Key events in developed markets next week

The Bank of England looks set to raise rates by another 25bp on Thursday. Although it will imply further tightening is possible, we think this hike will likely be the last. In the US, a flood of inflation data over the coming week is expected to show the disinflation trend

US: Upcoming data set to show the disinflation trend is firmly in place

After this week’s 25bp interest rate increase from the Federal Reserve, we think we are at the peak and the next move will be interest rate cuts in late 2023. The long and varied lags involved in monetary policy changes – coupled with a rapid tightening of credit conditions resulting from recent banking stresses – mean the headwinds for the US economy are intensifying. Job lay-off announcements and weak business and household sentiment already indicate there are real-world impacts with the upcoming data flow set to show that this is now weighing on price pressures.

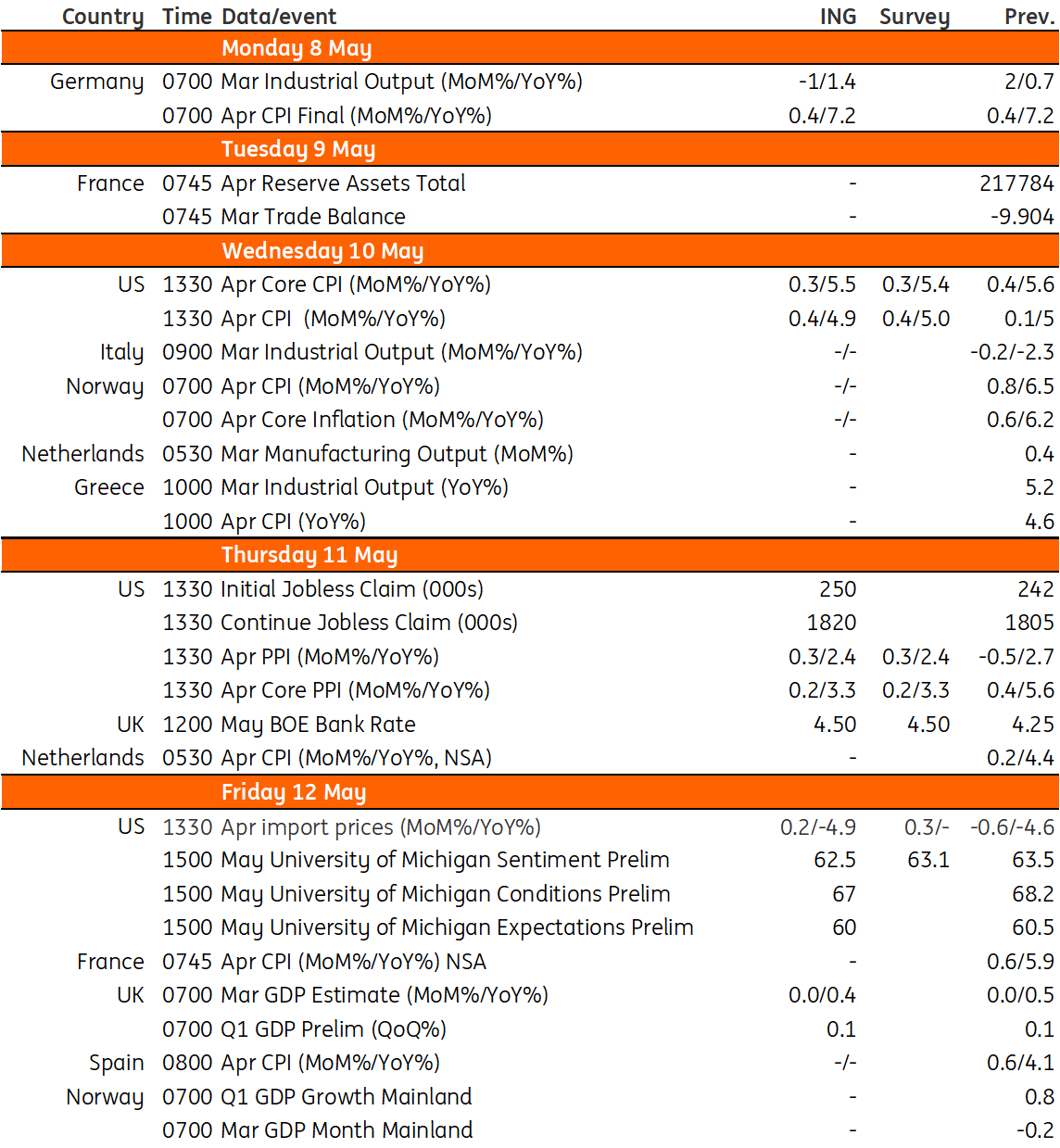

We will get import price inflation, producer price inflation and consumer price inflation over the coming week, and all three are set to show that the disinflation trend is now firmly in place. Import prices are falling in year-on-year terms already and we expect PPI to edge close to 2% YoY. CPI is still running well above the 2% target, but we do at least expect the annual to slow to 4.9%, having peaked at close to 10%.

Keeping in mind that the Federal Reserve has a dual target of 2% inflation and maximum employment, we expect to see recessionary forces push inflation close to target by year-end, with unemployment rising. We think this could result in 50bp interest rate cuts at both the November and the December FOMC meetings.

UK: Bank of England set for 25bp hike but we’re near the peak

After some hawkish inflation and wage data last month, the Bank of England looks poised for another 25 basis point rate hike on Thursday. Admittedly when you scratch beneath the surface, this data wasn’t a total disaster for the central bank. For one thing, CPI has outpaced the Bank’s forecasts because of food and core goods prices, neither of which will be viewed as long-lasting trends. The BoE's own "Decision Maker Panel" survey of CFOs has also been repeatedly pointing to lower price and wage pressure.

We doubt the Bank will want to shut down its options on Thursday – another unhelpful set of data over the coming weeks would pile on the pressure for them to do more in June. Expect the Bank to retain its data-dependent guidance that implies further tightening is possible – though the clear dovish risk is that the Bank “does a Fed” and waters down this guidance further, perhaps removing the bit about further tightening. Either way, we think Thursday’s hike is likely to be the last. Catch up on our latest preview here

Key events in developed markets next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

5 May 2023

Our view on next week’s key events This bundle contains 3 Articles