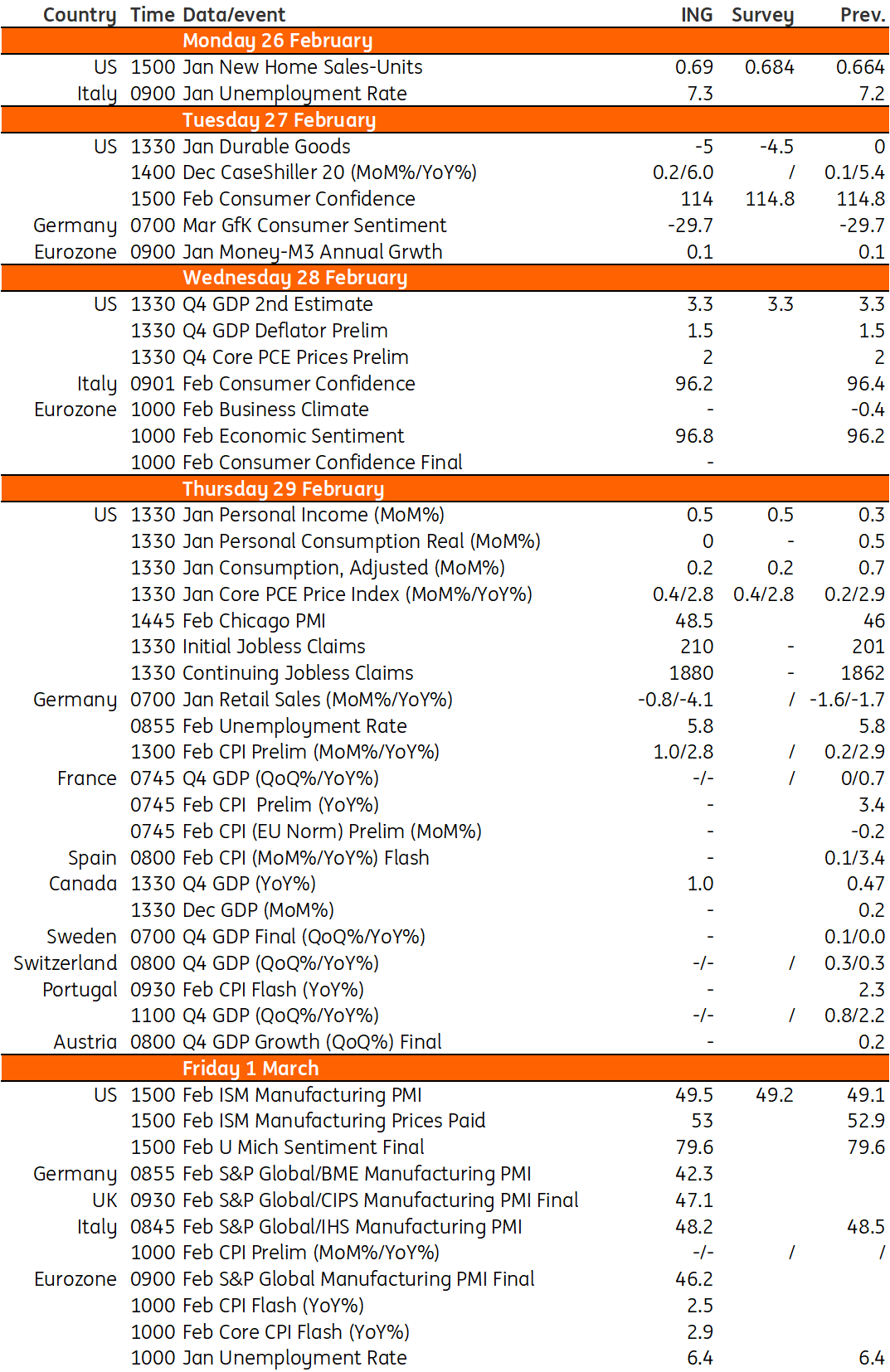

Key events in developed markets next week

Next week in the US, we will get the Fed's favoured measure of inflation the core PCE deflator, which we expect to rise by 0.4% month-on-month. In the eurozone, we will see the release of key data points including inflation and unemployment which may give the ECB an idea of whether rates can be cut later this year

US: Core PCE deflator to post a 0.4% MoM increase

Financial markets have moved back to pricing 75-100bp of Federal Reserve interest rate cuts this year having favoured 150-175bp just a few weeks ago. The strong growth, jobs and inflation numbers suggest that an imminent move is unlikely with the data needing to show more benign inflation prints as a bare minimum before the Fed will contemplate policy loosening.

We won’t get that next week with the Fed’s favoured measure of inflation, the core (ex-food & energy) personal consumer expenditure deflator, set to post a 0.4% MoM increase. We need to see MoM prints consistently below 0.2% MoM to be confident that inflation will return to the 2% year-on-year target over time, and we had been making excellent progress with six out of the past seven months seeing inflation come in sub 0.2%. However, the January PPI and CPI reports suggest that key components within the PCE deflator will post outsized increases this month with insurance, medical and portfolio management fees boosting inflation. Much of this isn’t especially driven by fundamental demand and supply factors - insurance is caused by higher crime relating to more expensive assets while strong equity market gains have boosted portfolio fees – but it presents a major stumbling block regarding the prospect of interest rate cuts. We are hopeful that February will post better numbers.

The same personal income and spending report will likely show that consumer spending started the year on a weak footing after retail sales fell more than expected, but the economy still has decent momentum with 4Q GDP revisions set to confirm the economy expanded at a 3.3% annualised rate in the final three months of last year – remember this was above every single forecast in the Bloomberg survey ahead of the initial release. Meanwhile, the rise in mortgage applications points to a decent bounce in new home sales, but this may not last long now that 30-year mortgage rates have pushed back above 7% and look set to head towards 7.25% in the next couple of weeks. Finally, the ISM manufacturing index should continue to grind higher but remain below the 50 break-even level. As such, the index will have been in contraction territory for 16 consecutive months.

Eurozone: Doubts about the pace of inflation drops have increased

For the eurozone, the big question next week is whether inflation figures will give the European Central Bank some comfort that rate cuts can happen later in the year. Doubts about the pace of inflation drops have increased in recent weeks. Don’t expect a big drop this month outside of some base effects. In France, energy taxes are being reintroduced, which adds to price growth. Also look at unemployment, which has remained stable around record lows for some time. We don't expect this will change anytime soon, but an upside surprise would add to dovish pressures on the ECB to cut rates sooner rather than later.

Key events in developed markets next week

Download

Download article

23 February 2024

Our view on next week’s key events This bundle contains 3 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more