Key events in developed markets next week

Next week our focus will be on the US jobs report, Eurozone inflation and UK consumer credit. But what else will have our attention in developed markets?

US Fed: "Gradually" getting there

High-frequency data suggests that after a respectable 2.3% annualised rate of growth in 1Q18, the US economy is likely to post something around the 3% mark in 2Q18. With inflation picking up – only the core PCE deflator is below the Federal Reserve’s 2% target, this should keep the Fed hiking rates “gradually”, and we certainly look for another 25bp move on 13 June 2018.

However, the market remains split on whether we will get one or two further hikes in the second half of the year. We currently favour two, citing the strong labour market and rising wages, which should be highlighted in this week’s jobs report. Unemployment at 3.9% has only been lower once in the past 48 years, and the lack of available workers is creating bottlenecks in the US economy. This suggests to us that wages will continue to bid higher, translating into rising inflation pressures.

Higher oil prices are also an issue that we will be watching. Gasoline prices are up 50 cents/gallon since the tax cuts equivalent to $900 per household were announced in December. Based on average annual consumption these price rises will cost drivers an extra $350 if maintained, so we see little downside risk to consumer confidence on the back of this. Higher mortgage rates are also a factor that may at the margin weaken sentiment. Nonetheless, it is important to remember that higher oil prices are no longer such an unambiguous negative for the US economy given the fact that the US is now the World’s number one producer. Jobs and investment in the sector are booming.

Eurozone: Inflation bounce back and preparations for the June ECB meeting

In the Eurozone, eyes will be on the May inflation release. The April numbers were a shocker as core inflation dropped to 0.7%, on which we should see somewhat of a bounce back this month. Unemployment could also edge down next week, which means that some good news could follow this week’s disappointing PMI.

Also, next week will see an entire series of ECB officials giving speeches, probably preparing the grounds for the June meeting. A meeting which increasingly looks like another “buying time” meeting.

Eyes on UK consumer credit growth as Bank of England mulls next move

Generally, UK consumer borrowing numbers come and go each month without much attention. That was until last month when consumer credit growth unexpectedly plunged to levels not seen since late-2012. Pinning down the exact cause of this is not easy, and it could prove to be a blip (some have pointed to the snow, although it’s not immediately clear why that should have made such a noticeable impact).

But according to a recent BoE credit conditions survey, we know that banks have significantly tightened standards (notably for credit card borrowing). If it becomes clear that borrowing has indeed ground to a halt, it would be another blow to battered UK retailers and would likely raise further doubts over a summer rate hike.

We’ll also get the manufacturing PMI, which showed some signs of fatigue last month. A further downside miss in May would indicate that weaker Eurozone momentum is starting to bite for UK producers.

Surge in oil prices to pick up German inflation

German inflation will be the first inflation data for the ECB for May. With the recent surge in oil prices, headline inflation should pick up. Watch out once again for possible seasonal distortions of German inflation data due to several holidays and long weekends in May.

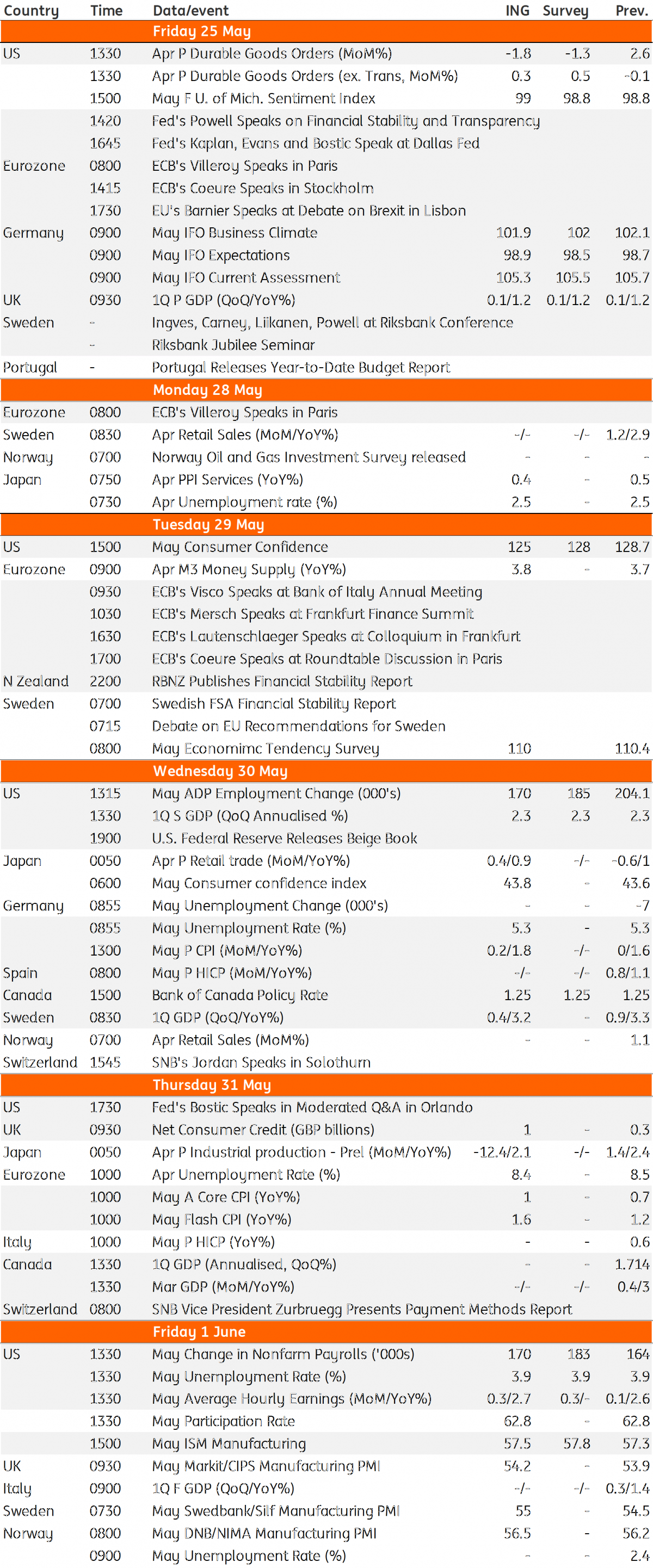

Developed Markets Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

24 May 2018

Our view on next week’s key events This bundle contains 3 Articles