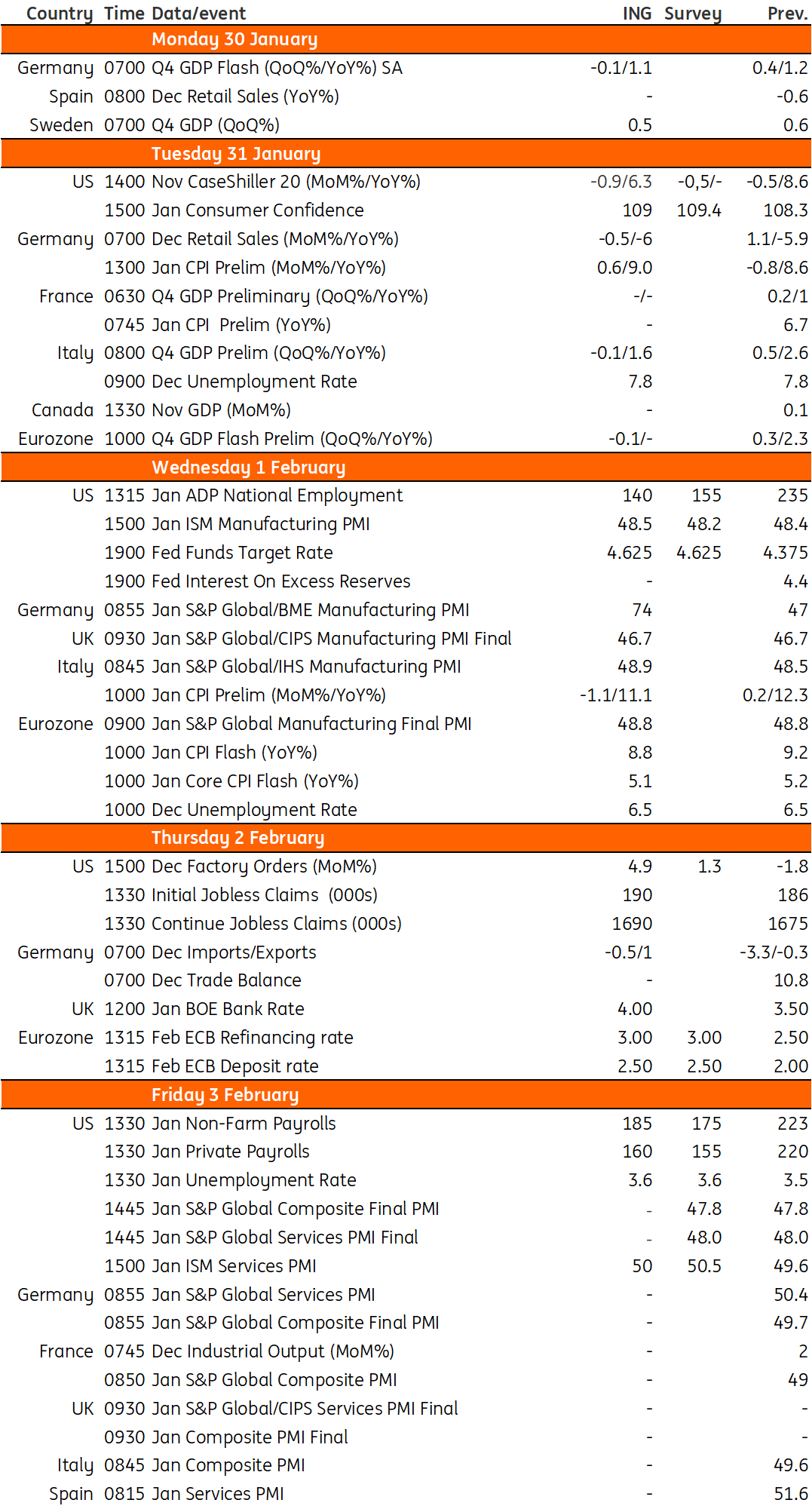

Key events in developed markets next week

Next week is packed with central bank meetings. We see the Federal Reserve raising rates by 25 basis points, given inflation is moving in the right direction. For the European Central Bank, a rate hike of 50bp looks like a done deal, and we believe the Bank of England is likely to follow in the ECB's footsteps, given wage growth is persistently high

US: A slowdown in the pace of tightening

Two major events in the US will shape market sentiment next week. First is the Federal Reserve policy meeting, where we expect it to raise the policy rate by 25bp. Having raised rates by 75bp on four consecutive occasions last year and then lifted the policy rate by 50bp in December, this marks a clear slowdown in the pace of tightening and appears justified given inflation is moving in the right direction and activity is slowing. However, the Fed remains wary and will again suggest that this is not the end for interest rate increases. The central bank will also be keen to dismiss the notion that it is preparing for potential rate cuts later this year. Financial conditions have loosened given movements in the dollar, Treasury yields and credit spreads and it may feel that any further loosening, fuelled by talk of potential policy easing in the second half of the year, could undermine its current actions in fighting inflation.

We will then be looking at the January jobs report. Employment creation remains strong for now, but job lay-off announcements are coming in thick and fast. We are nervously watching what happens to the temporary help component, which has already experienced five consecutive monthly falls. Given the nature of the role, which is easier to be hired into and fired from, this tends to lead to broader shifts in employment. As such, we expect to see a softer non-farm payrolls increase than seen in recent months, but it is still likely to be well above 100k given the large number of job vacancies that remain. Read our full Fed preview here.

UK: Bank of England to stick to 50bp hike following recent inflation data

The Bank of England looks more likely to follow the European Central Bank than the Federal Reserve next Thursday, and we expect a 50bp rate hike for the second consecutive meeting. While the minutes of the December meeting appeared to open the door to a potential downshift to a 25bp move next month, the reality is that the recent data has looked relatively hawkish. Wage growth is still persistently high, both in the official numbers and the BoE’s own business surveys. Headline inflation came in a little lower than the Bank projected back in November, but services CPI – seen as a better gauge of domestically-driven inflation – has come in above expectations.

Still, if we get a 50bp hike on Thursday then it’s likely to be the last. BoE officials have suggested that much of the impact of last year’s rate hikes is still to show through, and cracks are forming in interest-rate-sensitive parts of the economy. We expect one final 25bp hike in March, taking the Bank Rate to a peak of 4.25%. The key question for Thursday is whether the Bank itself acknowledges its work is nearly complete. We suspect it’s more likely to keep its options open. Read our full preview here.

Eurozone: ECB to hike by 50bp; Lagarde to make hawkish statement

When the European Central Bank meets next week, all eyes and ears will once again be on communication. A rate hike of 50bp looks like a done deal, but how far and how fast the ECB will go from there is still unclear. We expect hawkish comments by ECB President Christine Lagarde in order to prevent another drop in market interest rates. Current market expectations about ECB rate cuts in 2024 are premature. Read our full ECB preview.

Key events in developed markets next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

27 January 2023

Our view on next week’s key events This bundle contains 3 Articles