Key events in developed markets next week

The US economy is moving from strength to strength whilst other countries, notably Germany and the UK, are experiencing a 'softer' period. See what else is happening in developed markets this upcoming week

US juggernaut continues

Despite all the market worries about trade wars, the US economy goes from strength to strength.

The latest Atlanta Fed NowCast estimate for 2Q GDP growth is 4.5% based on the data flow for the quarter so far. This week we will see more evidence of excellent performance of the economy with the key business surveys remaining at elevated levels and the US economy continuing to add jobs in significant numbers. There is an outside chance the unemployment rate falls to a new 50 year low of 3.7% while the annual rate of wage growth could tick up to 2.8%. There may also be some better news on trade with the US deficit set to hold onto recent improvements given data on goods already released. As such we think the Federal Reserve will continue with its policy of gradual rate hikes. We look for a 25bp move in both 3Q and 4Q.

German politics to dominate Eurozone headlines

Not a whole lot to focus on in terms of eurozone data next week. Look for German industrial data for May and the eurozone unemployment rate, which could give perspective on how deep the soft patch has remained in Q2. At the same time, the aftermath of the European Summit and the impact on German politics could dominate headlines even more than the macro data.

Watch out for slippage in UK PMIs as the Bank of England mulls an August hike

We expect both the manufacturing and services PMIs to slip slightly next week. The UK manufacturing sector is showing signs that it is beginning to flag a little as European demand slows. Meanwhile, the service sector, which admittedly has regained some poise after the snow, continues to be plagued by political uncertainty and in the case of consumer-facing firms, ongoing household caution.

But barring a significant deterioration in sentiment, we doubt this will change the minds of BoE rate-setters when it comes to a rate rise in August. A summer hike still looks more likely than not.

UK ministers set for showdown as PM May pushes softer Brexit stance

Amid concern about the lack of a solution for the Irish border question, and increased warnings from business about the potential frictions at UK ports, it looks as if the government position on Brexit is softening. Reports suggest Prime Minister Theresa May is gearing up to keep the UK as a whole in both the customs union and the single market for industrial goods – albeit perhaps not technically under those names.

But getting her ministers on-board with this plan will be tricky, and Friday’s meeting has the potential to be very heated. High-profile ministerial resignations cannot be ruled out, and that’s before the plan has gone to Brussels, where it is likely to be met with similar resistance.

Riksbank in focus

Next week’s Riksbank policy meeting is likely to be a non-event. Having revised its rate forecast downwards in April, and with the outlook broadly unchanged since there is little reason for the Swedish central bank to change its stance at this point.

Sweden also sees the week-long Almedalen political conference, where the country’s politicians will set out their positions ahead of national elections in September.

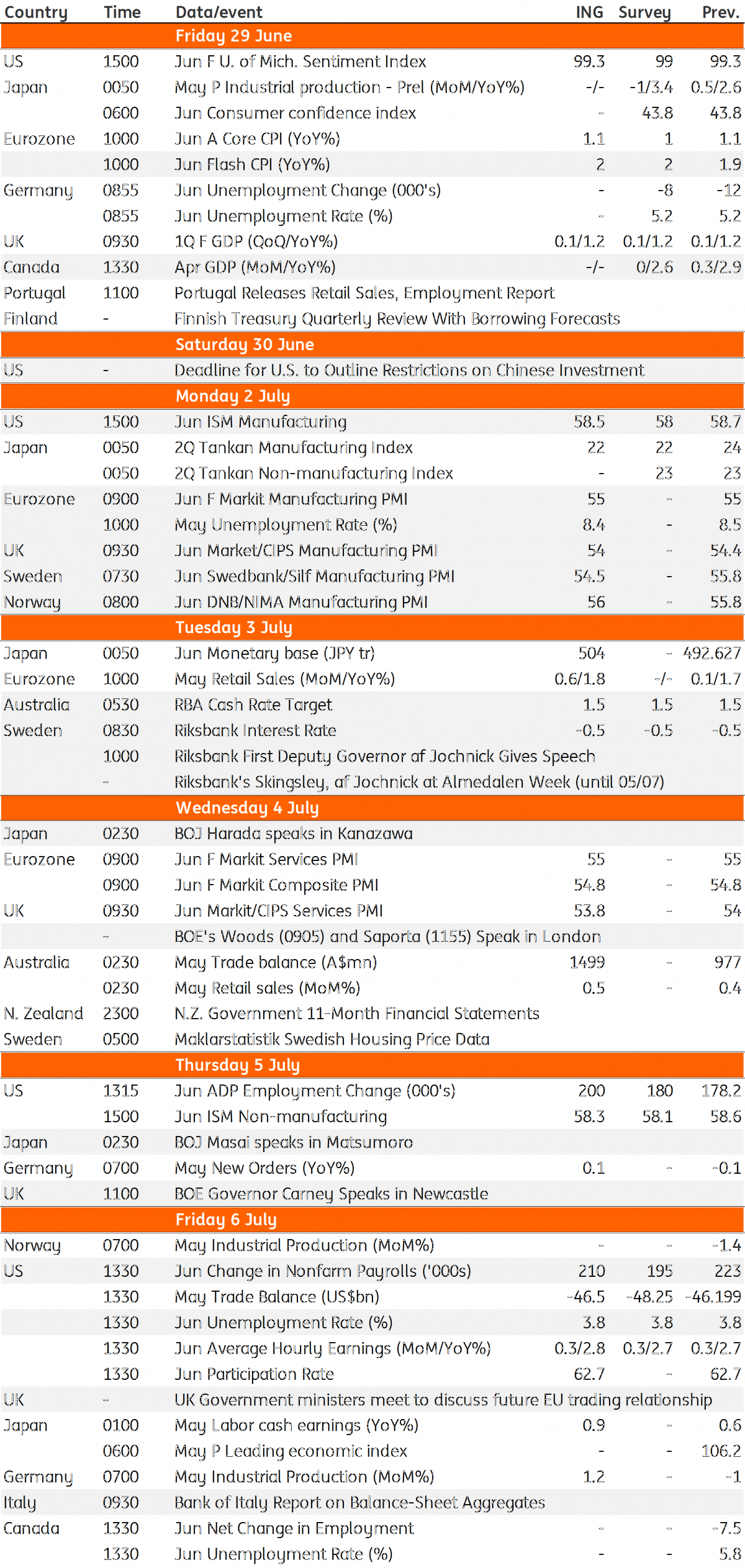

Developed Markets Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

28 June 2018

Our view on next week’s key events This bundle contains 3 Articles