Key events in developed markets next week

Increasing Covid-19 cases, political uncertainty and unemployment creeping upwards make it a very interesting time in developed markets. Keep an eye out for US and Eurozone labour market data, as well as continued Brexit talks

US: Uncertainty could increase next week with the jobs report

The rising number of Covid-19 cases globally, election uncertainty and the lack of a new fiscal support package have all weighed on US equities as investors become more cautious on the outlook for growth and corporate profitability. This sense of unease could build next week with some key data, most notably next Friday’s September jobs report.

Employment plunged 22.16mn between February and April, but the re-opening of the economy from May has seen more than 10.6mn of those jobs recouped. The market is looking for another increase in September, but of “only” 900k, meaning employment would remain more than 10.5mn lower than February even after five months of gains.

We look for payrolls growth of 850k with the unemployment rate only moving slightly lower as job gains are offset by a rising participation rate

Evidence from high-frequency data, such as payrolls tracking figures from Homebase suggests a plateauing in private sector employment while purchasing managers’ indices suggest only modest gains. Set against this we know that last month’s employment gain of 1.37mn included 240k government Census workers who were chasing people up to fill in their forms. There is going to be a partial unwind in the September report which will subtract from the headline figure. At the same time, initial and continuing claims remain highly elevated, underlining the strains in the jobs market – remember initial claims remain 200k above the peak level experienced during the Global Financial Crisis. We, therefore, look for payrolls growth of 850k with the unemployment rate only moving slightly lower as job gains are offset by a rising participation rate.

We would just caution that there could be some additional downside risk from the confusion over in-person and remote schooling. With many parents having to stay at home as remote schooling continues in many parts of the country this could further constrain jobs growth.

Other data includes the ISM report, which should rise modestly based on regional manufacturing reports while we also get GDP revisions, August personal income and spending and consumer confidence.

Eurozone: Inflation and unemployment to see little improvement

For the ECB, next week could be an interesting one.

The eurozone will see data released on inflation, which turned negative last month. We don't expect September data to show a turnaround, and it could well be that inflation remains negative for some time to come. Also important is the unemployment rate, which has been creeping up over recent months as furlough schemes have kept mass layoffs in check. We expect moderate increases to continue in the months ahead.

UK: Brexit talks resume as cautious optimism returns

The chances of the UK and the EU agreeing to a trade deal this year seem roughly 50:50.

The publication of the Internal Markets Bill (IMB) two weeks ago, that threatens to override parts of the withdrawal agreement, has cast serious doubt over the process. Yet as talks resume next week, there’s some renewed optimism that a breakthrough can still be achieved. The EU’s response to the IMB has been measured – Brussels has signalled it could take legal action, but it has been careful not to break-away from negotiations.

The wider political climate – rising Covid-19 cases in the UK, growing support for Scottish independence, among others – are also reportedly pushing the UK government towards reaching an agreement. Still, it’s clear the UK won’t do a deal at any price, and an agreement would still require a British climb-down on state aid.

It’s still not clear that this is the price the government is prepared to pay.

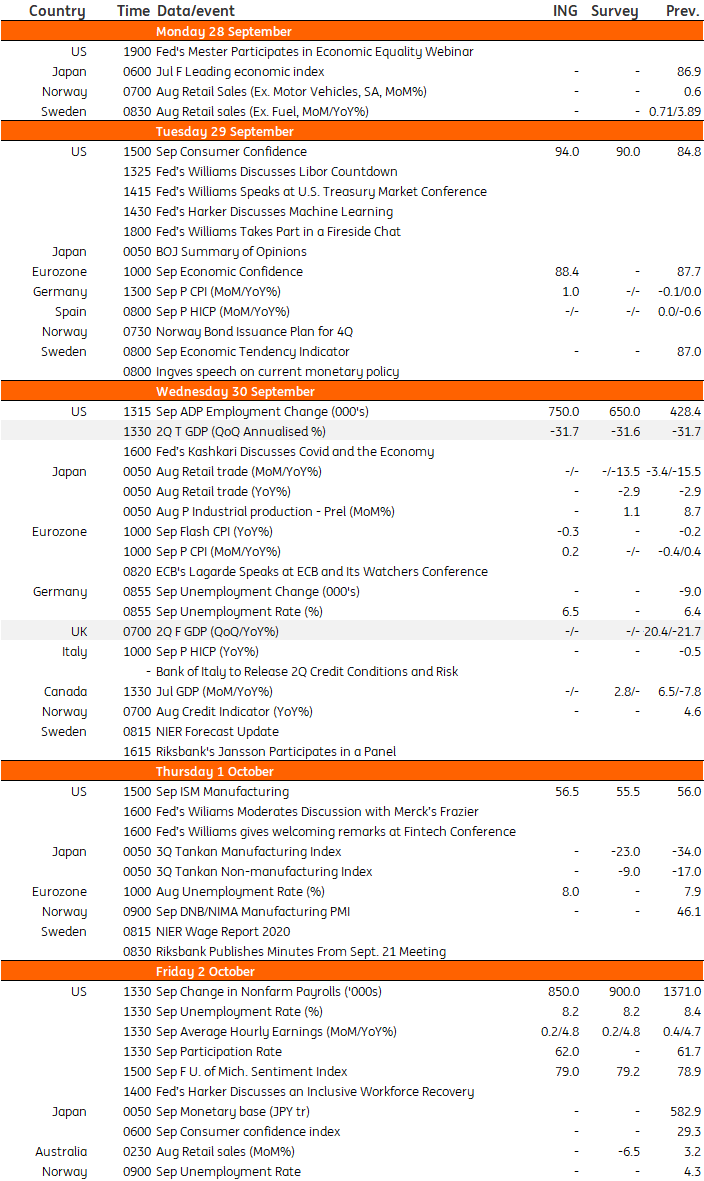

Developed Markets Economic Calendar

Download

Download article

25 September 2020

Our view on next week’s events This bundle contains 3 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more