Key events in developed markets next week

If you can't tell already, next week is going to be a big week for developed markets. Major central bank meetings will take place, but it will be more about what policymakers say and not what they do - which is important. We also have the eurozone's first-quarter GDP report, but the chances of a rebound here have faded

US: Think BIG

It will be a huge week for markets with key central bank meetings and the all-important US jobs report. 2019 started off weak as protectionism fears, a global slowdown, an inverted yield curve and concerns about the implications of a prolonged government shutdown all weighed on sentiment, but the mood is turning brighter. Corporate earnings season is going well and macro data has picked up too, so we would expect the Federal Reserve to sound a little more optimistic on the economic situation. Nonetheless, there is no prospect of them changing tack and they will continue to state that they will be patient with regards to monetary policy. Markets continue to price a 50:50 chance of a rate cut this year, but we think economic growth will prove to be resilient - a likely US-China trade deal is set to lift some of the uncertainty that has been hanging over the economy and markets.

Datawise, we look for consumer confidence to be boosted by equity market gains and the ongoing strength in the jobs market. This will be underlined by another decent rise in payrolls and a renewed uptick in wage growth after last month’s surprise dip. Indeed, the jobs market remains tight; the Federal Reserve’s Beige Book and other labour surveys continuing to highlight the struggle of finding suitably qualified labour. With the ISM indices set to hold at firm levels, we continue to look for the US to grow 2.4% this year – this is not a scenario that is consistent with a Fed rate cut.

Eurozone: Think BIG (again)

Next week is a big week for Eurozone data, as both GDP for the first quarter and inflation are due. Expectations for a rebound in GDP growth, after lacklustre growth at the end of 2018, have faded as business surveys have been worryingly weak in the first few months of the year. Inflation will again be dominated by the Easter effect, boosting the number for April after a weak March. Mind the underlying trend though, which remains modest (at best) and not getting much closer to the ECB's target of 2% as yet.

Bank of England set to keep tightening bias, although 2019 hike now unlikely

With the Bank of England set to keep rates on hold on Thursday, all the action will be in its statement and we think there are three things to watch.

First, wage growth. Skill shortages in certain parts of the economy have seen pay rise at the fastest rates since the crisis. While some momentum has dissipated in the most recent figures, we don’t expect the Bank to significantly change its view that wage growth will keep performing strongly. This means the Bank will likely keep the door ajar to further rate hikes, so the second thing to watch will be the vote count – some headlines have hinted that one or two policymakers may be prepared to vote for an immediate hike at this meeting.

But for the committee as a whole, the Brexit delay is likely to reaffirm the concerns expressed in the substantial growth forecast downgrade policymakers made back in February. Investment looks set to stay under pressure, and we suspect this will stop the Bank from hiking rates in 2019.

Germany: The 'Easter effect' should bring good news for the labour market

Both the labour market and inflation data should be affected by the timing of Easter and the weather. This affect comes as a fall in unemployment and an increase in inflation.

Canada: A positive sign of things to come

GDP growth in January came as an upside surprise (+0.3% MoM) and we suspect growth in February will be in the same direction – albeit slightly milder. We forecast an uptick of 0.1% on the month.

Motor vehicles appear to be a common theme running throughout February. Manufacturing sales fell 0.2%, with one of the main reasons being that fewer motor vehicles were sold. Nonetheless, we aren’t taking this as a sign that Canadian’s are refraining from spending on big-ticket items (just yet); retail and wholesale trade both increased in February, and the sales of parts to motor vehicles contributed positively in each case.

A sign of things to come? Quite possibly. The current robustness of the labour market, coupled with little signs that the US economy has begun its (anticipated) slowdown, bode well for good levels of both domestic and foreign demand in the near-term.

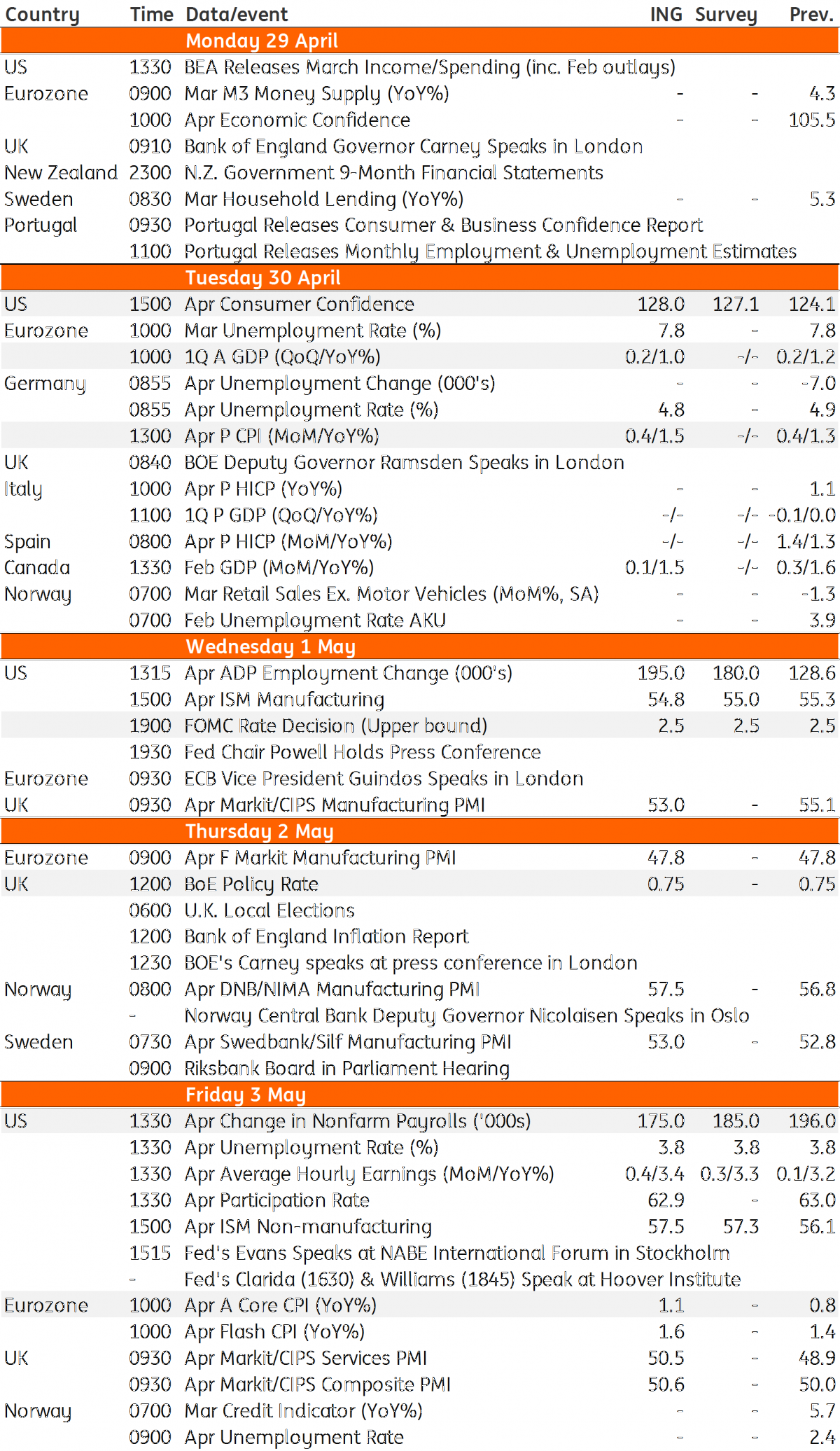

Developed Markets Economic Calendar

Download

Download article26 April 2019

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more