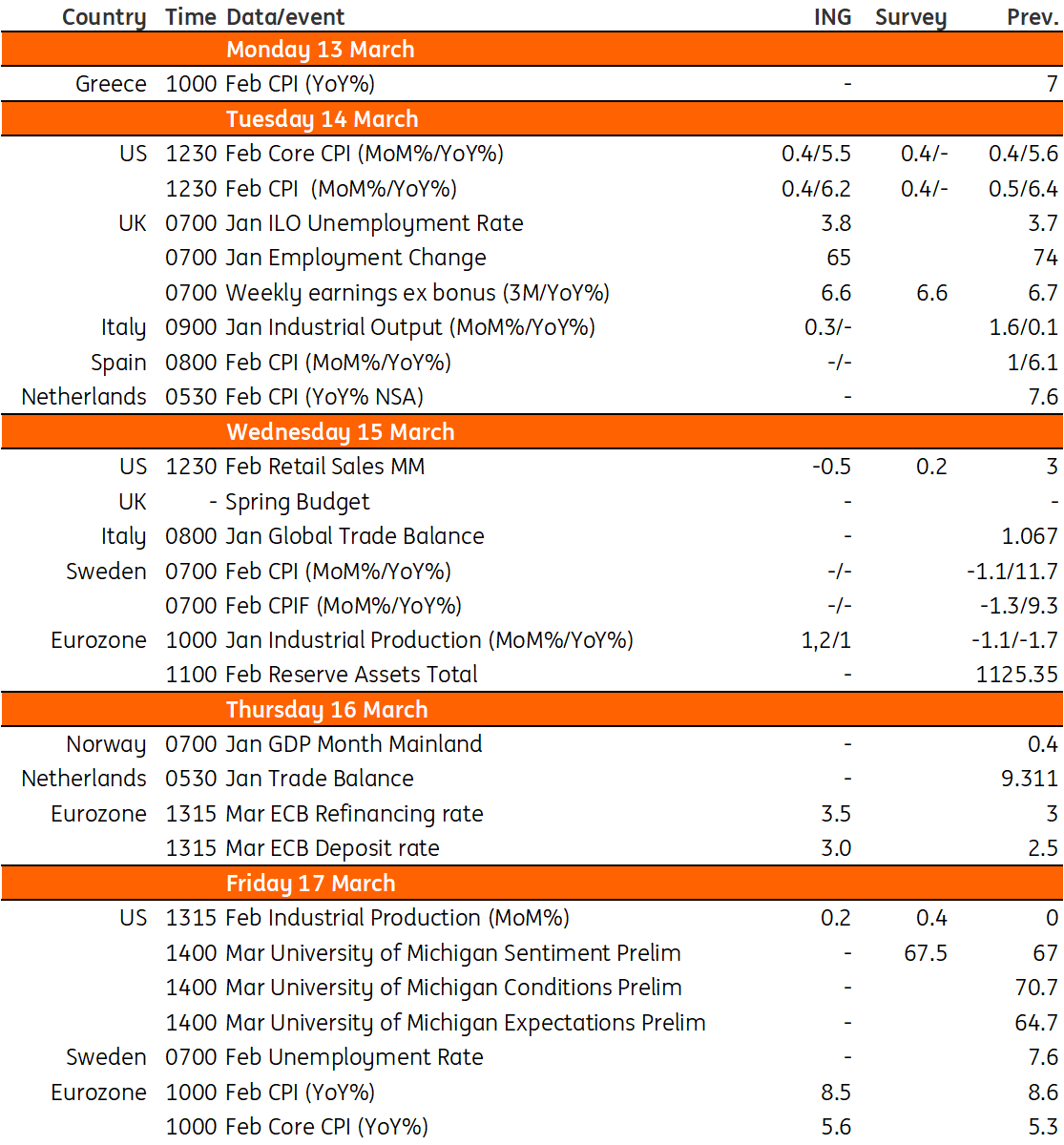

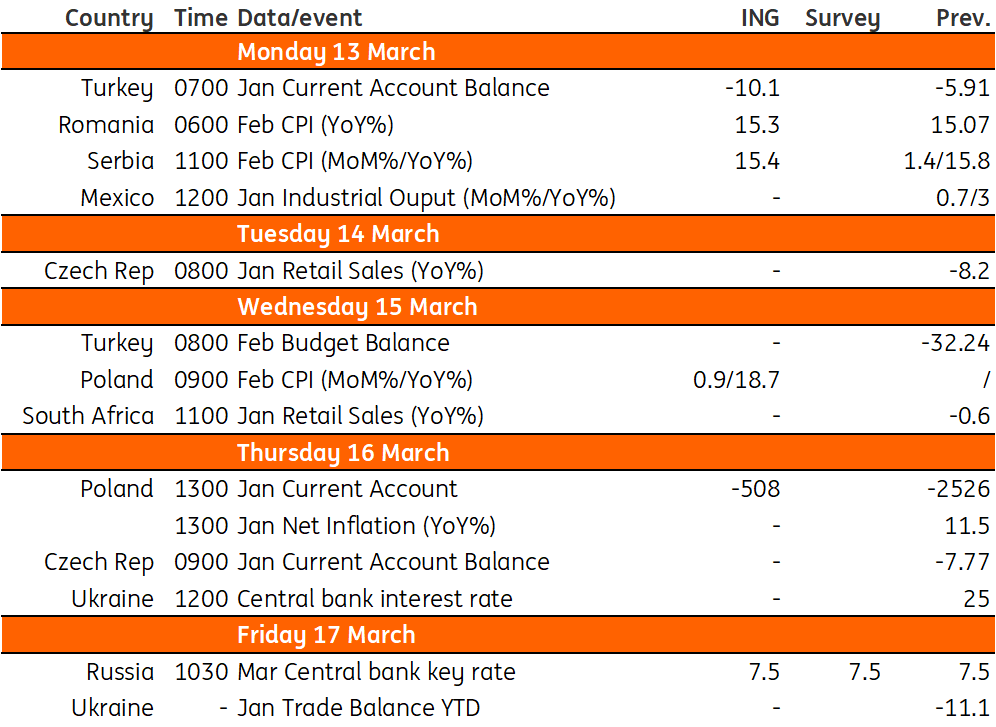

Key events in developed markets and EMEA next week

In the UK, all eyes are on Wednesday's Spring Statement and we believe there's little room for the Chancellor to row back on his previous plans for fiscal consolidation

US: Broad support for a 50bp move

After very strong data for January, all eyes are on the February numbers as markets look to gauge what the Federal Reserve has in store for interest rates. Warm weather and supportive seasonal adjustments to the data clearly boosted the activity story at the start of the year so we expect to see at least a partial correction in retail sales and industrial activity given the weather has subsequently followed more seasonal patterns. Inflation looks set to continue running hot though and that should mean that the market continues to favour a 50bp hike on 22 March.

Fed Chair Jerome Powell's hawkish shift clearly signals that the Fed is focused on the here and now. Importantly, these views were expressed during testimony to Congress so these were not personal opinions but the views of the majority of the Federal Open Market Committee. Given this broad support for a more aggressive response, it seems likely that we will need to see significant weakness in all reports to prevent a 50bp move from happening.

UK: Budget to scrap energy bill hike but maintain frugal medium-term plans

Wednesday’s Spring Statement from UK Chancellor Jeremy Hunt will be the third fiscal event since last September, but hopefully the least dramatic. The fall in wholesale gas prices means the Chancellor can scrap the planned increase in energy unit prices, which for the average household would have seen the annual bill rise from £2,500 (or £2,100 when accounting for a fixed discount which expires this month) to £3,000. By the summer, bills are likely to fall to £2,100 on an annualised basis, without any government support at all. Perhaps the key question is whether the Chancellor maintains plans for fixed one-off payments for low-income and vulnerable households. None of this necessarily precludes a recession, but it should mean it’s milder than expected a few months ago when gas prices were higher.

The near-term fiscal situation is also helped by the reduced risk premium in government borrowing since November’s Budget, and also the fact that recent borrowing figures have come in roughly £25bn lower than projected. But the medium-term picture, which is determined by new forecasts from the Office for Budget Responsibility, is unlikely to give the Chancellor much – if any – room to row back on his previous plans for fiscal consolidation. The OBR’s medium-term growth numbers have long looked too optimistic, and inflation too low. Unfortunately lowering government capital investment looks like the path of least resistance, at least politically, to achieve the government’s main fiscal goal of stabilising net debt as a percentage of GDP in the medium term.

