Key events in developed markets next week

Busy week of data releases for developed markets next week with PMI readings, some 3Q GDP releases and CPI. Developments on containment measures and vaccine news will be in the spotlight once again

US: Will more fiscal stimulus be needed after a tightening of containment measures?

It is a big week for US data given the release of the November jobs report and the ISM indices, but market sentiment will be more likely influenced by news on the timing of a vaccine and concerns about a near-term intensification of Covid containment measures in the wake of Thanksgiving gatherings. The number of cases was rising sharply before last week but holiday travel and socialising could see an acceleration that necessitates aggressive action to prevent healthcare systems buckling under the pressure of hospitalisations. Already we can see the jobs markets is suffering as curfews and restrictions kick in across more parts of the United States so the jobs report is already old news before it is even published – remember the data is collected the week of 12 November.

Consequently, we will be looking to see if there are any signs of movement on the fiscal side to provide support to an economy that is going to be experiencing more pain in the weeks ahead. Should politicians fail to step up, then expectations will build that the Federal Reserve will feel compelled to try and offer some support through extra liquidity injections and potentially more quantitative easing. Nonetheless, the Fed will again emphasise this is not going to generate meaningful demand. It is more about trying to shore up confidence until the Covid vaccines are released.

Canada: Strong GDP and jobs data to come, but recovery is still a long way off

Canada’s third quarter GDP is expected to show a robust rebound in excess of 45% annualised growth. Nonetheless this would still leave output nearly 5% below the level of the fourth quarter 2019. The jobs report should also show robust gains, but there would still be around 600,000 fewer people in work than February. As such, both reports will underline the point that there is still a long way to go in terms of recovery and unfortunately, we could see more bad news in the near term given rising Covid cases and the threat of more restrictions.

Eurozone: Inflation release and retail sales will further show the effect of the second lockdown

For the eurozone, the inflation rate for November will be key to watch as it will be the last important figure to come out ahead of the European Central Bank's December meeting. Not that it will sway the ECB much at this point of course, particularly as it's unlikely that the figure will move much from the October reading of -0.3%. Also interesting is whether retail sales have held up in October ahead of the November closures in some countries.

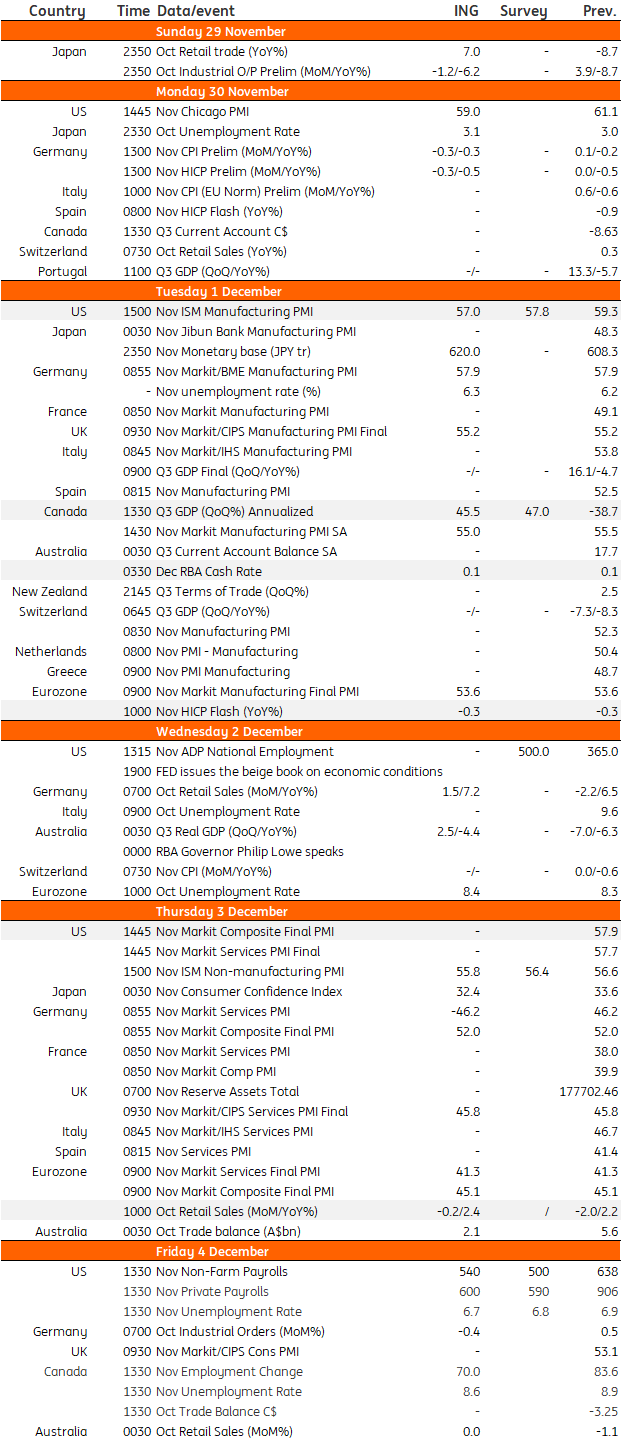

Developed Markets Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

27 November 2020

Our view on next week’s key events This bundle contains 3 Articles