Key events in developed markets next week

It's another big week for central bankers. Expect a rate hike from the Bank of England, which also kick starts the process of 'quantitative tightening'. The European Central Bank faces a balancing act between sounding more hawkish on inflation and keeping rate hike expectations at bay

US: PMIs and jobs data could cause some market caution

Federal Reserve Chair Jerome Powell has indicated that the central bank will soon be raising interest rates and that the economy, and importantly the jobs market, can withstand significantly higher interest rates. The marked shift in the concern about inflation means a minimum of four interest rate hikes and potentially five should be the baseline for 2022. This week’s data flow could cause some market caution though. It is clear that the Omicron wave hit the economy very hard in December based on consumer spending numbers and we don’t expect much, if any, improvement in January. We therefore expect downside risk for the January ISM releases as higher costs and consumer caution weigh on activity readings.

The January jobs report is likely to be weak, with a payrolls gain of just 100k expected. The risks are likely to be to the downside given the sharp drop-off in activity and higher-than-expected jobless claims since the Omicron wave hit. Admittedly there are more than 10 million job vacancies right now, but consumer and business caution has been heightened by the latest pandemic developments and hiring is set to have slowed.

Nonetheless, we remain hopeful that with Covid case numbers now falling in many states, we will start to see consumers re-engage with the economy. That should pave the way for much stronger activity and job readings in February and March.

Eurozone: A bumper week of data ahead of Thursday's ECB meeting

It's a big week in the eurozone with both gross domestic product (GDP) and inflation data due ahead of the European Central Bank (ECB) meeting. The GDP figures for the fourth quarter will give us a sense of how big an impact the fourth wave of coronavirus on the Eurozone economy has been. The first bits of hard data have given some reason for optimism, but the largest impact will have come in December, for which little information is available so far.

We expect a substantial slowdown from the third quarter, but still positive growth. For inflation, January is likely to show a modest decline. The impact of gas prices is still likely to increase, which is the same for goods inflation. However the German VAT effect will drop out of the numbers and oil price base effects will also play in favourably.

When it comes to the ECB, we don’t expect the central bank to give any hints on possible rate hikes. The time for this has not come, yet. Remember that the ECB and the eurozone economy are still lagging behind the Fed and the US economy in terms of the cycle, inflation, wages and labour market tightness. We don’t expect any policy announcements at next week’s meeting. Instead, the ECB’s main challenge will be regarding communication – on the one hand, to confirm its more hawkish stance on inflation and on the other, to keep any speculation on premature rate hikes at bay. Read more in our full preview

Bank of England to hike rates again and initiate quantitative tightening

It's becoming increasingly clear that Omicron's economic impact in the UK has been mild. That, combined with growing fears on the monetary policy committee about elevated headline inflation, suggests the Bank will increase rates by a further 25bp next Thursday. That also means the threshold to kick-start balance sheet reduction will also have been met, and we'd expect the Bank to end reinvestments of maturing bonds imminently.

Keep an eye open for what policymakers have to say on future rate hikes too. Markets, which are pricing roughly five rate rises this year, are likely overestimating what's to come. But we doubt policymakers will offer any material pushback at this stage. We expect a total of two or maybe three rate rises in total this year.

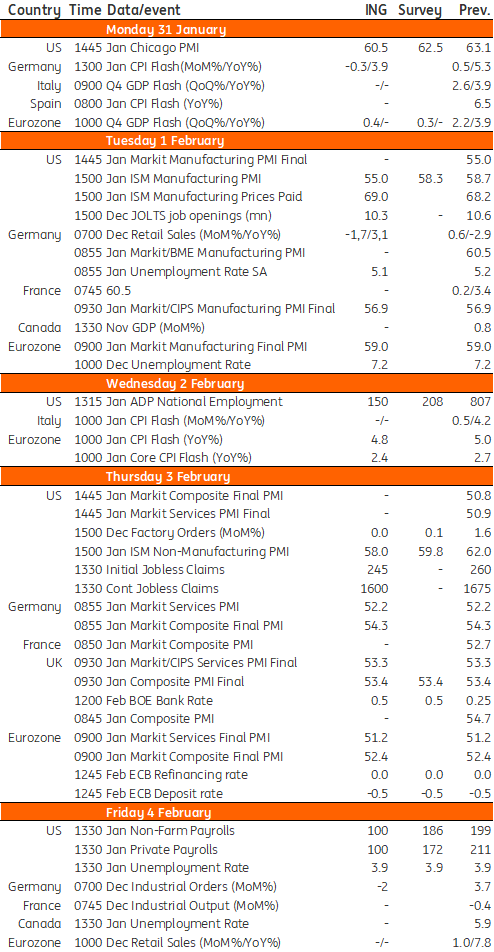

Developed Markets Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

28 January 2022

Our view on next week’s key events This bundle contains 3 Articles