We’ll also get another round of jobs numbers next week, and we’ll be looking for clearer signs that wage growth is finally peaking. Survey data suggests it is, but so far the official numbers have continued to show persistently large increases in pay on a three-month annualised basis. This is one reason why we think the Bank of England is likely to hike by 25bp at its March meeting, though with encouraging trends emerging in the surveys of pricing behaviour, we think by May the committee will be more relaxed.

Eurozone: Supply chain improvements should provide some optimism

The eurozone will look forward to industrial data next week, for which some optimism is warranted on the back of a rebound in German production. Supply chain problems are fading rapidly, which allows industry to catch up on previous orders. Production data will show whether other countries are also profiting from this or whether slowing new orders dominate the direction of production at this point.

Poland: Rates cutes are unlikely this year given the path of core inflation

Current account: €-508m (January)

The external imbalance is projected to gradually narrow over the course of 2023. The trade deficit should shrink on the back of improving terms of trade. Both exports and imports growth are slowing down, but the correction in energy commodities is expected to put a stronger drag on imports than softer external demand curbing exports. Solid January industrial output data from Germany back our trade forecasts. In January, we expect exports of goods to have expanded by 21.9% year-on-year, while imports grew by 19.5% YoY. In 2023, we expect the current account deficit to be 2.1% of GDP vs. 3.1% of GDP in 2022.

CPI inflation: 18.7% YoY (Feb)

The February CPI reading is highly uncertain due to the annual update of basket weights. We estimate that the update may bring an upward revision of the January reading to 17.4% YoY from 17.2% YoY reported previously. We believe that consumer inflation peaked in February at 18.7% YoY amid a low reference base – in February 2022, the government cut VAT rates on gasoline, food, electricity, natural gas and central heating.

The months ahead will bring disinflation on the back of stabilising fuel and energy prices that will gradually bring down annual CPI inflation to single-digit levels in the fourth quarter. At the same time, core inflation is projected to remain sticky and elevated as the earlier energy shock should continue feeding into the prices of other goods and services. In our view, the path of core inflation will not allow the National Bank of Poland to start cutting rates this year and the easing cycle may start in late 2024.

Key events in developed markets

Key events in EMEA next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

10 March 2023

Our view on next week’s key events This bundle contains 2 Articles