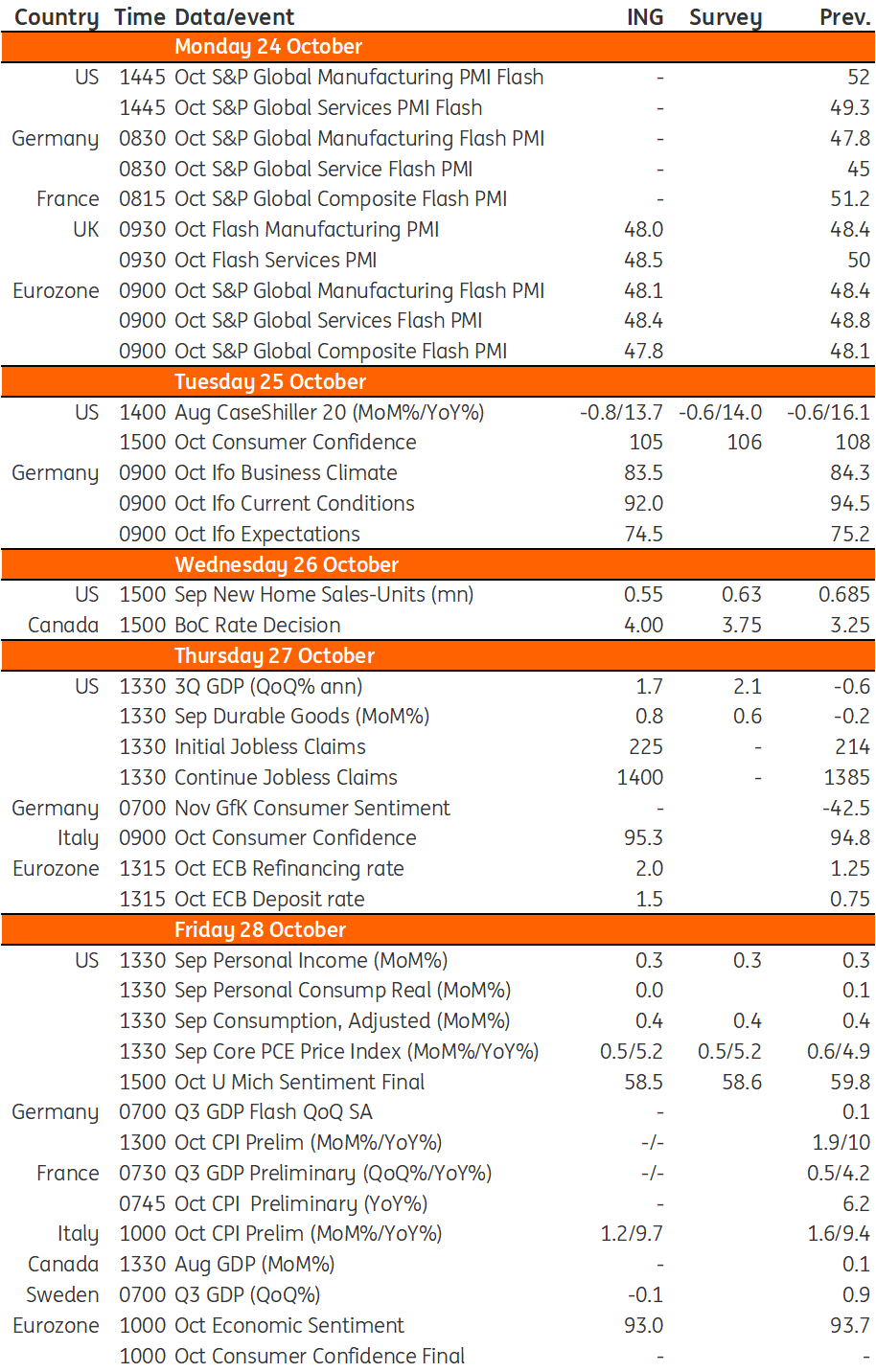

Key events in developed markets next week

All eyes will be on the European Central Bank meeting next week. We think a 75bp hike looks like a done deal. The PMI survey on Monday will also be closely watched, providing clues on whether the eurozone economy has contracted even further. For the Bank of Canada, we expect a similar 75bp rate hike, given the upside surprise in inflation

US: The Fed cannot slow the pace of hikes yet

There are lots of important numbers out for the US next week, but none are likely to change the market's forecast for a 75bp interest rate hike on 2 November. 3Q GDP is likely to show positive growth after the “technical” recession experienced in the first half of the year. Those two consecutive quarters of negative growth were primarily caused by volatility in trade and inventories, which should both contribute positively to the 3Q data. Consumer spending is under pressure though while residential investment will be a major drag on growth. We are forecasting a sub-consensus 1.7% annualised rate of GDP growth.

We will also get the Fed’s favoured measure of inflation, the core personal consumer expenditure deflator. This is expected to broadly match what happened to core CPI so we look for the annual rate to rise to 5.2% from 4.9%. With the economy growing and inflation heading in the wrong direction, the Fed cannot slow the pace of hikes just yet.

Also, look out for durable goods orders – Boeing had a decent month so there should be a rise in the headline rate although ex-transportation, orders will likely be softer. We should also pay close attention to consumer confidence and house prices. The surge in mortgage rates and collapse in mortgage applications for home purchases has resulted in falling home sales. With housing supply also on the rise, we expect to see prices fall for a second month in a row. Over the longer term, this should help to get broader inflation measures lower given the relationship with the rental components that go into the CPI.

Canada: a 75bp hike is the most likely outcome

In Canada, the central bank is under pressure to hike rates a further 75bp given the upside surprise in inflation. Job creation has also returned and consumer activity is holding up so we agree that 75bp is the most likely outcome having previously forecast a 50bp hike.

UK: Markets looking for clarity on fiscal plans and government stability

The ruling Conservative Party has said it will fast-track plans to get a new leader in place by next Friday - and potentially even by Monday if only one candidate makes it through the MP selection round. Candidates have until Monday at 2pm to clear the hurdle of 100 MP nominations to make it onto the ballot paper, before Conservative MPs vote on the outcome. With only a week to go until the Medium Term Fiscal Plan on 31 October, there's inevitably a question of whether this is enough time for a new prime minister to rubber stamp Chancellor Jeremy Hunt's plans for debt sustainability. Investors are - probably rightly - assuming that Hunt will remain in position under a new leader. But the bigger question is whether the Conservative Party can unite behind a new leader and whether a more stable political backdrop can emerge - because if it can't, then not only is there uncertainty surrounding future budget plans, but also whether we're moving closer to an early election.

Eurozone: ECB to hike by 75bp again amid ongoing inflation concern

The hawks have clearly convinced the few doves left of the necessity to go big on rate hikes again. Contrary to the run-up to the July and September meetings, there hasn’t been any publicly debated controversy on the size of the rate hike. In fact, European Central Bank President Christine Lagarde seems to have succeeded in disciplining a sometimes very heterogeneously vocal club.

To this end, it is hard to see how the ECB cannot move again by 75bp at next week’s meeting. As the 75bp rate hike looks like a done deal, all eyes will also be on other, more open, issues: excess liquidity, quantitative tightening and the terminal interest rate. Read more here.

Besides the ECB, which will be the key focal point for eurozone investors, we’re looking at the survey gauges of the economy next week. The PMIs on Monday will be critical to determine whether the eurozone economy has slid further into contraction or whether an uptick has occurred. There is not much evidence on the latter in our view, but Monday will provide more clarity on how the eurozone economy is performing in October.

Key events in developed markets next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

21 October 2022

Our view on next week’s key events This bundle contains 3 Articles