Key events in developed markets next week

The fall-out from the Trump-Xi meeting will set the mood for this week which combined with the multitude of US data releases should aid to evaluate the possibility of a rate cut in July. The UK's PMIs and the Riksbank meeting should also both signal that a hike in 2019 is unlikely

US: Managing expectations

The fall-out from the Trump-Xi meeting on the sidelines of the G20 meeting will set the tone for the week. If there is a positive outcome, i.e. trade talks resume with encouraging messages from both sides then risk appetite is likely to be supported. If talks break down and there is heightened animosity between the US and China then worries about an escalation of the trade war will result in sharp equity market falls and declining bond yields. We believe the former is more likely, but even if that happens we doubt a deal will be struck until much later in the year.

There is also plenty of US economic data, starting with the ISM manufacturing index. Given the outcome of the regional manufacturing surveys, there is a real risk that we see a sub-50 outcome, which will only increase fears of a US economic downturn. There is an inventory overhang and the uncertainty over global trade is making firms more cautious. We will also get the ISM non-manufacturing index which should perform a little better, but given weaker sentiment surveys and other macro data, we would still expect a decline. On Friday we will get the US jobs report and we expect a rebound following the surprisingly weak 75,000 outcome in May. This was a big downside miss relative to the consensus forecast with other surveys painting a more encouraging picture. Nonetheless, with Federal Reserve officials talking of precautionary action, the prospect of a July interest rate cut has certainly increased. Consequently, the risks are skewed towards the two 25bp cuts we have in our forecasts coming in July and September rather than September and December as we currently have.

UK: Subdued PMIs to suggest BoE unlikely to hike in 2019

Next week’s UK PMIs look set to emphasise that second-quarter growth is likely to more-or-less flatline. Admittedly much of this is being driven by manufacturing, where new orders and production have fallen back as firms grapple with elevated levels of stock (gathered in case of a possible ‘no deal’ Brexit). That should deliver another sub-50 manufacturing PMI, although things don’t look spectacular in the much larger service sector either. With Brexit uncertainty set to ramp up over the summer, we think it is unlikely that the Bank of England will hike rates this year.

Sweden: Riksbank unlikely to follow in the ECB’s dovish footsteps just yet

While the ECB looks poised to launch fresh stimulus measures over the next few months, for now, it doesn’t look like the Swedish Riksbank will follow suit. Policymakers have become a little more relaxed about potential currency strength, following a further bout of krona weakness since the start of the year. In fact, our FX team think the risks are tilted to further depreciation over the summer as global activity concerns outweigh the impact of the more dovish ECB (which is already largely priced-in).

But while we aren’t convinced Riksbank easing is on the cards, equally we think it is unlikely that the central bank will follow through with its forecasted tightening. We may get a fairly modest downgrade in the interest rate projection next week – driven by the fact that expectations for Fed and ECB policy have slipped –we’d still expect policymakers to signal that another move is possible by the middle of 2020.

However, with growth set to remain capped by falling residential construction and wary consumers, and the export outlook clouded by global trade tensions, we think it’s unlikely the Riksbank will follow through with rate hikes in the foreseeable future.

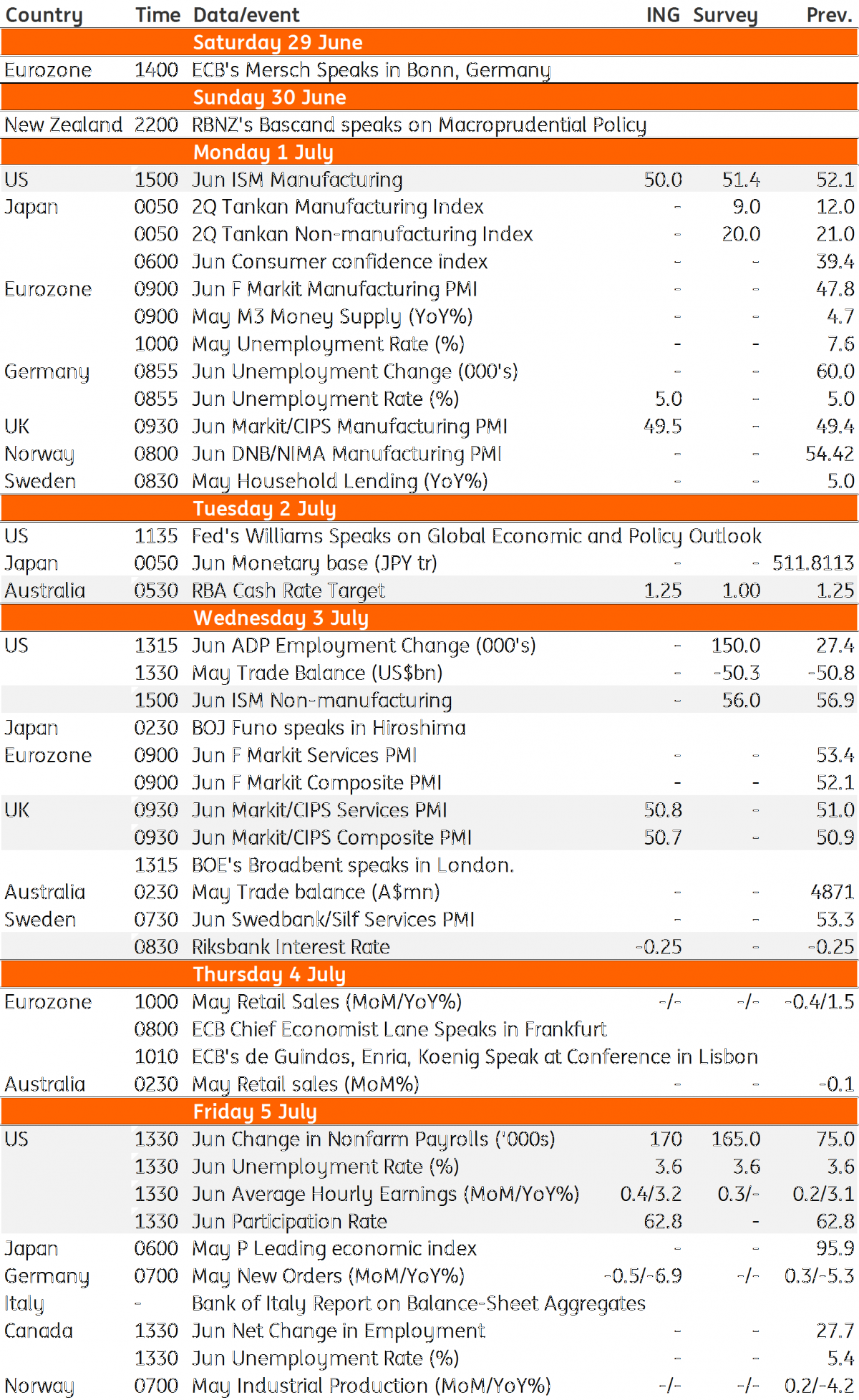

Developed Markets Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

28 June 2019

Our view on next week’s key events This bundle contains 3 Articles