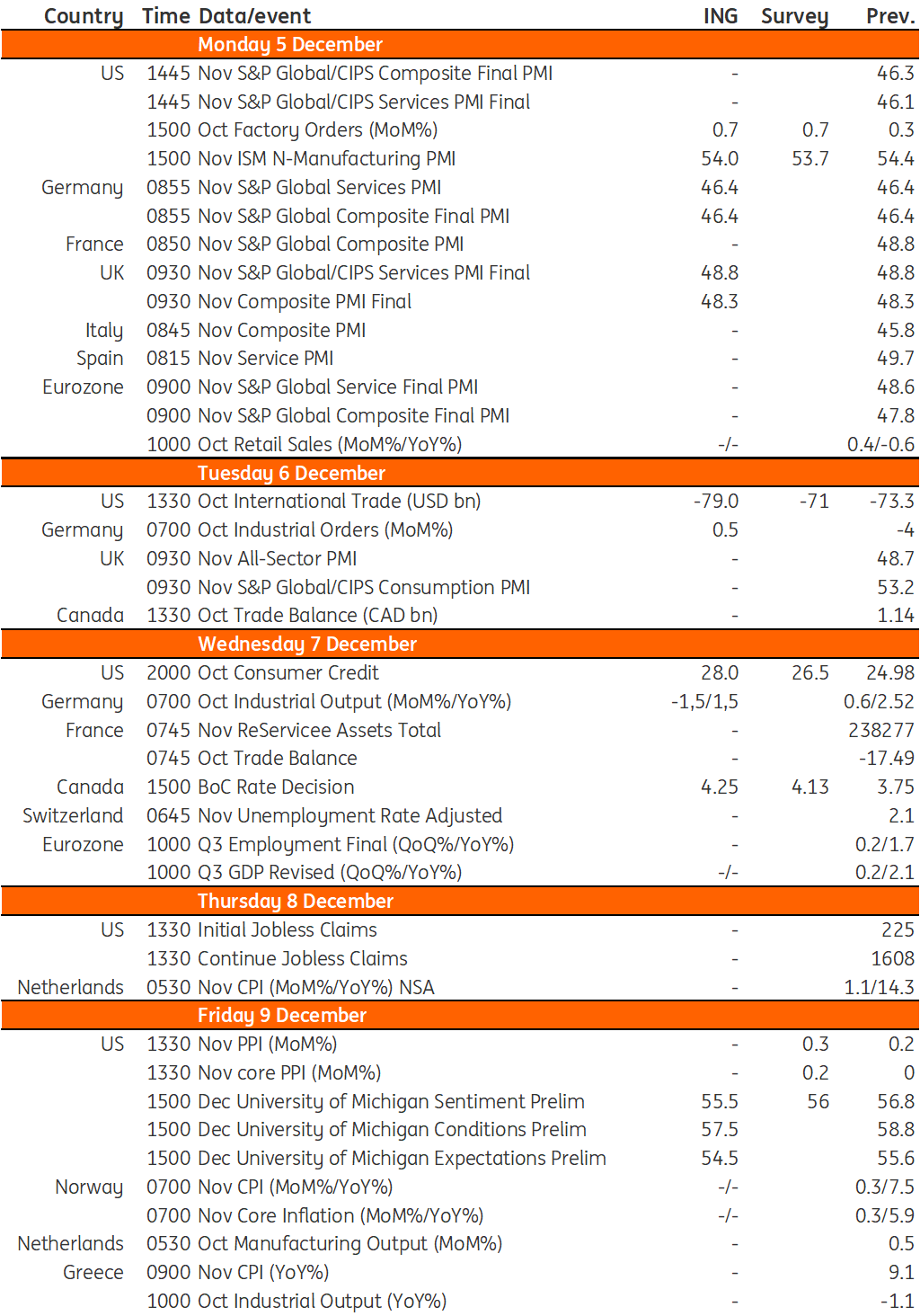

Key events in developed markets next week

The Bank of Canada's policy meeting will be the highlight of next week, and it's a very close call on whether to expect a 25bp or 50bp hike. For now, we favour the latter given robust third-quarter GDP data, ongoing elevated inflation readings and a tight jobs market

US: Recession fears remain elevated

We are rapidly heading towards the 14 December FOMC meeting where a 50bp interest rate hike looks likely after four consecutive 75bp moves. Nonetheless, the Federal Reserve will not be pleased with the recent sharp falls in Treasury yields and the dollar, which are loosening financial conditions and undermining the Fed’s efforts to beat inflation down. Consequently, we are likely to see strong messaging in the press conference and the accompanying forecast update that the rate rises are not finished and that the policy rate is set to stay high for a prolonged period of time. Markets are likely to remain sceptical given that recession fears remain elevated. Softening consumer confidence, weaker ISM services and a relatively subdued PPI report are unlikely to do the Fed many favours next week in this regard.

Canada: Favour 50bp however a very close call

In Canada, the highlight will be the central bank policy meeting for which both markets and economists are split down the middle on whether it will be a 25bp or 50bp hike. We favour the latter given a robust 3Q GDP outcome, the tight jobs market and the ongoing elevated inflation readings. But we acknowledge there are signs of softening in the economy. The housing market is looking vulnerable and Canadian households are more exposed to higher rates than elsewhere due to high borrowing levels so we recognise this is a very close call. We are getting very close to the peak though, which we think will be 4.5% in 1Q 2023.

Key events in developed markets next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

2 December 2022

Our view on next week’s key events This bundle contains 3 Articles