Key events in developed markets next week

Labour market data from the US, retail sales and a Bank of England policy rate decision are all key events to watch out for next week as we begin to see the effects of lockdowns being eased further

US: Jobs data highlights the challenges ahead

The US economy lost 22 million jobs between February and April as lockdowns forced businesses to close and lay off workers while the reopening through May and June has allowed nearly 8 million of those jobs come back. Nonetheless, there is still an almighty jobs deficit and with the renewed spike in cases leading many states to reverse course and reintroduce Covid-19 containment measures, we are seeing rising joblessness once again. This has been clearly highlighted by the recent initial and continuing claims numbers and the Homebase daily data on employment in the small business sector.

With respect to Friday’s US jobs report the timing of the data collection for payrolls is the week of the 12th of July so we still expect to see an increase given employment was rising in the second half of June and the first half of July - most of the job losses occurred in the second half of the month. We are more cautious than the market though and look for a figure closer to 750,000 versus the current consensus of 1.5 million. We wouldn’t rule out a negative number for August given the recent developments.

At the same time, the US$600 a week unemployment benefit boost to 30 million plus claimants has effectively ended and will be replaced with something much smaller in size. So with virus fears on the rise, jobs being lost and incomes being squeezed, we feel the recovery could be much bumpier than markets seemingly do.

Other data releases through the week include the ISM manufacturing and non-manufacturing reports, which should show another gain as larger firms start to see a pick-up in activity, but it is important to remember that these surveys don’t tell us much about the magnitude of improvements, merely that a growing number of companies are experiencing stronger activity. Renewed shutdowns could weigh on the ISM readings again from August.

Eurozone: Spike in retail sales expected

Next week will be slow in terms of macro data for the eurozone, but retail sales for June will be out and provide some interesting insight into how the recovery of consumer spending has fared in the second month after lockdowns. A sharp rise is still to be expected before things start to level off.

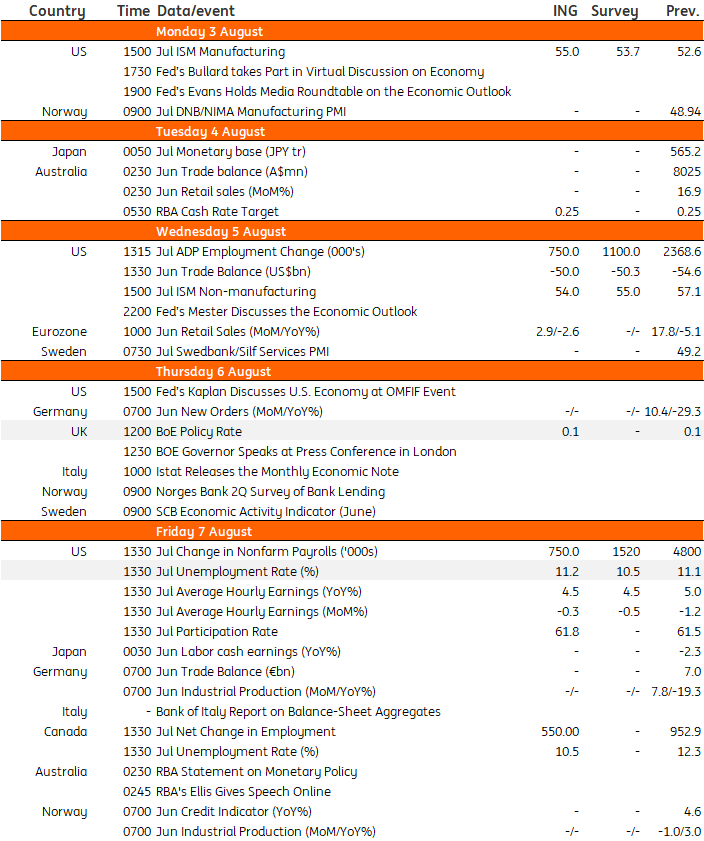

Developed Markets Economic Calendar

Download

Download article

31 July 2020

Our view on next week’s events This bundle contains 3 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more